Usha Resources Ltd. ("USHA" or the "Company") (TSXV:USHA) (OTCQB:USHAF) (FSE:JO0), a North American mineral acquisition and exploration company focused on the development of drill-ready battery and precious metal projects, is pleased to announce the listing of its common shares for trading on the Frankfurt Stock Exchange ("FSE") under the symbol "JO0" with ISIN CA91734F1080 and WKN A3DK8K

"With the recent acquisition of the Jackpot Lake Lithium Project, three planned drill programs and mounting investor interest in our Nicobat Nickel Project spin out, it makes sense to broaden USHA's visibility and connect with a larger, global community of potential European institutional and retail investors," commented Deepak Varshney, CEO of Usha Resources. "Anytime we can make it easier and help facilitate investment in the Company by the European investment community. we'll take action so that all shareholders benefit."

The Frankfurt Stock Exchange is the world's third-largest organized trading market in terms of turnover and dealing in securities behind the New York Stock Exchange and NASDAQ. The listing of the Company's shares on the FSE marks another step torward creating greater liquidity and increasing shareholder and overall market awareness for USHA's drill-ready projects. The Company's common shares are now cross-listed on the TSX Venture Exchange, OTCQB® and the FSE.

The Jackpot Lake Lithium Project

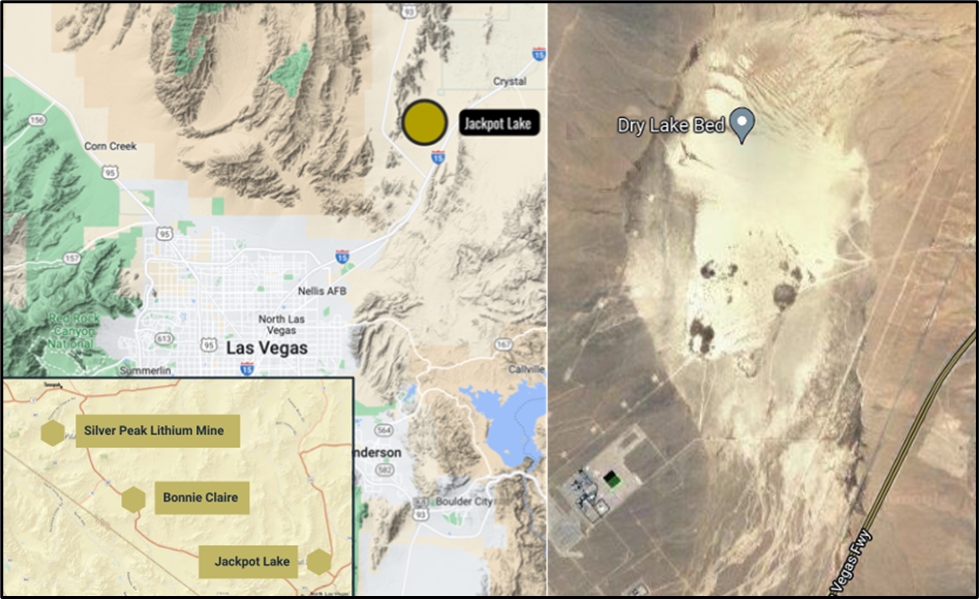

The Jackpot Lake Lithium Project ("the Property) is located within Clark County, 35 kilometres northeast of Las Vegas, Nevada, and is comprised of 140 mineral claims that total 2,800 acres. The project is exploring a "playa" which appears to be within a closed basin that may contain potentially lithium-rich brines. The geologic model is similar to that of Albemarle's Silver Peak Nevada Lithium Mine which has operated continuously since 1966, and Iconic Mineral's Bonnie Claire Project, which recently released a Preliminary Economic Assessment report (PEA) that indicates 40-year mine with an after-tax NPV8% of 1.5 billion, where sediments from lithium‑rich surrounding source rocks accumulate and fill the deposit leading to a potential concentration of lithium brine due to successive evaporation and concentration events.

Figure 1 - Left, location of Jackpot Lake. Right, aerial image of the "playa."

The project is considered to be "drill-ready" based on the following work which has successfully delineated a 5 x 2 kilometre anomaly within a closed basin that suggests the presence of a highly concentrated brine:

- 129 core samples collected by the USGS with an average lithium value of 175 ppm with a high of 550 ppm and spectrographic and atomic-absorption analyses of 135 stream sediment samples confirming the potential for lithium mineral deposits.

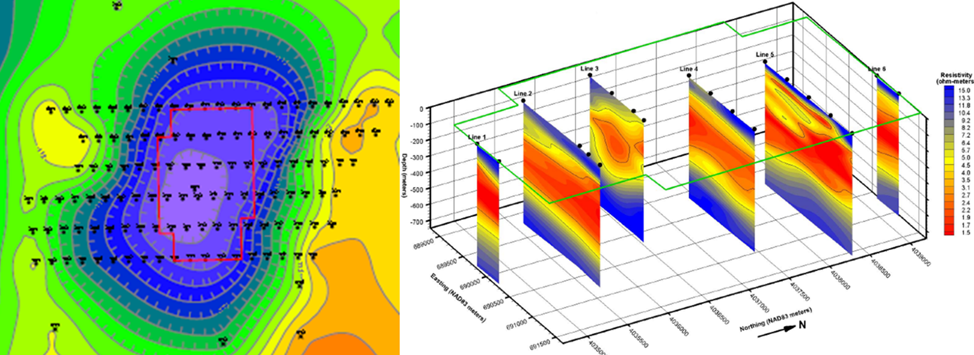

- Gravitational surveying which has identified a closed basin, critical for ensuring brines remain within the basin without dilution from external water sources.

- Geophysical modelling based upon gravitational and controlled source audio magnetotellurics/magnetotellurics (CSAMT/MT) surveys has provided evidence of highly concentrated brines which are relatively near the surface. The CSAMT survey results of the Jackpot Lake Project demonstrate a large consistent body of very low resistivity - consistent with highly concentrated brine behavior - throughout the property, predominantly above bedrock depths of 625 meters.

The CSAMT Survey and report was conducted and prepared by Hasbrouck Geophysics, who has extensive experience of both surveying and data processing for brine-bearing basin environments across the Southwestern United States.

Figure 2- Left, gravitational surveying outlined the footprint of the Jackpot lithium brine anomaly. Right, CSMAT survey slices showing a cross-section of the anomaly illustrating the highly enriched brines throughout the property in red.

Based on the above, the Company intends on completing an aggressive exploration program by drilling both shallow and deep holes to test the targets outlined by the CSAMT Survey at possible higher concentration brine zones with the goal of completing a 43-101 resource estimate by Q4 of 2022.

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Helgi Sigurgeirson, P.Geo., a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

About Usha Resources Ltd.

Usha Resources Ltd. is a North American mineral acquisition and exploration company focused on the development of quality battery and precious metal properties that are drill-ready with high-upside and expansion potential. Based in Vancouver, BC, Usha's portfolio of strategic properties provides target-rich diversification and consist of Jackpot Lake, a lithium project in Nevada; Nicobat, a nickel‑copper‑cobalt project in Ontario; and Lost Basin, a gold-copper project in Arizona. Usha trades on the TSX Venture Exchange under the symbol USHA, the OTCQB Exchange under the symbol USHAF and the Frankfurt Stock Exchange under the symbol JO0.

We seek Safe Harbor.

Usha Resources LTD.

"Deepak Varshney" CEO and Director

For more information, please phone Tyler Muir, Investor Relations at 1 (888) 772-2452, email tmuir@usharesources.com, or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

SOURCE: Usha Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/700067/Usha-Resources-Begins-Trading-on-the-Frankfurt-Stock-Exchange-as-FSEJO0