November 05, 2023

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to provide an update on its Tumbes Basin TEA project offshore Peru.

Highlights

- Acquisition of comprehensive historical dataset complete, including more than 3,800 km2 of 3D seismic data.

- Only one exploration well has been drilled in the 4,858km2 TEA area using 3D seismic data.

- Opportunity to explore a proven hydrocarbon bearing basin which remains virtually undrilled using modern 3D seismic data.

- The Company will now reprocess an aggregate of 1,000km2 of 3D seismic, targeting highly prospective area(s) with a view to refining advanced exploration targets and to allow the deployment of Quantitative Interpretation and Artificial Intelligence based interpretation methodologies.

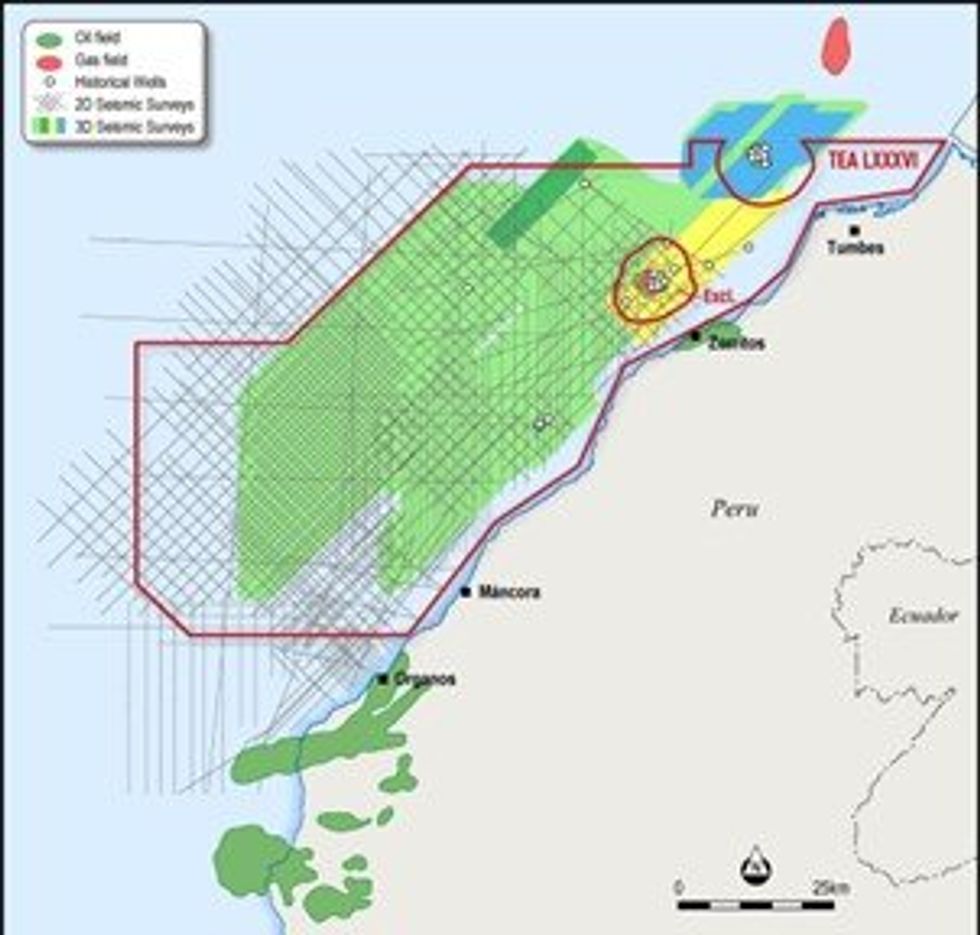

Global’s US based Joint Venture partner, Jaguar Exploration Limited (Jaguar) has obtained over 3,800km2 of 3D seismic data covering more than 66% of the Tumbes Basin TEA area (Figure One).

In addition, more than 7,000 km of 2D seismic data and information from more than 50 wells relevant to the TEA area have also been received as well as numerous technical studies and independent resource and reserve audits. This information will be collated and incorporated into a prospectivity study which is now underway.

Despite the many discoveries of oil and gas made within and immediately adjacent to the Tumbes TEA it is significant to note that only two wells have been drilled since these 3D seismic data were acquired. One of those was a step-out well on an existing field to test the downdip extent of the oil column while the other was a genuine exploration well. The Tumbes TEA therefore presents the Company with a rare opportunity to explore a proven hydrocarbon basin which remains virtually unexplored using modern 3D seismic data.

The Jaguar technical team have started work on the first phase of the interpretation project. The next milestone will be to high-grade areas within the Tumbes TEA where the 3D seismic data will undergo reprocessing. This should improve the fidelity of the data.

The processing algorithms being used are designed to optimise the impact of new Quantitative Interpretation and Artificial Intelligence methodologies that will be used as part of the prospect definition process.

The plethora of seismic data and identification of technical studies and independent audits detailing resources for several prospects inside the block is a significant step forward for the Company in advancing the Peruvian offshore opportunity.

Further updates will be provided once the high-graded areas are defined.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

06 March

Syntholene Energy Corp. Announces Completion of Conceptual Design Report and Technoeconomic Analysis

Report Validates Pathway to Industrial Scale Synthetic Fuel Production Targeting Cost Competitiveness with Fossil FuelsSyntholene Energy Corp. (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) ("Syntholene" or the "Company") announces the completion of its Conceptual Design Report ("CDR") and integrated... Keep Reading...

06 March

Angkor Resources Announces Closing of Evesham Oil and Gas Sale

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 6, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of all final payments and closing of the sale of its 40% participating interest (the "Assets") in the Evesham Macklin oil and gas... Keep Reading...

05 March

Oil Prices Surge as Iran Conflict Halts Tanker Traffic Through Hormuz

Oil and gas prices extended their sharp climb this week as the escalating conflict between the US, Israel and Iran disrupts shipping through one of the world’s most critical energy chokepoints.Crude oil futures surged again on Thursday (March 5), with the US benchmark climbing roughly 3.5... Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00