June 27, 2023

Quantum Graphite (ASX:QGL), The Company announces today the second and final phase of the thermal purification results of the test work program conducted by INEMET, ProTherm Systems and Sunlands Power.

This final phase of the program was supervised by the Company’s technical consultants and ALS’ Perth laboratories at Balcatta conducted the elemental analysis following thermal treatment at 2,850°C.

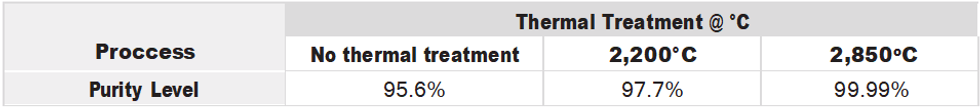

The results confirm within the sensitivity of the test equipment:-

- Uley flake purity of 99.99% graphitic carbon (gC) is achievable from the Sunlands proprietary thermal treatment process

- The direct correlation between predicted impurity element removal (IER) and actual removal of these elements based on the boiling point data for all detectable Uley flake impurities

These results have a significant impact on the Company’s Uley 2 Project, i.e.,

- Based on this purity level the current market price for the Company’s Uley 2 products is approximately US$1,5401 per tonne - compared to the basket price used in the 2019 DFS of US$9192

- The Sunlands proprietary process is commercially scalable and can deliver this level of purity in a production environment

- Commercial demand for such purified product confirms the need to increase production levels in the anticipated revision of the Company’s DFS

Commercial Impacts of Results

The results confirm that commercial production of Uley flake at a purity of 99.99% can be achieved utilising the Sunlands proprietary process, free of any chemical processes or processes with adverse environmental effects.

Managing Director, Sal Catalano commented that,

“The results deliver on the Company’s commercial strategy to deliver the leading natural flake products across all applications. From high technology industrial uses to thermal storage products and feed material for Li-ion anode, Uley flake demonstrably delivers a superior product in an environmentally sustainable way”.

As previously announced, the Company is updating its 2019 Definitive Feasibility Study (DFS). As part of this update the Company will revise the DFS basket price to reflect the market price for Uley flake at the 99.99% purity level. Based on the latest available market data, the market price across all Uley products at this purity level is approximately US$1,540 (DFS, US$919). The Company will revise the DFS basket price based on the relevant market price at the time of the release of the update to the DFS.

There is significant market demand, across industrial and battery markets segments, for such purified graphite. This strengthens the market case for the production level to be increased to more than 100,000 tonnes per year.

Head of Asia Pacific Trading for Uley 2 offtaker, MRI Trading AG, Andrew Briscoe said,

“These are very exciting results. The capability to deliver Uley flake of this quality into the market puts MRI in an extraordinary position. We are now placed to market the highest quality flake to some of the most sophisticated customers in Europe and Japan”.

The increase in basket price is anticipated to be achieved with a capital investment of less than 50% of the capital cost disclosed in the DFS. Moreover, the use of the Sunlands thermal energy storage technology provides a pathway for use of renewable energy to produce Uley Green Purified Graphite.

Results in Line with Projections

On 23 March 2023, the Company announced the first phase results of this program. These results confirmed that thermal treatment of Uley flake at a temperature of 2,200°C eliminated all impurities with a boiling point of up to 2,200°C and achieved a purity of 97.59% gC.

Based on the results of this thermal treatment, the Company’s technical team predicted that thermal treatment of Uley flake at temperatures of up to 3,000°C would achieve a purity of approximately 99.86% gC; these projections were based on the most prevalent impurities remaining after the first phase thermal treatment being Sulphur (S), Aluminium (Al), Calcium (Ca), Iron (Fe), and Silicon (Si).

Click here for the full ASX Release

This article includes content from Quantum Graphite, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

24 February

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00