- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 02, 2023

Blackstone Continues to Optimise Project Development Strategies Through Ongoing Engagement with Prospective Technology and Off-take Partners

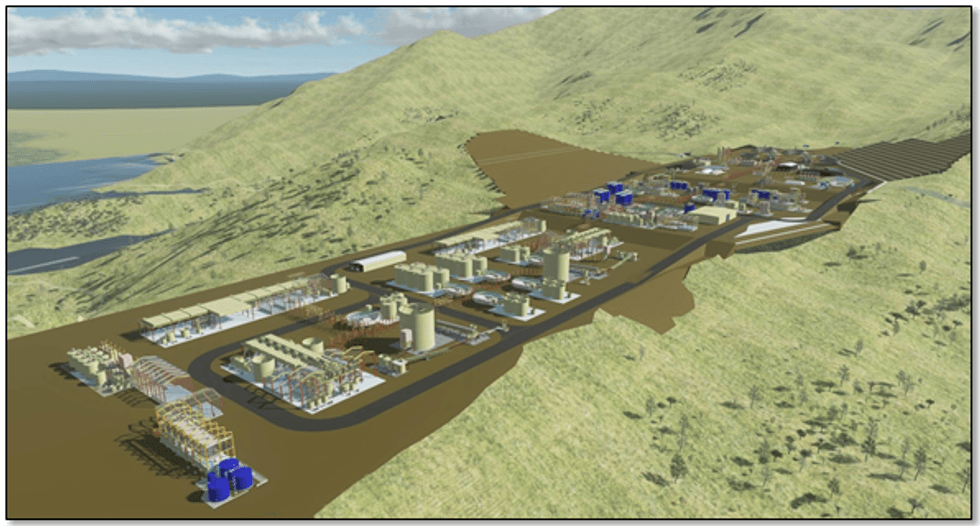

Blackstone Minerals Limited (ASX:BSX) (“Blackstone” or the “Company”) wishes to provide an update on corporate activities, and on the Ta Khoa Project development. With completion of the Ta Khoa Refinery (“TKR”) piloting program, Blackstone has progressed critical project milestones in collaboration with prospective technology and off-take partners (the “Partners”). The development strategy will focus on the following critical activities:

1. Partnerships: continued engagement with Partners to reach a final JV structure and investment contribution.

2. Multi-product strategy: evaluation of various product and throughput staging options, including an initial nickel sulphate start up scenario, which would de-risk early project cashflows, and improve the project development schedule.

3. Community: collaboration with community stakeholders to ensure greatest community support and to aid the permitting process for land access and thus enable early works activities.

4. Permitting: dossier submitted seeking investment policy for the Ta Khoa Refinery, environmental impact assessment and social and economic baseline surveys commenced.

Further details can be found below.

Partnerships

Five groups visited the Project site in 2022 as part of the partnership due diligence process. These visits were accompanied by meetings with government representatives (provincial and federal), Austrade, Australian Department of Foreign Affairs and Trade, financial institutions and other important stakeholders.

Following the announcement of Joe Biden’s Inflation Reduction Act in the United States, the global landscape for battery materials has change dramatically. We are seeing similar new initiatives rolling out in the European Union (EU) and this puts Blackstone in a unique position due to the existing Free Trade Agreement (FTA) between Vietnam and the EU. Following a trip to South Korea in January 2023 to meet with Partners, Blackstone has seen an increased level of engagement with clear interest in the European FTA, as well as the low carbon footprint associated with the Ta Khoa Project nickel products.

The consideration of a multi-product strategy was welcomed by the Partners. Having the flexibility to sell nickel and cobalt sulphate intermediate products while completing precursor cathode active material (“pCAM”) qualification processes will provide cashflow security during the critical project ramp-up phase. This strategy has also attracted several new downstream players, with short term nickel sulphate off-take a desirable contract to secure.

Blackstone looks forward to developing these relationships further in 2023 and is working with its advisors to ensure that the right partner is chosen, delivering the best outcomes for Blackstone shareholders.

Multi-product Strategy

In consultation with Partners and Wood, the lead engineering consultant for the Definitive Feasibility Study (“DFS”), Blackstone is exploring various options. While the development strategy will depend upon the final partnership structure, key considerations being assessed include:

- Production of crystal nickel and cobalt sulphate intermediate products, prior to development of the pCAM facility funded from operating cashflow,

- Staged development of the Refinery, with an initial train capacity for 200,000 tonnes of concentrate feed per year, before expanding with a second train to 400,000 tonnes per year, which would be funded from operating cashflow,

- Early development of the Ta Khoa Massive Sulphide Vein (“MSV”) projects, (King Snake and Ban Chang), and operation though the existing concentrator.

Each of these options de-risk Blackstone’s path to project cashflows and are being evaluated from a technical and economic perspective.

Blackstone is pleased to announce the integration of the Vietnamese engineering firm Narime into the DFS delivery team. Narime will assist Wood in ‘nationalising’ the Ta Khoa Refinery design as well as supporting Blackstone to complete ‘in-country’ vendor and contractor due diligence and source local construction pricing to feed into the DFS estimates. Nationalising the Ta Khoa Refinery design will assist Blackstone in expediting the permitting process as all document submissions need to comply to Vietnamese Standards.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00