Tudor Gold Corp. (TSXV: TUD) (FSE: H56) (the "Company" or "Tudor") is pleased to announce the results from the third drillhole completed from the 2025 exploration drilling program (the "Program") at its 80%-owned Treaty Creek Project, located in the heart of the Golden Triangle of Northwestern British Columbia.

Drilling Highlights:

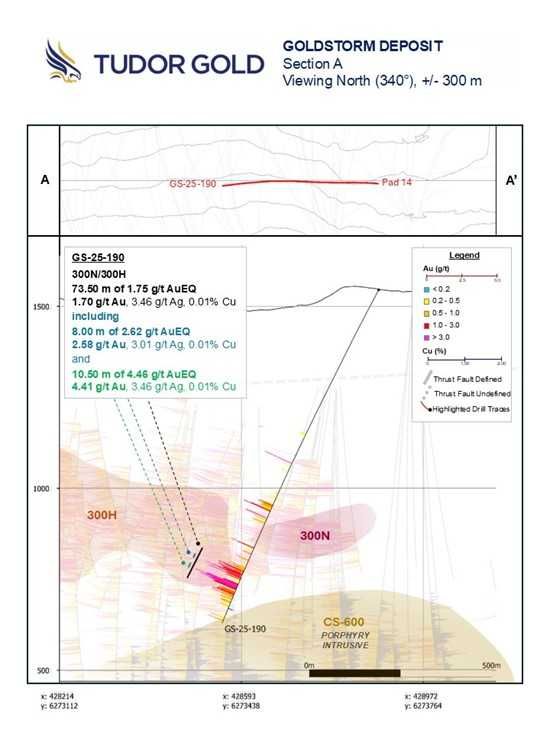

Hole GS-25-190 intersected a 70-meter ("m") eastward extension of the 300 Horizon Zone ("300H"), linking mineralized intercepts within 300H and 300 North Zone ("300N") along a potential SC-1 Zone structural corridor. Highlights of the mineralized intercept:

-

1.70 g/t gold, 3.46 g/t silver and 0.01% copper (1.75 g/t gold equivalent ("AuEQ")) over 73.50 m, including:

-

2.03 g/t gold, 2.06 g/t silver and 0.01% copper (2.06 g/t AuEQ) over 38.0 m, including:

2.58 g/t gold, 3.01 g/t silver and 0.01% Cu (2.62 g/t AuEQ) over 8.00 m; and

4.41 g/t gold, 3.46 g/t silver, 0.01% copper (4.46 g/t AuEQ) over 10.50 m

-

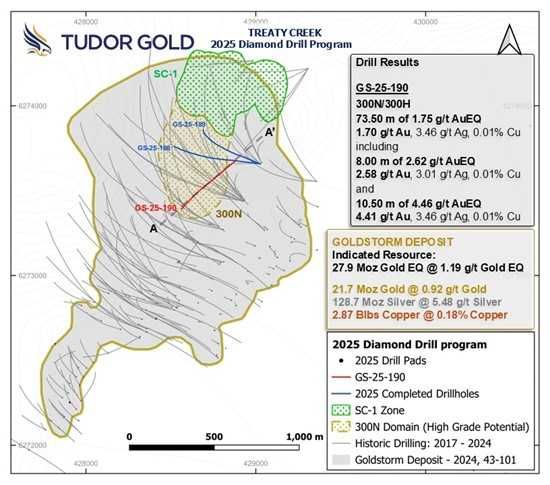

See Table 1 below for select drill results of hole GS-25-190 accompanied by a plan map and cross sections.

GS-25-190 was targeted to infill high-grade mineralization between 300N and 300H and provide continuity between the two previously unconnected zones. This drill hole expands the mineralized footprint of 300H by 70 m to the east and 300N by 45 m to the southwest. In addition, the intercepted mineralization occurs along a structural orientation similar to the previously identified four sub-parallel gold-bearing breccia systems of the SC-1 Zone. Mineralization along this axis now connects 300H and 300N.

Tudor has filed a permit application for the development of an underground ramp to access the high-grade gold SC-1 Zone as well as the other higher-grade gold zones. Once the ramp is completed, underground drill stations will be excavated to support definition drilling for mine-planning purposes and provide for more efficient expansion drilling. Underground drilling is expected to reduce the time and cost of delineating the high-grade gold zones and allow for year-round drilling by Tudor.

Remaining Drill Holes and Mineral Resource Update

The results from the remaining two drill holes from the 2025 Exploration Program will be released in the coming weeks. Following the receipt of the remaining drill hole data, an updated Mineral Resource estimate will be prepared that will include all drilling from 2024 and 2025 exploration programs comprising approximately 15,000 meters of drill data. The updated block model used to estimate the 2025 Mineral Resource will be comprised of 5mx5mx5m blocks rather than the 10mx10mx10m blocks used to estimate the 2024 Mineral Resource estimate. The smaller block size will provide better resolution of the higher-grade gold mineralization. The updated Mineral Resource estimate is targeted to be completed in the fourth quarter of this year.

Table 1: Select Drill Results for Drillhole GS-25-190

| Hole | Collar Coords | Dip/ Azimuth | From (m) | To (m) | Interval (m) | Gold (g/t) | Silver (g/t) | Copper (%) | AuEQ(3) (g/t) |

| GS-25-190 | 428884 mE 6273677 mN | -66/235 | 857.50 | 931.00 | 73.50 | 1.70 | 3.46 | 0.01 | 1.75 |

| including | 872.00 | 910.00 | 38.00 | 2.03 | 2.06 | 0.01 | 2.06 | ||

| Including | 872.00 | 880.00 | 8.00 | 2.58 | 3.01 | 0.01 | 2.62 | ||

| and | 899.50 | 910.00 | 10.50 | 4.41 | 3.46 | 0.01 | 4.46 |

All assay values are uncut and intervals reflect drilled intercept lengths.

HQ and NQ diameter core samples were sawn in half and typically sampled at standard 1.5 m intervals.

The following metal prices were used to calculate the Au Eq metal content: Gold $1850/oz, Ag: $21/oz, Cu: $3.75/lb. Calculations used the formula AuEQ = Au g/t + (Ag g/t*0.0100901) + (Cu ppm*0.0001236). All metals are reported in USD and calculations consider recoveries of 90 % for gold, 80 % for copper, and 80 % for silver.

True widths have not been determined as the mineralized body remains open in all directions. Further drilling is required to determine the mineralized body orientation and true widths.

Plan Map of Drillhole GS-25-190

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4494/269607_plan_map_2025-10-02.jpg

Cross Sections of Drillhole GS-25-190

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4494/269607_sections_2025-10-02.jpg

Qualified Person

The Qualified Person for this news release for the purposes of National Instrument 43-101 is the Company's Senior Vice President of Exploration, Ken Konkin, P. Geo. He has read and approved the scientific and technical information that forms the basis for the disclosure contained in this news release.

QA/QC

Diamond drill core samples were prepared at MSA Labs' Preparation Laboratory in Terrace, BC and assayed at MSA Labs' Geochemical Laboratory in Langley, BC. Analytical accuracy and precision are monitored by the submission of blanks, certified standards and duplicate samples inserted at regular intervals into the sample stream by Tudor Gold personnel. MSA Laboratories quality system complies with the requirements for the International Standards ISO 17025 and ISO 9001. MSA Labs is independent of the Company.

About Treaty Creek

The Treaty Creek Project hosts the Goldstorm Deposit, comprising a large gold-copper porphyry system, as well as several other mineralized zones. As disclosed in the "NI-43-101 Technical Report for the Treaty Creek Project", dated April 5, 2024 prepared by Garth Kirkham Geosystems and JDS Energy & Mining Inc., the Goldstorm Deposit has an Indicated Mineral Resource of 27.87 million ounces (Moz) of AuEQ grading 1.19 g/t AuEQ (21.66 Moz gold grading 0.92 g/t, 2.87 billion pounds (Blbs) copper grading 0.18%, 128.73 Moz silver grading 5.48 g/t) and an Inferred Mineral Resource of 6.03 Moz of AuEQ grading 1.25 g/t AuEQ (4.88 Moz gold grading 1.01 g/t, 503.2 Mlb copper grading 0.15%, 28.97 Moz silver grading 6.02 g/t), with a pit constrained cut-off of 0.7 g/t AuEQ and an underground cut-off of 0.75 g/t AuEQ. The Goldstorm Deposit remains open in all directions and requires further exploration drilling to determine the size and extent of the Deposit.

About Tudor Gold

Tudor Gold Corp. is a precious and base metals exploration and development company with claims in British Columbia's Golden Triangle (Canada), an area that hosts producing and past-producing mines and several large deposits that are approaching potential development. The 17,913 hectare Treaty Creek Project (in which Tudor Gold has an 80% interest) borders Seabridge Gold Inc.'s KSM property to the southwest and borders Newmont Corporation's Brucejack Mine property to the southeast.

For further information, please visit the Company's website at www.tudor-gold.com or contact:

| Joseph Ovsenek President & CEO (778) 731-1055 Tudor Gold Corp. Suite 789, 999 West Hastings Street Vancouver, BC V6C 2W2 info@tudorgoldcorp.com (SEDAR+ filings: Tudor Gold Corp.) | Chris Curran Vice President of Investor Relations and Corporate Development (604) 559 8092 chris.curran@tudor-gold.com |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the completion and anticipated results of planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating gold prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed herein and from time to time in the filings made by the Company with securities regulators.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/269607