April 18, 2023

Blue Star Helium Limited (ASX:BNL, OTCQB:BSNLF) (Blue Star or the Company) provides an update on progress on its maiden Voyager helium development in Las Animas County, Colorado.

Highlights

- Final approval received to drill the first two helium development wells at the high- grade Voyager helium development.

- These two wells offset the BBB#1 helium discovery and are planned to be production wells.

- Drilling of the first well is expected to commence in late Q2 or Q3.

- Additional five-well OGDP for Voyager to be submitted to COGCC in first week of May; together with the BBB 33#1 and 34#1 locations, delivers robust inventory from which the initial 3-4 production well locations at Voyager will be selected.

- Commercial discussions for provision of leased helium facility at Voyager highly advanced and expected to conclude in execution of a facilities agreement in coming weeks.

- Blue Star on track for first helium production and sales from Voyager during H2 CY2023.

Voyager helium development wells approved for drilling

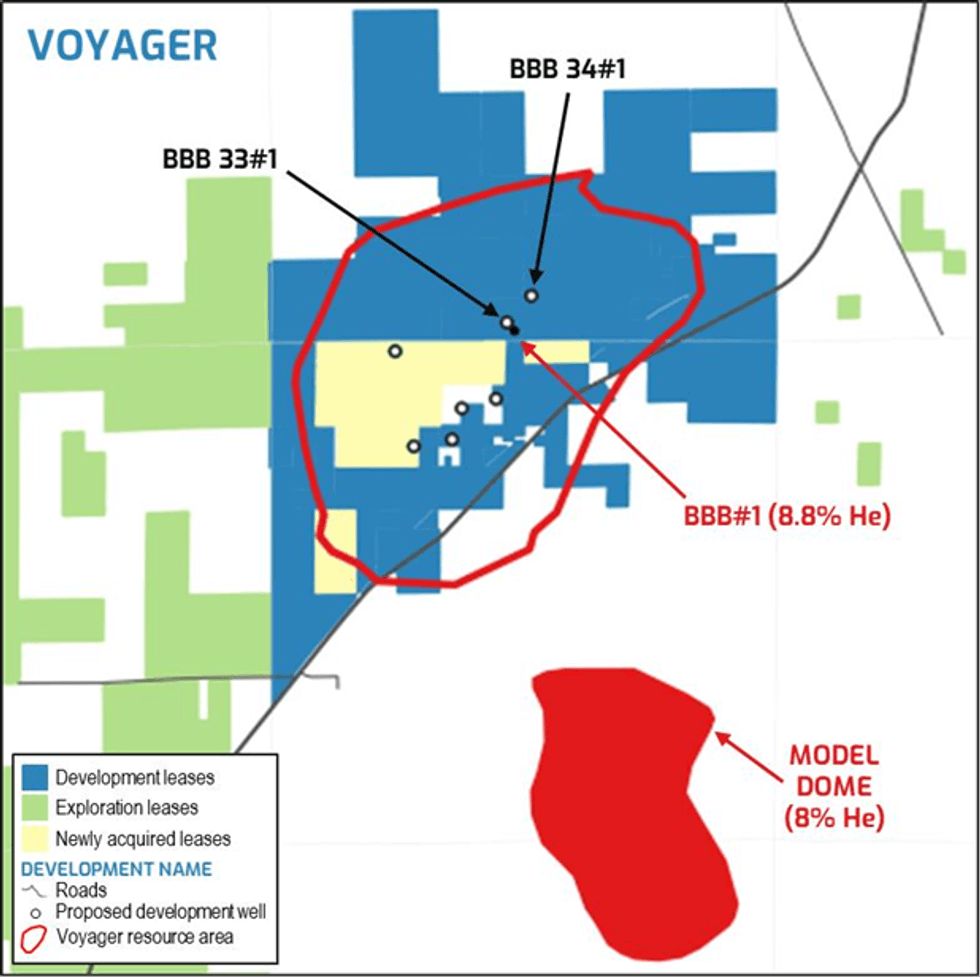

The Colorado Oil and Gas Conservation Commission (COGCC) has approved the Forms 2 relating to each of the BBB 33#1 and BBB 34#1 helium development wells (refer Figure 1). These wells relate to the “BBB 2860” Oil and Gas Development Plan (OGDP) located within the Company’s high-grade Voyager helium development. This is the final COGCC approval required to be able to drill these wells.

These two wells offset the BBB#1 helium discovery and are intended to produce into the initial Voyager facility (see BNL announcement dated 19 December 2022). Drilling of the first of these wells is expected to commence in late Q2 or Q3 and is planned to include subsequent flow and pressure testing evaluation.

Additional Voyager helium development wells submission

Following the acquisition of strategic mineral leases and surface access agreements (see BNL release of 11 April 2023), the next planned OGDP submission at Voyager has been expanded to five wells and is planned to be submitted in the first week of May after expiry of mandatory pre- submission notices to the County.

Previously this OGDP included the three eastern wells on the map below (on existing leases shown in blue). Submission of the OGDP was paused to add the two highly regarded well locations associated with the newly acquired strategic minerals leases (shown in yellow). This approach follows COGCC guidance.

Coupled with BBB 33#1 and 34#1, approval of these further locations is expected to deliver a robust inventory of permitted wells from which to select the initial 3-4 production well locations at Voyager.

COGCC advised at the operator meeting on 14 March 2023 that it is implementing a revised permitting process which is designed to shorten the time between submission and hearing to 4.5 months. COGCC says that the current process takes on average 7 months.

Helium processing facility commercial discussions

Blue Star is progressing negotiations with a mid-stream company for the lease of a helium processing facility at Voyager (see BNL announcement of 19 December 2022). These discussions are now highly advanced and expected to conclude in execution of a facilities agreement in the coming weeks for supply and operation of the helium processing plant. Accordingly, given the COGCC’s revised permitting guidance, Blue Star is continuing to target first helium production and sales from Voyager during H2 CY2023.

Click here for the full ASX Release

This article includes content from Blue Star Helium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BNL:AU

The Conversation (0)

28 November 2022

Blue Star Helium

Developing High-Grade Helium Assets in Colorado

Developing High-Grade Helium Assets in Colorado Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00