March 17, 2024

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to release assay results from drilling undertaken at the Ricciardo deposit (previously known as Silverstone) within its Golden Range Project located in the Murchison region of Western Australia. The results released today have confirmed the presence of high-grade shoots below existing oxide open pits and demonstrates the excellent exploration potential for further discoveries at Ricciardo.

HIGHLIGHTS:

- Assay results received for thirteen (13) RC holes drilled at the Ricciardo deposit with all holes intersecting significant intervals of gold mineralisation, including:

- 32m @ 3.59 g/t Au from 148m, incl. 1m @ 10.85 g/t Au from 151m (RDRC019)

- 11m @ 3.43 g/t Au from 149m (RDRC031)

- 14m @ 1.15 g/t Au from 114m (RDRC022)

- 3m @ 5.61 g/t Au from 114m, incl. 1m @ 11.20 g/t Au from 114m (RDRC025)

- Drilling has identified two new high-grade shoots beneath the historical open pits at Silverstone and Silverstone South.

- Significant extensions of high-grade gold mineralisation have been intersected under the Ricciardo deposit at shallow depths (of between 150 - 200m) – which confirms the potential for further discoveries below historical open pits.

- Drilling demonstrates the excellent potential for significant growth of the Ricciardo deposit and Resource.

- Assays from a further nine (9) RC holes are pending with results anticipated to be received in the next four weeks.

- The Ricciardo deposit remains open along strike and at depth, with further growth-focussed drilling of this area planned from Q2 CY2024.

- Ricciardo sits in the middle of the 25km long Golden Corridor at Golden Range, which hosts six discrete deposits that are all open at depth and possess immediate growth potential.

- Ricciardo and the Golden Corridor to be the key focus of Warriedar’s exploration in 2024.

Warriedar Managing Director and CEO, Dr Amanda Buckingham, commented:

“We are very pleased with the results from this first batch of assays from the growth-focussed 2024 drilling program at Ricciardo. The results demonstrate the excellent potential to expand the Mineral Resource at Ricciardo, which has a strike length of 2.3km with high-grade gold mineralisation occurring at numerous locations along the trend.

With further assays pending, and follow-up drilling planned to commence from next quarter, we are excited as to what our exploration activities at Ricciardo can deliver for Warriedar this year.”

Engage with this announcement at the Warriedar InvestorHub

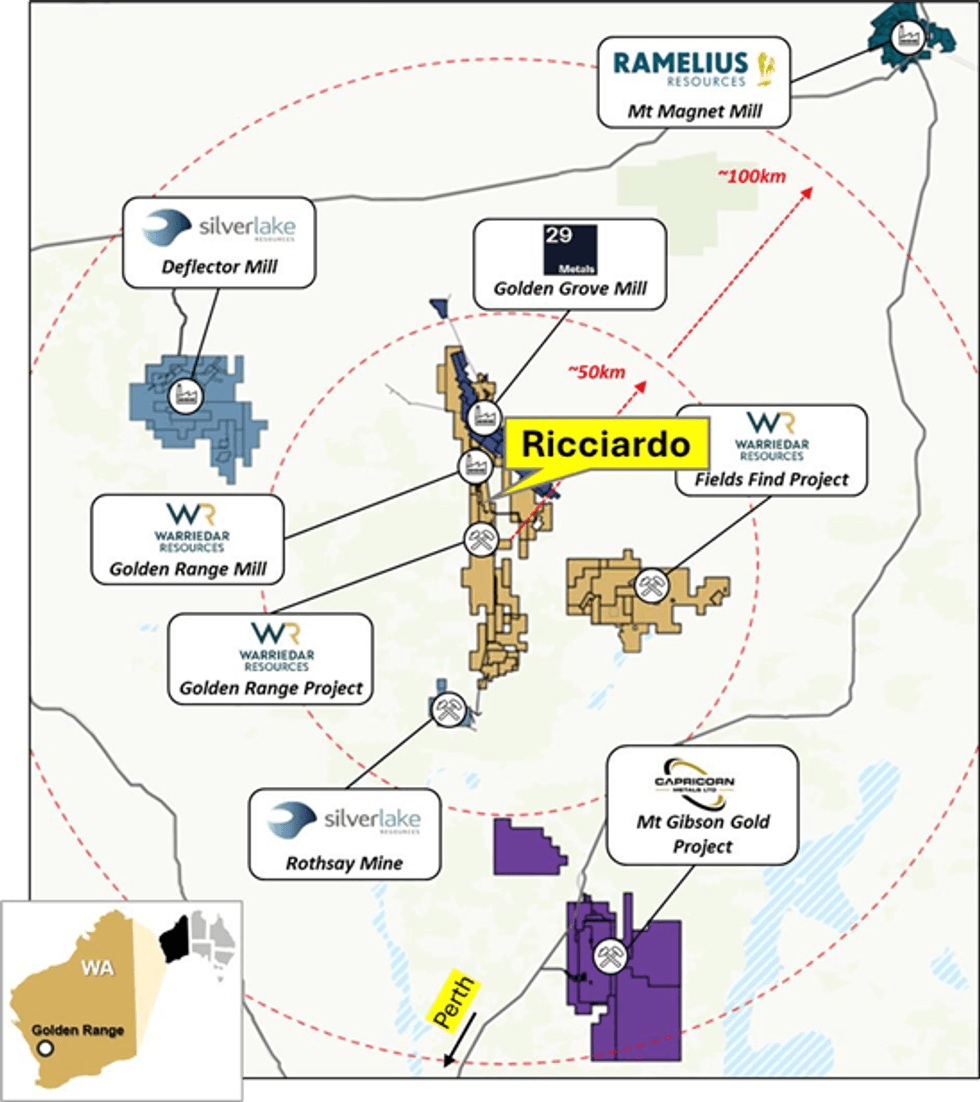

Figure 1: Location of the Ricciardo deposit within the Golden Range Project.

Robust high-grade extensions delivered across Ricciardo

21 holes have been drilled at Ricciardo during 2024 for 3,500m of drilling. This drilling was targeted to significantly extend the Ricciardo Mineral Resource boundaries at depth and along strike. The results released today have been able to achieve both goals.

Assay results have now been received for 13 holes drilled at Ricciardo. All 13 holes have returned significant gold intercepts, as reported in Table 2, with the better results provided below;

- 32m @ 3.59 g/t Au from 148m in RDRC019 beneath Ardmore pit.

- 11m @ 3.43 g/t Au from 149m in RDRC031 beneath Silverstone pit.

- 8m @ 1.84 g/t Au from 171m in RDRC032 beneath Silverstone pit.

- 14m @ 1.15 g/t Au from 114m in RDRC022 beneath Silverstone South pit.

- 10m @ 1.63 g/t Au from 156m in RDRC027 (ended within mineralisation) beneath Silverstone South pit.

The results have identified two additional high grade gold shoots within existing mineralisation as well as significant down-dip extension of the known mineralisation below the historic Silverstone and Silverstone South open pits. These results demonstrate the high-grade growth potential beneath Ricciardo both along strike and down dip of all five historic pits (Eastern Creek, Silverstone South, Silverstone (Copse), Ardmore, and Silverstone North) see Figure 3.

The Ricciardo deposit has a current Mineral Resource estimate of 8.7 Mt @ 1.7 g/t Au for 476 koz gold (6 koz Measured, 203 koz Indicated, 267 koz Inferred).1 The oxide material at Ricciardo (extending to 45 - 60m depth) has previously been mined across two separate phases: 2001 - 04 and 2013 - 19.

The Ricciardo gold system spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth.

The high-grade shoots comprising the Ricciardo mineralisation remain open both at depth and along strike. As a result of the strong growth potential (and its existing scale and grade), Ricciardo is a key focus area for Warriedar this year. Follow-up drilling at Ricciardo is planned from Q2 CY2024.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00