March 26, 2024

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to provide an operational update on the mining restart at its 100% owned Cloncurry Copper Project (CCP).

HIGHLIGHTS

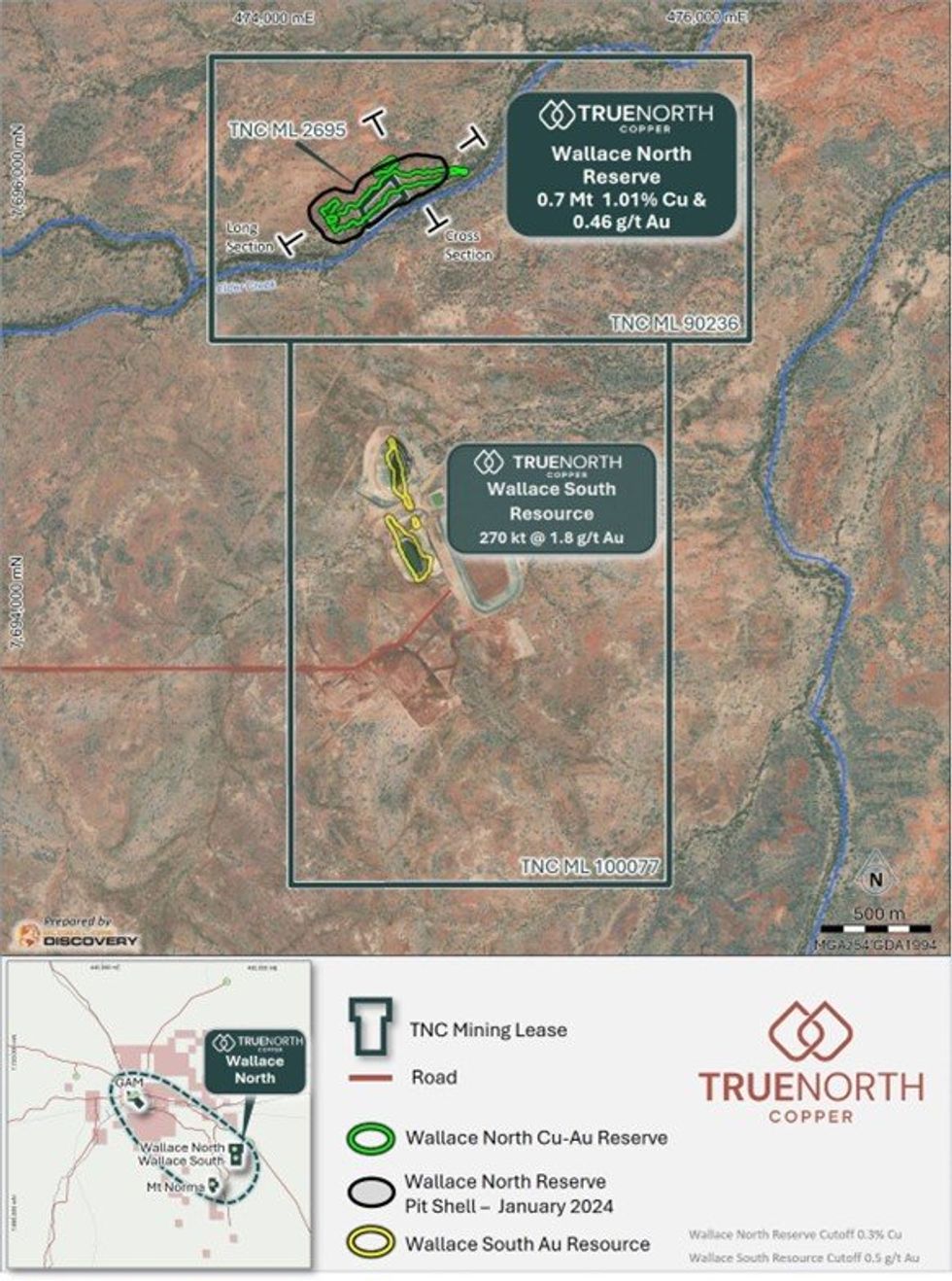

- TNC will commence mining ore at Wallace North in early Q4 FY24 (see Figure 2).

- Mining preparation at Wallace North progressed in March 2024 (as access and mine areas dried after monsoonal rainfall events in February and early March) including the following:

- Mobilisation of mining equipment and support infrastructure to the Wallace North project site (see Figures 4 & 5).

- Preparation of existing access and haulage roads for upcoming mining activities (see Figure 3).

- Completion of short-term mine scheduling by technical service teams.

- Onboarding of skilled mining fleet operators.

- The mining ramp-up will initially build ore stockpiles, with haulage expected to start in mid-May 2024. Oxide ore will be transported by road train to the Cloncurry Operations Hub's heap leach. Sulphide ore will be transported to a nearby concentrator for toll treatment under TNC's toll-milling agreement with Glencore International AG1 (Glencore).

- The CCP currently incorporates the Great Australia Mine Reserve3 (includes Great Australia Mine [GAM], Taipan and Orphan Shear deposits) and the Wallace North Reserve4 totalling 4.7Mt grading 0.80% Cu and 0.13g/t Au containing 37.5kt of copper and 20.0koz of gold (see Figure 1) at a strip ratio of 4.22.

- The CCP restart plan confirms positive project economics including mine revenue of A$367M with free cash flow of A$111M, and a pre-tax NPV10 of A$88M over a 4.6 year mine life, at USD$8,500/t Cu price and USD$1,850/oz Au price (0.7 A$:USD exchange rate)2.

COMMENT

True North Copper’s Managing Director, Marty Costello said:

“This is an exciting and transformative phase for TNC. Thanks to the hard work of our Mining Operations Team we are prepared and ready to deliver on our Cloncurry Copper Project Mining Restart Plan with mining commencing at Wallace North in early Q4 FY24.

CCP project economics confirm a robust mining operation that is low risk and low-cost. Projected mine revenue is A$367M with a free cash flow of A$111M.

Our plans to develop Mt Oxide into our next mine continue as we finalise the Vero mineral resource re-estimation and optimisation study.”

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

3h

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

14h

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

15h

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third-Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00