October 09, 2024

Tartana Minerals Limited (ASX: TAT) (the Company) is pleased to advise that it has entered into a non-binding term sheet to acquire a private explorer, Queensland Strategic Metals Pty Ltd (QSM) (the Acquisition).

Highlights:

- Non-binding agreement to acquire Queensland Strategic Metals Pty Ltd (QSM) which holds ten EPMs and one ML covering copper, tin, tungsten, antimony and silver and gold prospects.

- Key QSM projects include Laheys Creek, Comeno, De Wett, Lady Agnes and Tap’n’Toe, Fluorspar in the which polymetallic (Sn, Pb, Cu, Ag, Au, REE, Indium) prospects relate to Carboniferous-Permian granites.

- The most advanced is the Daisy Bell prospect where a mineralised 6 – 9 m wide greisen dyke can be traced for at least 1.8 km along strike. Historical percussion drilling includes:

- 7.6 m @ 1.25% Sn & 0.3% WO3 from 32.0m (Hole 2)

- 13.7 m @ 1.46% Sn & 0.48% WO3 from 36.6m (Hole 10)

- Other projects include Ortona and Cherry Tree copper projects where high grade (>10% Cu) chalcocite exposures are present in outcrop. Ortona has a magmatic affiliation with exposure of copper (chalcocite) grading up to 10% Cu in a series of parallel veins as well a 1.8 m zone grading 1.3 % Co & 1.0 % Ni at surface. Cherry Tree has prospective magnetic targets near the Dianne Hight Strain zone supported by a chalcocite exposure.

- The QSM assets compliment the existing Tartana exploration portfolio providing both additional copper targets as well as increasing Tartana’s exposure to critical metals.

- Completion remains subject to executing binding formal documentation and shareholder approval pursuant to Chapter 7 and Chapter 10 of the ASX Listing Rules.

Completion of the Acquisition remains subject to formal documentation being executed and shareholder approval by Tartana’s shareholders for the purposes of ASX Listing Rule 10.1, 10.11, and 7.1 (further detailed below), amongst other conditions precedent. There can be no assurances that the transaction will complete until such time that all conditions precedent have been met. A summary of the terms of the non-binding agreement is set out at Annexure A.

Acquisition Rationale

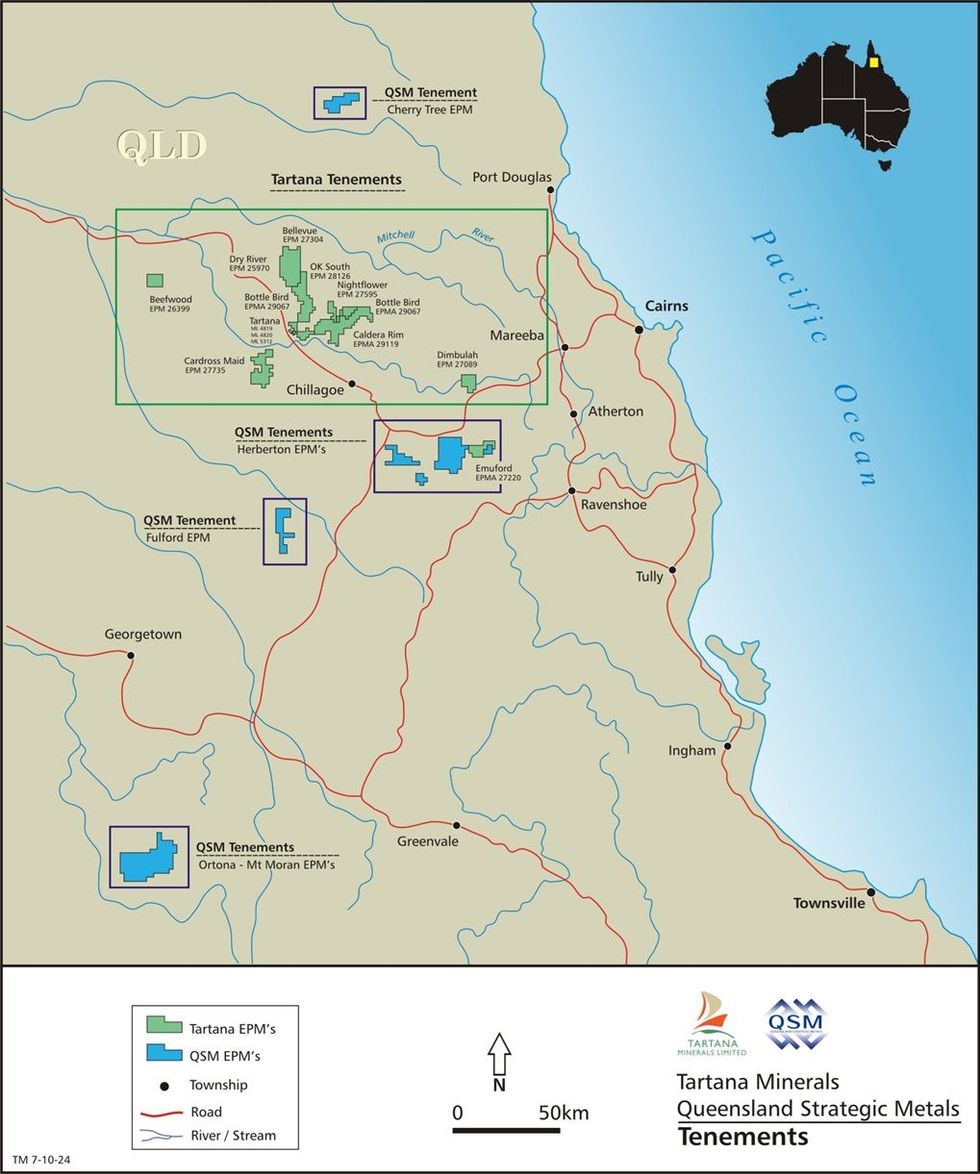

QSM’s EPMs and ML are located Far North Queensland and are complementary to Tartana’s existing exploration portfolio with two copper projects with high grade copper surface mineralisation as well as several EPMs covering critical mineral prospects. The critical mineral EPMs are in proximity to Tartana’s own Herberton (Emuford) EPM Application (EPMA 27220) and are part of move by Tartana to increase its exposure to tin, tungsten and silver and other critical metals.

With Tartana’s Copper Sulphate production continuing to produce healthy cash flows, the Company has also been focused on investigating the development of primary copper mineralisation at the Tartana open pit as well as increasing its exploration portfolio to incorporate additional and complementary projects targeting copper and critical metals. While the former has involved drilling a metallurgical hole (D15) and completing metallurgical test work (flotation recoveries and ore sorting), the opportunity to acquire QSM addresses the latter.

About QSM

QSM has, over the course of recent years aggregated ten EPMs and one ML covering 771 km2 in Far North Queensland (See Figure 2). QSM has acquired the tenements through a series of transactions with tenure holders with a focus on discovery of hardrock critical and strategic metal projects, particularly tin, tungsten and copper.

In some cases the vendors of these tenements have held them for a significant period of time with a focus on alluvial mining over hard-rock exploration. QSM was able to secure attractive terms to acquire these tenements by leaving the alluvial rights in the hands of the vendors or Queensland Alluvial Resources Pty Ltd (further detailed below).

QSM has 7 project areas which are listed in Figure 1. Each project area contains prospects recorded by the Queensland Department of Resources and these are listed under each project/EPM. The dominant metal associated with each project is colour coded with many relating to the minor metals; tin, tungsten and antimony.

While there are many prospects in several of the permits, QSM has completed site visits and discussed the various prospects with ‘old time miners’ to establish which particular projects offer potential scale and potential unmined mineralisation. These projects are in bold in Figure 1.

A detailed project review has been provided at Annexure B.

Click here for the full ASX Release

This article includes content from Tartana Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TAT:AU

The Conversation (0)

12 August 2025

Financing Update and AGM Date

Tartana Minerals (TAT:AU) has announced Financing Update and AGM DateDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Tartana Minerals (TAT:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

13 May 2025

Director led financing and change of Chairman

Tartana Minerals (TAT:AU) has announced Director led financing and change of ChairmanDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Tartana Minerals (TAT:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

24 April 2025

Beefwood Project Clarification and Drilling Update

Tartana Minerals (TAT:AU) has announced Beefwood Project Clarification and Drilling UpdateDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00