- WORLD EDITIONAustraliaNorth AmericaWorld

May 26, 2024

Tempest Minerals Ltd (TEM) is pleased to update the market on the progress at the Remorse Target. The Remorse Target is a 4km long coincident base metal and geophysical target located in the Company’s Flagship Yalgoo Project. TEM has received preliminary approval for drilling at the central area of the target. As a result of recent ground-truthing work, TEM believes a larger expanded program design of ~5000m is required. Approvals are in the final stages and work is anticipated to commence in June/July.

Key Points

- Expanded drill program planned at the 4km Remorse Copper Target

- Approvals in final stages for ~5000m RC campaign

- Commencement of works expected June/July

Yalgoo Project

Background

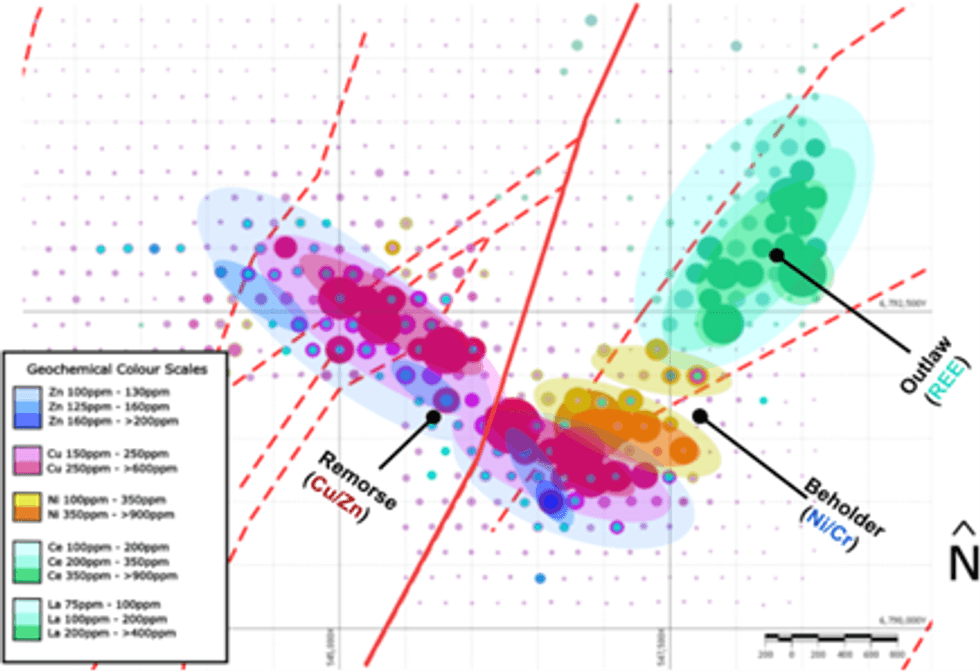

TEM’s landholding in the Yalgoo Region of Western Australia comprises more than 1,000km2 1 of 100% owned tenements highly prospective for base and precious metals 2. The Company has been actively exploring the project and identified an entirely new mineralised belt 3 with previous drilling showing the belt to be fertile for previously unknown mineralisation 4, 5, 6, 7. The Yalgoo Project currently hosts dozens of exciting exploration targets 8 with the Remorse and Sanity targets being the Company’s priority at this time.

TEM previously announced the presence of large-scale copper zinc anomalies at the Remorse Target 9, 10, which were further strengthened by the identification of an overlapping geophysical anomaly detected during a large-scale regional EM survey 11 covering much of the central portion of the Yalgoo project. The Company announced in late 2023 12 the intention to drill test the Remorse Target and has been vigorously pursuing regulatory requirements 13 amidst challenging demand-driven delays 14, 15 while also conducting additional field 16 and preparatory work.

Remorse Target Status

Approvals

Phase I

Based upon the initial geochemistry results, TEM designed a modest drill program to test specific structural targets potentially related to higher copper values in the wide-spaced surface geochemistry. TEM progressed approvals for this work in late 2023 and approval was received in Q1 2024.

Phase II

Further ground truthing and more detailed geological mapping of the Remorse Target in Q1 2024 conclusively showed a much larger geological target zone which also mirrors the broader geochemical footprint of the anomaly. An expanded drill program was designed for this larger footprint which will entail ~5000m RC drilling. Permits for this expanded work are in the final stages of the approval process with the regulatory bodies and heritage surveys planned for early June 2024. Drilling is expected to commence shortly thereafter.

Click here for the full ASX Release

This article includes content from Tempest Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

5h

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

8h

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

02 March

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00