September 09, 2024

Drilling will test priority targets identified along strike from major gold and critical minerals discoveries and mines in Western Australia and the Northern Territory

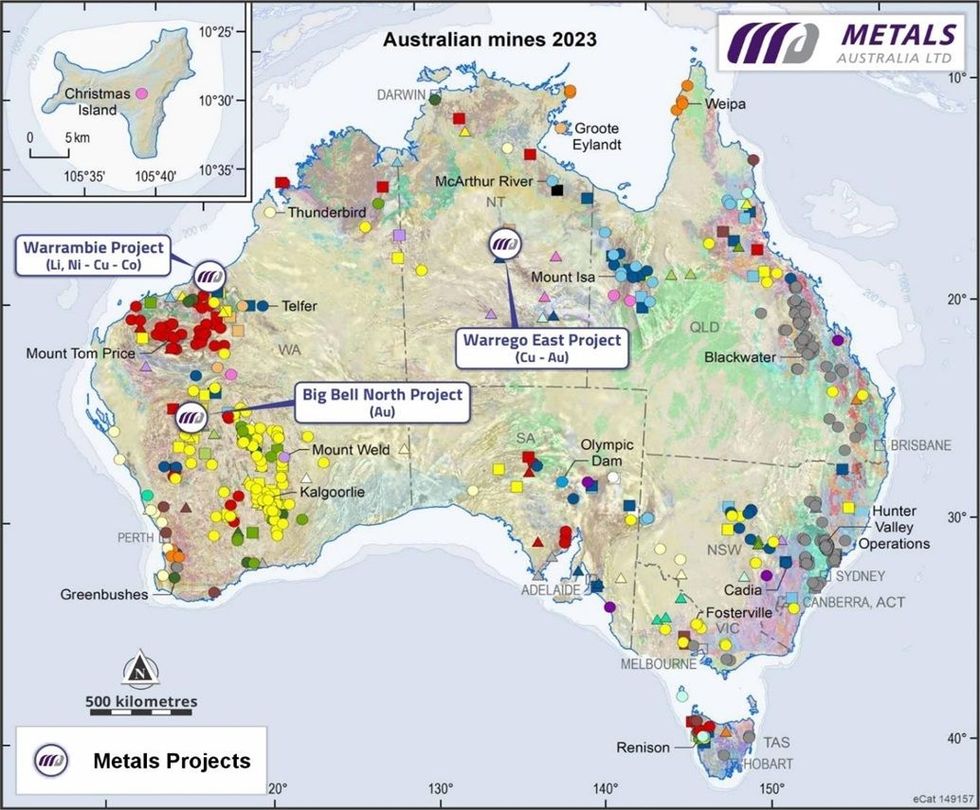

Metals Australia Ltd (ASX: MLS) (“the Company”) is pleased to announce that drilling has commenced testing the first of three key exploration projects in Australia1,8, which are highly prospective for gold and critical minerals. All three projects are located along strike from major mineral deposits in world-class mineral fields (see Figure 1).

- An aircore drilling program of up to 6,000m is underway testing gold, lithium-pegmatite and Ni-Cu- Co targets across the Warrambie Project in WA’s northwest Pilbara1. Warrambie straddles the Scholl Shear Zone, which is analogous to the Mallina Shear – host to the nearby, 10Moz, Hemi gold deposit3. The drilling will also test for major lithium-pegmatites, being located just 10km east of the Andover lithium discovery2,5.

- An up to 120-hole aircore drilling program is permitted to follow an extensive soil sampling and gravity program underway at Big Bell North in WA’s world-class Murchison Gold Province, testing greenstone-splay fault hosted gold targets identified from interpretation of imagery from the recently completed aeromagnetic survey1. Big Bell North is located along strike to the northeast of the 5Moz Big Bell gold deposit4.

- Approvals imminent for a substantial drilling program at the Warrego East copper-gold project within the Tennant Creek Mineral Field, which historically produced a world-class 25Mt @ 6.9g/t Au and 2.8% Cu6. Warrego East is directly east of Warrego mine, which produced 6.75Mt @ 1.9% Cu and 1.8g/t Au6. The drilling will test a series of gravity and magnetics defined ironstone hosted copper-gold targets within a corridor which links the Warrego Mine with the Gecko and Orlando copper-gold deposits6,7.

Metals Australia CEO Paul Ferguson commented:

“2024 is shaping up as the most active and exciting period in Metals Australia’s history - with the three aggressive gold and critical minerals drilling and exploration programs launched at Warrambie, Big Bell North and Warrego East in Australia being advanced in parallel with our two gold and critical minerals programs underway in Canada.

“Critically, our projects are all located in world-class mineralised provinces along strike from major discoveries and historical mines.

We believe all our projects have potential for major new discoveries and we look forward to a period of strong news flow and results throughout the remainder of 2024 and beyond - as we look to unlock their potential and build value for MLS shareholders.”

Warrambie Lithium-Pegmatite, Gold and Ni-Cu-Co Targets, Northwest Pilbara, WA

An extensive aircore drilling program has commenced testing bedrock lithium-pegmatite targets identified at Warrambie as well as gold and Ni-Cu-Co targets in previously un-explored areas under shallow cover.

Up to 50 aircore holes (up to 6,000m) are being drilled to test targets generated through interpretation of previously acquired detailed aeromagnetics and detailed gravity imagery over the Warrambie project (see Figure 2), including:

- Lithium pegmatite targets associated with northeast-trending fault corridors associated with gravity lows which intersect magnetic mafic intrusive rocks1,8. This is an analogous geological setting to the neighbouring Andover lithium pegmatite discovery (drilling intersections of up to 209m @ 1.42% Li2O2) – which is associated with a 5km wide, northeast-trending structural corridor in mafic intrusive rocks (Figure 2).

- Orogenic gold (and Ni-Cu-Co sulphide) targets associated with magnetic anomalies in the Scholl shear which extend west of the Sabre Resources Ltd (ASX:SBR) Sherlock Bay Project, which hosts a 100,000t Ni-Cu-Co sulphide resource9, where recent drilling produced a significant gold (Ni-Cu-Co) intersection mineralisation (8m @ 1.07 g/t Au, 0.3% Ni, 0.11% Cu in SBDD01010) - see Figure 1. The Scholl Shear is parallel and analogous to the Mallina shear which hosts the world-class, >10Moz, Hemi Gold Deposit (DeGrey Mining, ASX:DEG)3.

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

05 November 2025

Drilling the Manindi Vanadium-Titanium-Magnetite Discovery

Metals Australia (MLS:AU) has announced Drilling the Manindi Vanadium-Titanium-Magnetite DiscoveryDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00