January 23, 2024

Magnetic Resources NL (Magnetic or the Company) is pleased to announce, after a significant 107% increase in overall resource in our Laverton Project to 22.7Mt @1.69g/t totalling 1.24moz of gold at 0.5g/t cut off and LJN4 increased by 317% from 204,000oz to 852,000oz, which was announced on November 23 2023 (Table 1), a number of deeper step out holes were carried out to see whether the LJN4 resource could be extended further at depth. Some compelling and exciting intersections are outlined below.

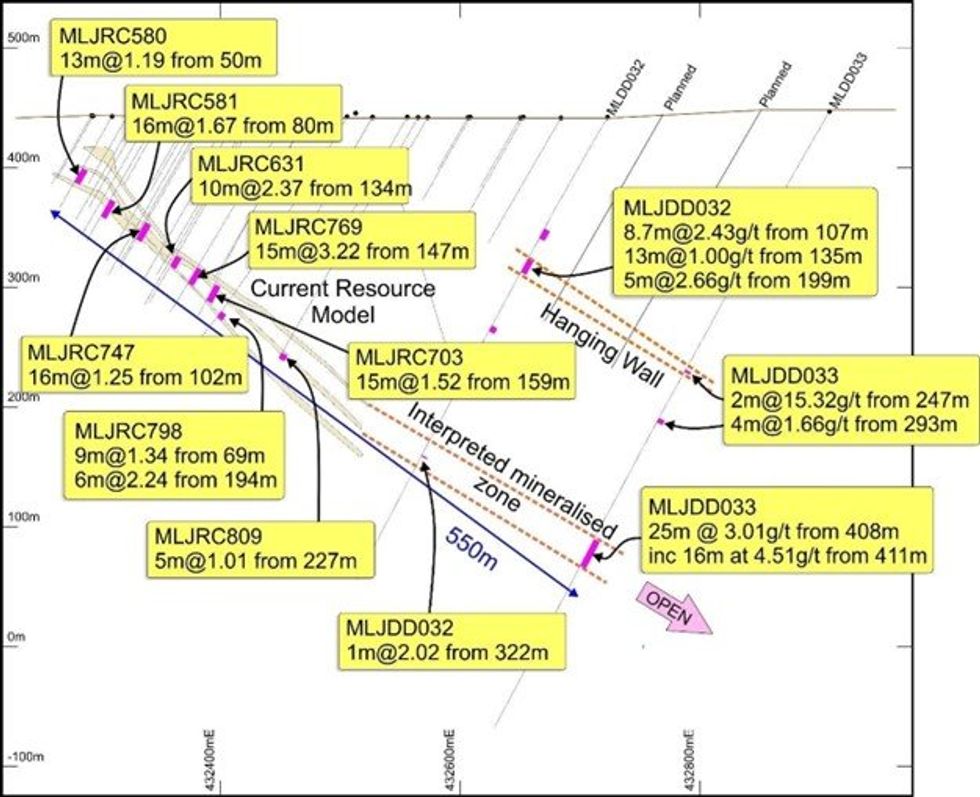

- MLDD033 intersected 16m at 4.51g/t from 411m, which was a very large 200m step out below the current resource (Figure 1). This intersection of 72 gram- metres is potentially underground mineable and is still open downdip. The section in Figure 1 indicates mineralisation continuity of 550m down dip, which is by far the biggest down dip extension identified to date within LJN4. This structure and mineralisation is expected to continue at depth within the Chatterbox shear, which is a regional scale structure that controls many deposits along its length including LJN4, Apollo, Beasley Creek and Wallaby. A seismic survey Magnetic completed (ASX Release 15 February 2021) shows a depth extent of 1.5km.

The above intersection in MLJDD033 occurs partly in a pyrite bearing black shale with intercalated carbonate and minor breccia, and partly in a pyrite-bearing carbonate with pyrite ranging from disseminated to semi-massive, which is a new style of alteration. - New hanging wall mineralisation was also discovered in MLJD033 with an intersection of 2m at 15.32g/t from 247m, and 8.7m at 2.43g/t from 107m and 13m at 1.00g/t from 135m in MLJDD032. These hanging wall intersections are associated with a breccia zone and are planned to be followed up with RC drilling.

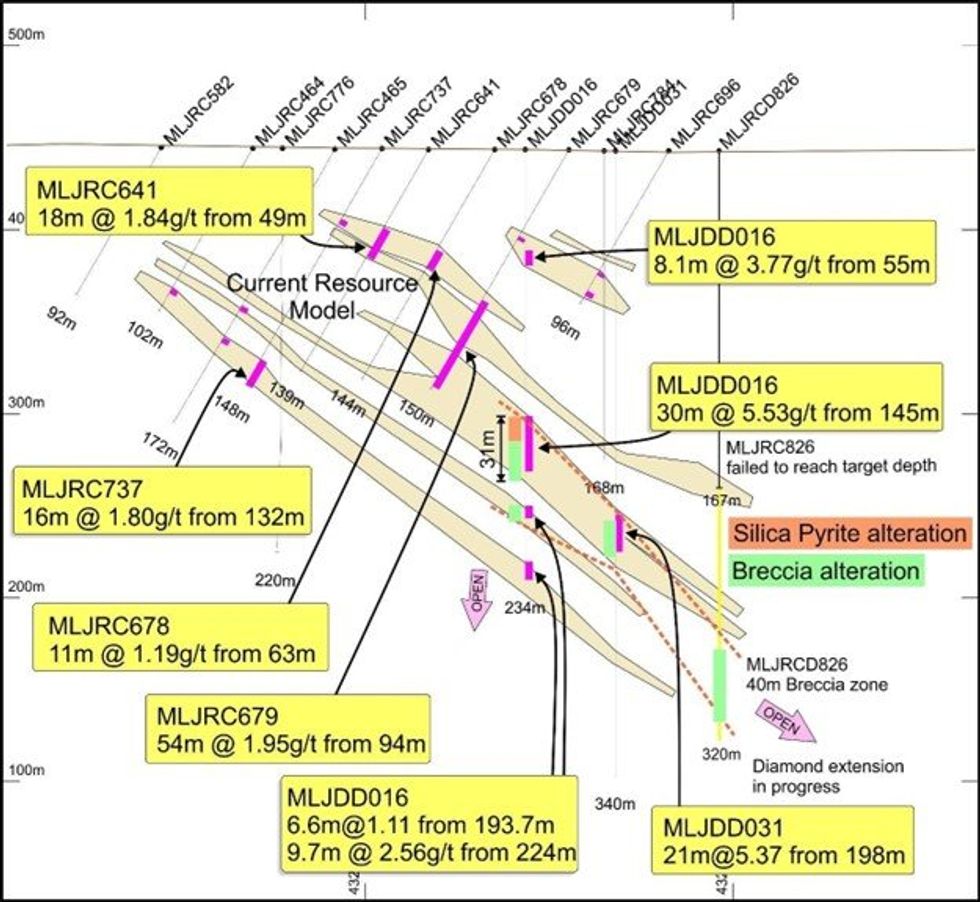

- MLJRCD826 intersected a 40m thick breccia zone from 270m-310m, which visually looks very promising and has assays pending (Figure 2 and 5). It is directly 65m down dip from MLJDD031 which intersected 21m at 5.37g/t from 198m within a breccia. This is in turn 50m down dip from MLJDD016, which intersected 30m at 5.53g/t from 145m, which is also within a breccia.

MLJRCD826 is a large step out and is outside the current resource which augers well for the next resource upgrade. MLJRCD826 is still open down dip and to the south and RC holes are being planned to follow up this promising thick breccia zone. - MLJRCD802 intersected our best intersection to date, of 133m at 2.87g/t from 173m, which includes 61m at 4.68g/t from 243m (1m splits). Assays are awaited for the down dip extension within MLJRC820 from 290m to 453m (Figure 3).

- MLJDD034 intersected 6.8m @12.06g/t from 151m (contained within a 11.5m zone with 4.8m of core loss) in a gossanous chert breccia.

The multiple very thick intersections which often contain silica-pyrite and breccia alteration, are up to 50m thick. These are mainly within a 250m long central zone, which is still open to the south and east.

The central part of the 800m long LJN4 deposit has been infill drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-4.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00