October 30, 2024

Tempest Minerals Limited (ASX: TEM) is pleased to report its activities during the September quarter 2024.

Key Points

- Corporate

- Rights Issue Completion

- Projects

- Yalgoo prospectivity analysis

- Yalgoo drilling commenced at Remorse

- FiveWheels geochemical and heritage surveys completed

Projects

Yalgoo

Tempest’s flagship project is the Company’s holding in the Yalgoo region of Western Australia. Totalling more than 1,000km2 and located near high profile neighbours including: 29 Metals Ltd (ASX:29M) - Golden Grove Copper, Zinc, Gold, Silver Mine; Spartan Resources Ltd (ASX:SPR) - Yalgoo Gold Project; Silverlake (ASX:SLK) - Deflector and Rothsay Gold Mines, Capricorn Metals Ltd (ASX:CMM) Gold, EMU NL (ASX:EMU) - Gnows Nest Gold Project; Tungsten Mining (ASX:TGN) - Mt Mulgine Project; Fenix (ASX:FEX) - Iron Ore Operations, and Karara and Sino Iron ore operations and more.

Tempest has used data-driven processes to identify poorly or unexplored areas of highly prospective geology. This approach has had considerable success and includes the discovery of multiple instances of new mineralisation.

The project contains a number of different geological domains - though much of these have considerable overlap. Within these domains, exploration targets continue to be identified through ongoing exploration and data analysis and are being explored systematically according to prioritisation based on geological and other criteria.

Click here for the full ASX Release

This article includes content from Tempest Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

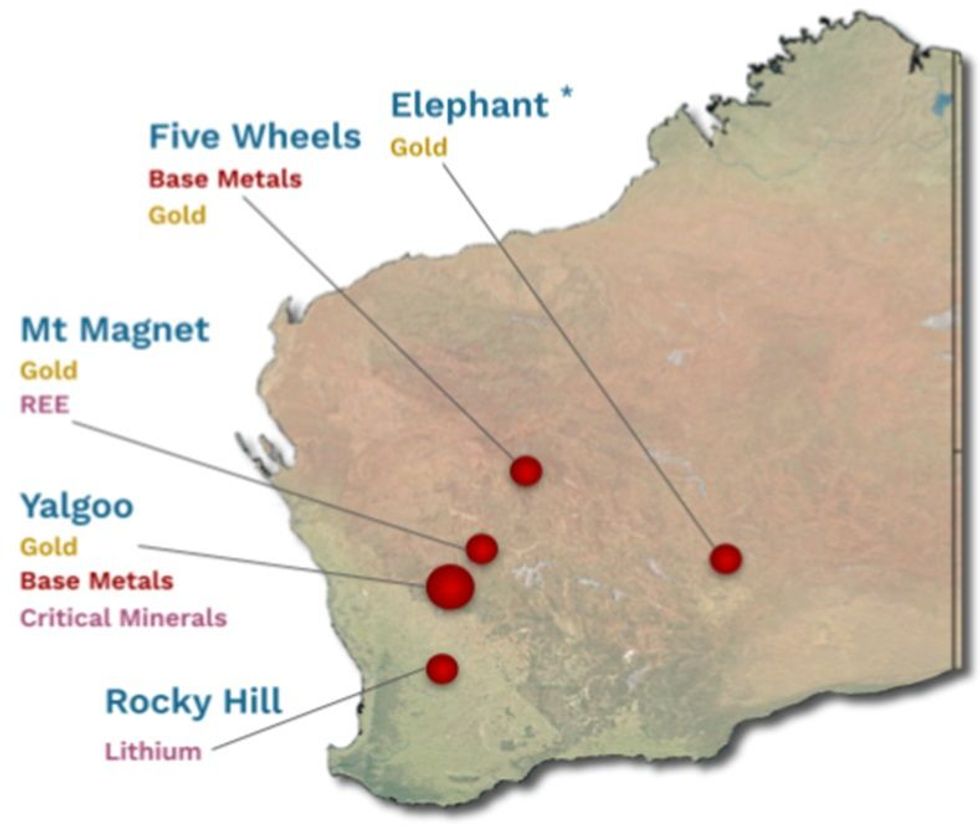

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

22m

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

7h

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

9h

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

19h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

21h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

23h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00