Ur-Energy Inc. (NYSE American:URG)(TSX:URE) (the "Company" or "Ur-Energy") is pleased to announce the successful results of Phase 1 field testing on its patented injection well casing and installation technology

On April 21, 2022, the Company announced a research and development project to field test its patented injection well casing and installation method at its operating Lost Creek Uranium ISR Facility in south-central Wyoming. Following that announcement, the Company received approval of a Non-Significant Permit Amendment from the Wyoming Department of Environmental Quality - Land Quality Division ("LQD") and began field testing. We have now completed Phase 1 testing of the technology.

Field tests in Lost Creek's Mine Unit 2 demonstrated the mechanical integrity of injection wells installed using our new technology, with a 75% reduction in drill rig time compared to conventional methods and an 85% reduction in casing cost. The cost savings from reduced drill rig time will be partially offset by increased in-house labor. Based upon testing to date, the overall cost reduction to install an injection well is estimated to be between $2.50 and $3.50 per pound of U3O8 produced. This represents as much as a 49% savings on the installation of an injection well. Injection wells generally represent approximately 65% of wells in wellfields designed with traditional "five-spot" recovery patterns.

Beyond improving the economics of injection well installation, our new installation technique is anticipated to result in numerous environmental benefits, including:

- Reduction of heavy vehicle traffic since drill rig time on injection wells is reduced from approximately 3.5 to 0.5 days per well as demonstrated during initial field tests;

- Up to 85% fewer air emissions during installation of injection wells;

- Less noise due to shortened drill rig and water truck time;

- A further reduction in already low well failure rates due to fewer points of potential failure, because the casing material is "tougher" in many respects than conventional PVC well casing, and the completion method requires less exposure to the drill string and bit compared to conventional methods; and

- Initial Mechanical Integrity Tests ("MITs") can be performed during installation without the need to re-enter the well.

Steve Hatten, Ur-Energy's Chief Operating Officer, stated, "I want to congratulate our Lost Creek development team for their creative thinking and hard work that brought the Phase 1 testing of our new well installation technology to a successful conclusion. We believe the development of the technology is the most significant technological advancement in the in-situ uranium recovery industry since the introduction of down-flow ion exchange columns. We are excited to proceed to Phase 2 testing and at operational levels to fully model how we can reduce operating costs while enhancing the speed and efficiency of uranium recovery and groundwater restoration."

Next Steps

Several additional steps will be taken by the Company prior to implementing our new technology on a commercial scale. First, to finalize permitting, we will submit a report to LQD detailing the results of initial testing. Because LQD Staff previously reviewed the engineering and witnessed the installation of wells utilizing the technology, we expect final approval will be efficiently processed.

Phase 2 field testing will focus on well development methods with the goal of maintaining flow rates consistent with conventional methods and verifying required rig time as utilized in Phase 1 installations. We will continue testing all aspects of the new technology, including well integrity and flow rates, by installing and operating several of the new injection wells in an operational setting. If the wells perform as expected, the technology will be implemented across Company operations.

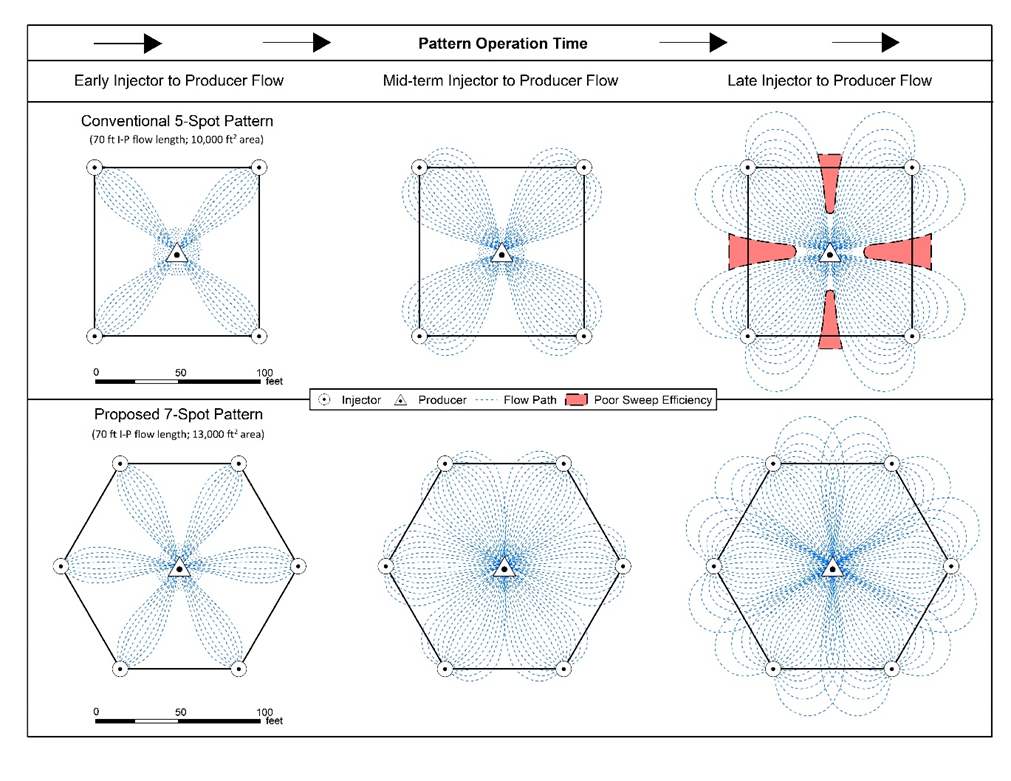

Given the potential significant cost savings presented by our technology, we will initiate a hydrologic modeling exercise to determine what well pattern geometry and spacing is most cost effective. We believe the five-spot well pattern geometry currently used throughout the industry may be improved by utilizing our new technology in a seven-spot geometry as illustrated below. This seven-spot geometry is expected to increase the sweep efficiency, improve the percentage of uranium recovered, and shorten the time required for mining and groundwater restoration. The modeling exercise will balance the well geometry and spacing against economics to determine the most cost-effective way to utilize the new technology.

Future Application and Value to Ur-Energy

The new well installation technology is expected to be applicable across the in-situ recovery industry including in recovery of copper, lithium, soda ash, potash and other soluble minerals. The technology can also be applied in the groundwater restoration industry when treated water is re-injected into the host aquifer. The technology may also provide cost benefits when micro-purging of groundwater monitor wells is desirable. The Company plans to monetize the patented technology by licensing it to these and potentially other industries.

While Phase 1 results have been favorable, additional testing, as described above, is required before determining if the technology will be proven commercially viable. By its very nature, research and development is challenging and outcomes are difficult to predict. We will provide an update after the planned additional injection wells are placed in operation, which is the ultimate test.

Ur-Energy professional and operations staff will continue to diligently pursue new technologies and other optimization of processes to drive down our already low production cost while reducing our environmental footprint. As previously announced, research and development on advanced, water filtration and treatment processes is ongoing. This project may require several more months before results are known and can be reported.

About Ur-Energy

Ur-Energy is a uranium mining company operating the Lost Creek in-situ recovery uranium facility in south-central Wyoming. We have produced, packaged, and shipped approximately 2.6 million pounds U3O8 from Lost Creek since the commencement of operations. Ur-Energy has all major permits and authorizations to begin construction at Shirley Basin, the Company's second in situ recovery uranium facility in Wyoming and is in the process of obtaining remaining amendments to Lost Creek authorizations for expansion of Lost Creek. Ur‑Energy is engaged in uranium recovery and processing activities, including the acquisition, exploration, development, and operation of uranium mineral properties in the United States. The primary trading market for Ur‑Energy's common shares is on the NYSE American under the symbol "URG." Ur‑Energy's common shares also trade on the Toronto Stock Exchange under the symbol "URE." Ur-Energy's corporate office is in Littleton, Colorado and its registered office is in Ottawa, Ontario.

FOR FURTHER INFORMATION, PLEASE CONTACT

John W. Cash, Chairman, CEO & President

866-981-4588, ext. 303

John.Cash@Ur-Energy.com

Cautionary Note Regarding Forward-Looking Information

This release may contain "forward-looking statements" within the meaning of applicable securities laws regarding events or conditions that may occur in the future (e.g., whether and on what timing all necessary additional permitting will be received from LQD; whether the new well installation methods and materials will be successfully proven out in Phase 2 testing and in future operational tests including the cost savings and environmental benefits which may be achieved; whether changes to the traditional five-spot geometry of recovery patterns will be successful and what new geometric recovery and restoration sweeps will be utilized; whether the new technology will be applicable to and adopted by other industries and what value that may bring to the Company; and the viability and timing of other research and development efforts of the Company) and are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "expects," "does not expect," "is expected," "is likely," "estimates," "intends," "anticipates," "does not anticipate," or "believes," or variations of the foregoing, or statements that certain actions, events or results "may," "could," "might" or "will be taken," "occur," "be achieved" or "have the potential to." All statements, other than statements of historical fact, are considered forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statements include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish estimated resources and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods and amounts varying from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; inflation; changes in exchange rates; fluctuations in commodity prices; delays in development and other factors described in the public filings made by the Company at www.sedar.com and www.sec.gov. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained herein are based on the beliefs, expectations and opinions of management as of the date hereof and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in circumstances or in management's beliefs, expectations or opinions that occur in the future.

SOURCE: Ur-Energy Inc.

View source version on accesswire.com:

https://www.accesswire.com/729110/Ur-Energy-Successfully-Completes-Phase-1-Field-Tests-of-Patented-Well-Installation-Technology