May 26, 2024

Tempest Minerals Ltd (TEM) is pleased to update the market on the progress at the Remorse Target. The Remorse Target is a 4km long coincident base metal and geophysical target located in the Company’s Flagship Yalgoo Project. TEM has received preliminary approval for drilling at the central area of the target. As a result of recent ground-truthing work, TEM believes a larger expanded program design of ~5000m is required. Approvals are in the final stages and work is anticipated to commence in June/July.

Key Points

- Expanded drill program planned at the 4km Remorse Copper Target

- Approvals in final stages for ~5000m RC campaign

- Commencement of works expected June/July

Yalgoo Project

Background

TEM’s landholding in the Yalgoo Region of Western Australia comprises more than 1,000km2 1 of 100% owned tenements highly prospective for base and precious metals 2. The Company has been actively exploring the project and identified an entirely new mineralised belt 3 with previous drilling showing the belt to be fertile for previously unknown mineralisation 4, 5, 6, 7. The Yalgoo Project currently hosts dozens of exciting exploration targets 8 with the Remorse and Sanity targets being the Company’s priority at this time.

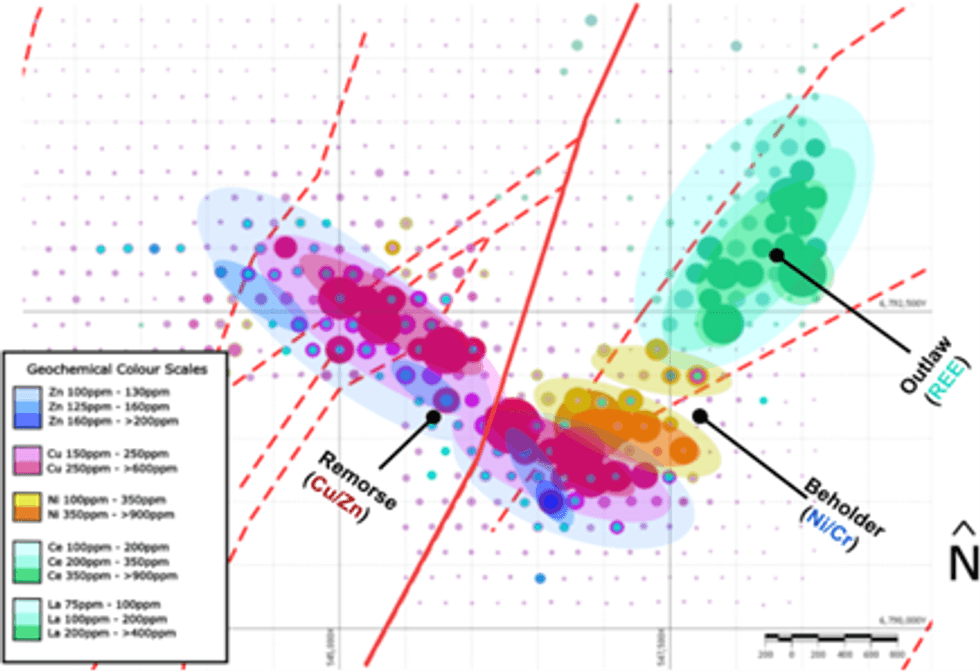

TEM previously announced the presence of large-scale copper zinc anomalies at the Remorse Target 9, 10, which were further strengthened by the identification of an overlapping geophysical anomaly detected during a large-scale regional EM survey 11 covering much of the central portion of the Yalgoo project. The Company announced in late 2023 12 the intention to drill test the Remorse Target and has been vigorously pursuing regulatory requirements 13 amidst challenging demand-driven delays 14, 15 while also conducting additional field 16 and preparatory work.

Remorse Target Status

Approvals

Phase I

Based upon the initial geochemistry results, TEM designed a modest drill program to test specific structural targets potentially related to higher copper values in the wide-spaced surface geochemistry. TEM progressed approvals for this work in late 2023 and approval was received in Q1 2024.

Phase II

Further ground truthing and more detailed geological mapping of the Remorse Target in Q1 2024 conclusively showed a much larger geological target zone which also mirrors the broader geochemical footprint of the anomaly. An expanded drill program was designed for this larger footprint which will entail ~5000m RC drilling. Permits for this expanded work are in the final stages of the approval process with the regulatory bodies and heritage surveys planned for early June 2024. Drilling is expected to commence shortly thereafter.

Click here for the full ASX Release

This article includes content from Tempest Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

1h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

1h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00