TinOne Resources Inc. (TSXV: TORC) (OTCQB: TORCF) ( Frankfurt : 57Z0) (" TinOne " or the " Company ") is pleased to announce that it has defined coherent and locally coincident lithium and tin soil anomalies during ongoing exploration activities at its 100%-owned, 9,600 hectare Aberfoyle Project (" Aberfoyle " or the " Project ") located in the tier-one mining jurisdiction of Tasmania, Australia .

Highlights

- Definition of a coherent lithium-in-soil anomaly (approximately 3,000 x 700- 200m at a cut-off of 200ppm) coincident with, and extending beyond, the Dead Pig-Guinea Pig lithium prospect area

- Peak lithium in soils was 875 ppm (0.18% Li 2 O)

- Definition of two strong tin-in-soil anomalies (200 ppm cut-off) over the Rex Hill and Guinea Pig-Dead Pig prospects

"We are very pleased with the initial results from our reconnaissance-style soil sampling program at Aberfoyle ," commented Chris Donaldson , Executive Chairman. " We have now identified a significant lithium-in-soil anomaly across the Dead Pig and Guinea Pig prospects where we previously reported rock samples containing up to 1.14% Li2O. Sampling focus now extends to the Royal George area, which is also considered highly prospective for both lithium and tin."

Key Results

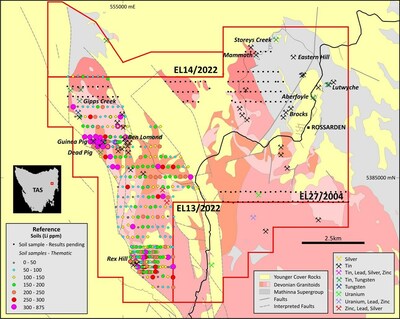

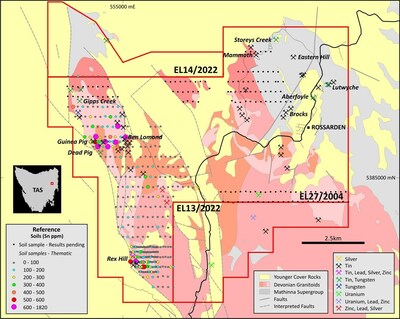

First pass soil sampling has been completed over prospective target areas at the Aberfoyle project (Figure 2). Initial sampling was completed on a wide-spaced 200 x 400m grid, with more detailed sampling on a 50 x 200m across the Rex Hill area (Figure 2). A total of 657 samples have been taken so far and results have been received for 364 samples.

The geochemical results received to date have defined coherent lithium and tin anomalies in the Dead Pig-Guinea Pig and Rex Hill prospect areas (Figure 2). At the Dead Pig-Guinea Pig area, a core area of highly anomalous lithium, greater than 300 ppm, occurs over an area of approximately 600 x 300m . At a 200ppm cut-off, the lithium anomaly is coherent over more than 3,000 x 700- 200m . Results from two lines immediately north of the Dead Pig-Guinea Pig anomaly have not yet been received and the anomaly is thus open to the north. The highest lithium in soil result was 875 ppm (0.18% Li 2 O) within a 400m , greater than 0.1% Li 2 O, zone across the Dead Pig-Guinea Pig area.

The soil geochemical results also define a coherent tin anomaly at the 200ppm level over approximately 900 x 300m in the Rex Hill prospect area. The Rex Hill prospects contains a historic mine developed on a mineralized breccia surrounded by veined and greisen altered granite. The soil program has been highly successful in defining the broader footprint of the prospect area and the results will be used to define drill targets and inform the next phases of exploration.

Ongoing Work and Next Steps

Detailed multi-element analysis of the soil geochemical data and integration with geological and structural mapping and rock geochemical data are ongoing and the results are expected to define potential drill targets.

TinOne's field team continues to undertake geological mapping and additional systematic and targeted rock sampling across the highly prospective lithium and tin mineralized areas identified to-date and across other prospective areas known from historic records. Geochemical results from ongoing rock sampling are expected in the coming weeks.

In addition, TinOne geologists have located drill holes stored in the Mineral Resources Tasmania (MRT) drill core storage facility with records of micaceous alteration. These holes are being logged and where micaceous alteration (potentially lithium-bearing) is observed, sampling for geochemical analysis is being undertaken.

The Company also plans a program of mapping and rock and soil sampling on the southern outlier part of EL27/2004 at Royal George. This part of the tenement covers an area around the historic Royal George tin mine hosted by a similar tin granite to the Dead Pig area. As such, the area is considered highly prospective for both lithium and tin. There has been no effective on-ground exploration in this area for nearly four decades.

About the Aberfoyle Project

The Aberfoyle project area straddles the boundary between the Silurian to Devonian Mathinna Supergroup sedimentary rocks and the Devonian Ben Lomond Granite. The historic Aberfoyle (tin) and Storeys Creek (tin-tungsten) mines as well as other vein systems are hosted in the sedimentary rocks and occur as strike extensive systems of sheeted and stockwork veining. Elevated lithium has not previously been reported from the project area.

Historic records and drilling indicate the mineralized vein system at Aberfoyle is up to 60 metres wide, 800 metres in length and extends approximately 400 metres in the down dip direction. The Lutwyche prospect occurs approximately 1 kilometre northeast of Aberfoyle and is comprised of two sets of mineralized veins which can be traced along strike for approximately 750 metres.

An additional sediment-hosted vein system, the Kookaburra, is located 200 metres southwest of the main Lutwyche vein system and is known to be approximately 40 metres wide with an along strike extent of at least several hundred metres.

Mineralization at Storeys Creek is hosted within a 30 to 50 metre wide, north-northwest striking sheeted vein array which dips to the southwest. The system can be traced along strike for 300 metres and extends 400 metres in the down dip direction. The Ben Lomond Granite crops out approximately 1km west of the mine and has been identified at depth at 180 metres below the surface.

Additional poorly known sediment-hosted vein systems occur at Brocks, Eastern Hill and elsewhere in the tenement.

Granite-hosted occurrences are developed throughout the exposed areas of granitoid outcrop and consist of vein, disseminated and breccia style occurrences with associated greisen style alteration. These have given rise to historic small scale hard rock and more extensive alluvial production in the Gipps Creek, Rex Hill, Ben Lomond , Royal George and other areas.

The Company interprets that both sediment- and granite-hosted systems have developed in structural corridors of multi-kilometre extent and that historic exploration has not systematically explored these corridors. TinOne believes systematic exploration of these prospective corridors will result in the definition of high-quality drill targets.

Sample Methodology

Soil samples reported here were collected by experienced field assistants using hand sampling techniques with a depth ranging from 30 to 100cm, with an average of 59cm depth. Samples were coarsely sieved in the field with typically 0.5 and 1 kg despatched to the laboratory. Samples were placed in pre-numbered, calico bags and then into large rice sacks which were sealed for shipping. On receipt by the laboratory they were dried and sieved to -180µm (-80 mesh).

Quality Assurance / Quality Control

Rock samples were delivered to ALS Limited in Burnie, Australia for sample preparation and then forwarded to ALS Perth for analysis. The ALS Perth facilities are ISO 9001 and ISO/IEC 17025 certified. Tin and tungsten are analysed by ICP-MS following lithium borate fusion (ALS method ME-MS85), overlimit results are reanalysed by XRF (ALS method XRF15b). Forty-eight element multi-element analyses are conducted by ICP-MS after a four-acid digestion (ALS method ME-MS61).

Control samples comprising certified reference samples (including reference material certified for lithium) duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

About TinOne

TinOne is a TSX Venture Exchange listed Canadian public company with a high-quality portfolio of tin, tin/tungsten and lithium projects in the Tier 1 mining jurisdictions of Tasmania and New South Wales, Australia . The Company controls some of the most important tin districts in Tasmania , including Aberfoyle , Rattler Range and Great Pyramid and is focussed on advancing its highly prospective portfolio. TinOne is supported by Inventa Capital Corp.

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Dr. Stuart Smith ., Technical Adviser for TinOne. Dr. Smith is a Qualified Person as defined under the terms of National Instrument 43-101.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the development of the Company's projects; future mineral exploration, development and production; and the release of exploration results.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of TinOne, future growth potential for TinOne and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; TinOne's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect TinOne's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and TinOne has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on early stage mineral projects; metal price volatility; risks associated with the conduct of the Company's mining activities in Australia ; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in TinOne's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although TinOne has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. TinOne does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

SOURCE TinOne Resources Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/26/c1419.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/26/c1419.html