Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports assays from an additional four holes which tested the recently acquired Puro Corazon claim and returned thick intervals of high-grade and strongly silver-enriched polymetallic mineralization.

Highlight assays include:

a 15.3 metre interval averaging 195g/t Ag, 0.3% Cu, 6.6% Pb and 9.0% Zn (581g/t AgEq), including a 3.1 metre interval averaging 267g/t Ag, 0.3% Cu, 7.8% Pb and 14.8% Zn (837g/t AgEq)(1) from drillhole 25CLM-206

a 22.0 metre interval averaging 103g/t Ag, 0.5% Cu, 5.0% Pb and 7.2% Zn (426g/t AgEq), including a 3.0 metre interval averaging 208g/t Ag,1.2% Cu, 10.8% Pb and 15.8% Zn (929g/t AgEq)(1) from drillhole 25CLM-206; and

a 11.1 metre interval averaging 54g/t Ag, 0.3% Cu, 1.2% Pb and 2.3% Zn (157g/t AgEq), including a 0.4 metre interval averaging 761g/t Ag, 2.6% Cu, 25.0% Pb and 21.2% Zn (1994g/t AgEq)(1) from drillhole 25CLM-207

(1) see AgEq calculation criteria in notes to Table 1. Intervals are reported as estimated true thickness unless otherwise indicated

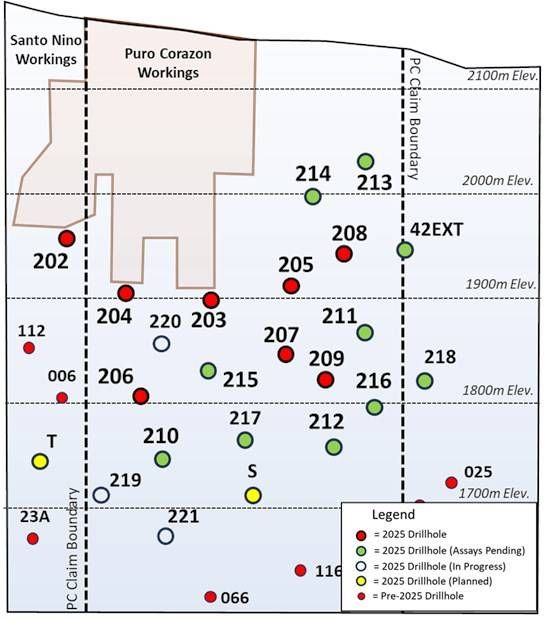

Drilling tested down dip and to the south of earlier reported drill holes 25CLM-202, -203, -204 and -205 which returned several high-grade intercepts within a hanging wall replacement zone of mineralization that include 10.5 metres averaging 1,115g/t AgEq (see News Release dated December 1, 2025) from 25CLM-203 and 10.4 metres averaging 743g/t AgEq (see News Release dated January 6, 2026) from 25CLM-205 as well as other mineralized intercepts. The new intercepts, particularly from drill hole 25CLM-206, continue to demonstrate continuity of the replacement lens and helps establish a potential plunge direction for the high-grade extensions of mineralization which has now been tested to a depth of 235 metres below surface.

Vice President of Exploration, Rob Macdonald stated "These latest drill results continue to demonstrate the lateral and down-dip extensions of mineralization below and along strike of the existing Puro Corazon workings. The drill program continues to test the projections of this mineralization with the goal of establishing continuity with the previously defined Skarn Front and El Sol mineral deposits within the context of an updated Mineral Resource Estimate."

Twenty-one core holes out of twenty-two planned holes have been completed to date or are in progress. Analyses from eight drill holes have now been reported and further assays are anticipated over the coming weeks.

Figure 1: Plan view of the drilling on the recently acquired Puro Corazon Claim.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5344/281822_41eeea50c49c287b_002full.jpg

Figure 2: Longitudinal Section of the Puro Corazon Target. Note: pierce points reflect intercepts into the main Skarn zone

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5344/281822_41eeea50c49c287b_003full.jpg

Table 1: Select Assay Results from the Cerro Las Minitas project.

| Collar Data | ||||||||||||||||

| Hole # | Az Deg (UTMN) | Dip Deg | Depth (m) | From (m) | To (m) | Interval (m) | Est. Tr. Thck. (m) | Ag (g/t) | Au (g/t) | Cu (%) | Pb (%) | Zn (%) | AgEq (g/t) | ZnEq (%) | Dpt (us$) | Notes |

| 25CLM-206 | 81.0 | -66.0 | 552.0 | 321.4 | 348.8 | 27.4 | 22.0 | 103 | 0.0 | 0.5 | 5.0 | 7.2 | 426 | 15.9 | 457 | |

| inc. | 325.1 | 332.0 | 6.9 | 5.6 | 156 | 0.0 | 0.9 | 7.8 | 12.2 | 691 | 25.8 | 743 | ||||

| and inc. | 337.8 | 341.6 | 3.8 | 3.0 | 208 | 0.0 | 1.2 | 10.8 | 15.8 | 929 | 34.7 | 1001 | ||||

| 25CLM-206 | 357.7 | 376.7 | 19.1 | 15.3 | 195 | 0.0 | 0.3 | 6.6 | 9.0 | 581 | 21.7 | 614 | ||||

| inc. | 361.6 | 366.0 | 4.4 | 3.5 | 238 | 0.0 | 0.4 | 9.8 | 13.4 | 813 | 30.4 | 861 | ||||

| and inc. | 372.0 | 375.9 | 3.9 | 3.1 | 267 | 0.0 | 0.3 | 7.8 | 14.8 | 837 | 31.2 | 881 | ||||

| 25CLM-206 | 383.0 | 397.4 | 14.4 | 11.6 | 65 | 0.0 | 0.0 | 2.7 | 1.8 | 169 | 6.3 | 179 | 29.8% Dilution | |||

| inc. | 396.0 | 397.4 | 1.4 | 1.1 | 303 | 0.0 | 0.1 | 11.6 | 6.0 | 696 | 26.0 | 736 | ||||

| 25CLM-206 | 496.0 | 514.9 | 19.0 | 15.2 | 73 | 0.0 | 1.1 | 0.1 | 0.0 | 157 | 5.9 | 190 | Anomalous Composite | |||

| inc. | 509.2 | 514.9 | 5.8 | 4.6 | 94 | 0.0 | 2.8 | 0.0 | 0.0 | 301 | 11.2 | 380 | ||||

| 25CLM-207 | 81.0 | -66.0 | 393.0 | 240.9 | 243.7 | 2.8 | 2.0 | 78 | 0.0 | 0.2 | 3.0 | 4.1 | 261 | 9.7 | 277 | |

| 25CLM-207 | 247.8 | 249.7 | 1.9 | 1.4 | 156 | 0.0 | 0.9 | 5.3 | 9.6 | 583 | 21.8 | 631 | ||||

| 25CLM-207 | 297.6 | 313.2 | 15.6 | 11.1 | 54 | 0.0 | 0.3 | 1.2 | 2.3 | 157 | 5.9 | 170 | 60% dilution | |||

| inc. | 297.6 | 298.2 | 0.6 | 0.4 | 761 | 0.1 | 2.6 | 25.0 | 21.2 | 1994 | 74.4 | 2150 | ||||

| and inc. | 310.4 | 311.4 | 1.0 | 0.7 | 54 | 0.0 | 0.6 | 0.2 | 11.0 | 393 | 14.7 | 419 | ||||

| 25CLM-207 | 320.1 | 323.2 | 3.1 | 2.2 | 70 | 0.0 | 0.1 | 0.7 | 7.2 | 284 | 10.6 | 296 | ||||

| 25CLM-208 | 50.0 | -45.0 | 366.0 | 23.3 | 27.9 | 4.6 | 4.0 | 149 | 0.1 | 0.0 | 0.2 | 0.3 | 165 | 6.2 | 173 | |

| inc. | 26.0 | 26.7 | 0.6 | 0.6 | 411 | 0.0 | 0.0 | 0.0 | 0.4 | 424 | 15.8 | 438 | ||||

| 25CLM-208 | 240.3 | 241.8 | 1.4 | 1.1 | 190 | 0.0 | 1.1 | 6.4 | 6.1 | 559 | 20.9 | 612 | ||||

| 25CLM-208 | 273.8 | 275.1 | 1.3 | 1.0 | 109 | 0.0 | 0.2 | 1.4 | 4.2 | 265 | 9.9 | 281 | ||||

| 25CLM-208 | 273.8 | 275.1 | 1.3 | 1.0 | 78 | 0.0 | 0.6 | 2.5 | 4.5 | 288 | 10.8 | 315 | ||||

| 25CLM-209 | 64.5 | -54.0 | 540.0 | 219.2 | 220.4 | 1.2 | 0.9 | 105 | 0.1 | 0.3 | 1.4 | 0.6 | 175 | 6.5 | 195 | |

| 25CLM-209 | 385.3 | 386.5 | 1.2 | 0.9 | 97 | 0.0 | 0.4 | 3.2 | 5.3 | 329 | 12.3 | 353 | ||||

1) Analyzed by FA/AA for gold and ICP-AES by ALS Laboratories, North Vancouver, BC. Silver (>100ppm), copper, lead and zinc (>1%) overlimits assayed by ore grade ICP analysis,

2) High silver overlimits (>1500g/t Ag) and gold overlimits (>10g/t Au) re-assayed with FA-Grav. High Pb (>20%) and Zn (>30%) overlimits assayed by titration. AgEq and ZnEq were calculated using prices of $2,800/oz Au, $32/oz Ag, $4.50/lb Cu, $0.95/lb Pb and $1.25/lb Zn.

3) AgEq and ZnEq calculations utilized relative metallurgical recoveries of Au 48.6%, Ag 93%, Cu 70%, Pb 87% and Zn 93%.

4) Composites are calculated using a 80g/t AgEq cut-off in sulphide and 0.5g/t AuEq in the oxide gold zone. Composites have <20% internal dilution, except where noted; anomalous intercepts are calculated using a 10g/t AgEq cut-off.

Next Steps

The Company is planning to incorporate the results of the Puro Corazon drilling program into the much larger Cerro Las Minitas project which is expected to significantly enhance the project economics. Final assays are anticipated to be received by the end of the first quarter of 2026, after which the Company intends to:

- update the Mineral Resource Estimate of the Cerro Las Minitas project; followed by

- an update of the Preliminary economic Assessment ("PEA") of the project in accordance with the provisions of National Instrument 43-101 and

- continue to advance baseline data collection and permit readiness review

The Company reports that work on the Cerro Las Minitas project continues advancing numerous upside opportunities identified subsequent to the July 2024 PEA, while also derisking and advancing the project with the commencement of baseline data collection, hydrology, geotechnical, archaeological and land surveys and studies.

As currently modelled, the Cerro Las Minitas project features a large-scale underground mining operation with robust project economics and high gross revenues in a well located and mining friendly jurisdiction in southeast Durango, Mexico. For more information on the details of the current economic assessment of the Cerro Las Minitas project please refer to Southern Silver's news release dated June 10, 2024.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is an exploration and development company with a focus on the discovery of world-class mineral deposits either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our specific emphasis is the 100% owned Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico's Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. Located in the same State as the Cerro Las Minitas property is the newly acquired Nazas, gold-silver property. Our property portfolio also includes the Oro porphyry copper-gold project and the Hermanas gold-silver vein project where permitting applications for the conduct of a drill program is underway, both located in southern New Mexico, USA.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly the collection of the data from the CLM project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

On behalf of the Board of Directors

"Lawrence Page"

Lawrence Page, K.C.

President & Director, Southern Silver Exploration Corp.

For further information, please visit Southern Silver's website at southernsilverexploration.com or contact us at 604.641.2759 or by email at corpdev@mnxltd.com .

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Forward-looking statements in this news release include plans to advance and develop the CLM property including updating the Mineral Resource Estimate followed by an update of the PEA. These statements are based on a number of assumptions, including, but not limited to, general economic conditions, interest rates, commodity markets, regulatory and governmental approvals for the Company's projects, and the availability of financing for the Company's development projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements include the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281822