January 22, 2024

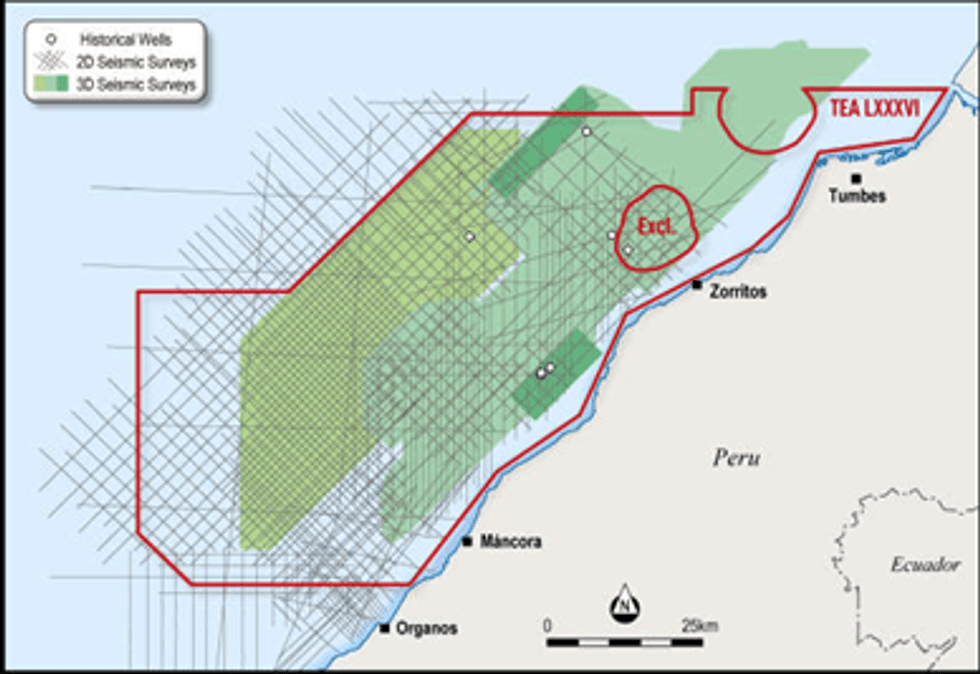

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to provide an update on its Tumbes Basin Technical Evaluation Agreement (“TEA”) offshore Peru (Figure 1). In August 2023, the Company executed TEA LXXXVI with PeruPetro, the Government department responsible for the administration and promotion of oil and gas exploration in Peru. The 4,858km2 TEA incorporates almost all of the offshore Tumbes Basin, in moderate water depths of between 100m and 1,500m. The block is surrounded by, and includes, multiple historic and currently producing oil and gas fields.

Highlights

- Identification and interpretation of historical data has identified more than 20 potential leads in the TEA area.

- Work programme commenced to develop, rank and ‘high-grade’ these leads and define new prospective features.

- The next milestone will be to select areas for 3D seismic reprocessing with a view to the deployment of new Quantitative Interpretation and Artificial Intelligence based interpretation methodologies.

The Company has now collected and curated a significant quantity of geophysical and geological data over the TEA and the wider Tumbes Basin and interpretation work is underway.

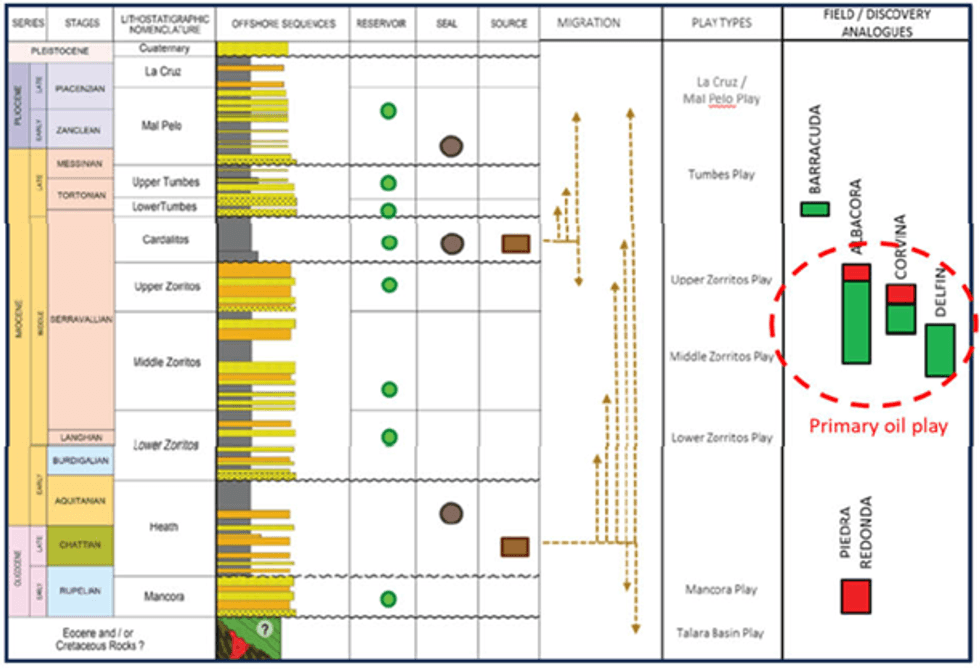

There are several oil and gas discoveries in the Tumbes Basin itself, with the southerly adjacent Talara Basin representing the most prolific offshore hydrocarbon basin in Peru. The majority of existing discoveries and prospective targets in the Tumbes Basin are within the Miocene Zorritos Formation, with hydrocarbons sourced from the Oligo-Miocene Heath Formation (Figure 3).

The Tumbes Basin has a complex geological history related to the Pacific Plate colliding with, and being subducted beneath, the South American Plate. The basin is heavily faulted (Figure 4) creating a multitude of structural trapping styles.

Despite the presence of several discoveries within and adjacent to the TEA area, only one well, Marina- 1, has been drilled to test an exploration prospect informed by 3D seismic data. Marina-1 was drilled in 2020 and encountered some hydrocarbon shows in shallow Pliocene reservoirs, however the anticipated reservoirs in the Tumbes Formation were not well developed. The well did not reach the Zorritos Formation which is the primary reservoir target in the basin.

Marina-1 was a commitment well drilled in the early period of the COVID pandemic when oil prices had dropped significantly due to global uncertainty.

The results of the Marina-1 are to be reviewed in detail and will be of value in determining where the Tumbes reservoir might be better developed. There are over 3,800 km2 of 3D seismic data within the TEA area and, as noted above, Marina-1 is the only exploration well to have been drilled since these data were acquired.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00