- Snowline's initial drill campaign on the recently discovered Valley zone intersected the targeted sheeted vein arrays with visible gold in all four holes.

- Hole V-21-002 averaged 1.01 g/t Au over 136.75 m from 35.25 m downhole, within a broader mineralized zone averaging 0.85 g/t Au over 186 m.

- Assays to follow for 3 of 4 holes at Valley, all of which intersected similar mineralization to V-21-002.

- A diamond drill is currently on-site at Valley, ready to advance target in Spring 2022.

Snowline Gold Corp. (CSE:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce initial drill results from Phase I drilling at the Valley zone on its Rogue gold project in the Yukon Territory, Canada. Hole V-21-002 intersected a broad zone of gold mineralization associated with visible gold in sheeted vein arrays. The hole averaged 1.01 gt Au over 136.75 m from 35.25 m downhole, within a broader zone of mineralization averaging 0.85 gt Au over 186.0 m from 31.5 m downhole. These results mark the in-situ discovery of a potentially significant gold system and demonstrate the fertility of the bulk-tonnage Valley gold target

Drillhole ID | Coordinates (NAD83 Zn9) | Orientation (True) | Interval* (metres) | Grade (Au g/t) | ||||

Easting | Northing | Azimuth | Dip | From | To | Width* | ||

| V-21-002 | 385917 | 7057833 | 175 | -70 | 31.5 | 217.5 | 186.00 | 0.85 |

| including | 35.3 | 172.0 | 136.75 | 1.01 | ||||

| including | 36.8 | 38.9 | 2.10 | 3.49 | ||||

| including | 50.0 | 50.7 | 0.65 | 9.67 | ||||

| including | 119.0 | 119.8 | 0.80 | 5.48 | ||||

Table 1 - Hole details and notable intervals in V-21-002. Localized hot spots of up to 9.67 g/t Au over 0.65 m were present in the mineralized interval, but overall grades are otherwise relatively consistent. *Interval widths reported; at this point there is insufficient data to reliably estimate true widths of the zone.

"This is Snowline's second significant drill discovery in as many drill programs in 2021," commented Scott Berdahl, CEO and director of Snowline. "We launched the company around the idea of an unrecognized gold district hiding in a relatively unexplored package of prospective rocks here in the Yukon's Selwyn Basin. Beyond our excitement for the Valley discovery itself, we are similarly excited at the implications these results have toward validating our district-scale exploration thesis. With two discoveries in hand and many additional prospective targets, we are eager to get started on our 2022 exploration season."

Drill hole V-21-002 totalled 242 m in length and averaged 0.69 g/t Au over 239 m (excluding the top 3 m of overburden which was not assayed). The hole ended in elevated to anomalous gold mineralization, with the final 6.5 m of drilling averaging 0.25 g/t Au, including 1.01 g/t

Au over 0.5 m from 235.5 m.

Figure 1 - Gold assay results (yellow) for V-21-002 plotted against lithologies for holes V-21-001 & V-21-002. Both holes crossed large zones of hornfels associated with the emplacement of the Valley stock, with intense silicification often obscuring original lithologies.

"These results and related geochemical metal associations with bismuth and tellurium conclusively characterize Valley as a classic reduced intrusion-related gold system," commented Snowline chair and director Dr. Craig Hart, an internationally recognized expert on this deposit type. "It has lots of similarities to Kinross' Ft. Knox Gold Mine in Alaska and Victoria Gold's Eagle Gold Mine in the Yukon, and most importantly these early results yield some very good grades. These systems are well understood, and these early Valley drill holes are in just one shoulder of the system - so there is still lots of room to follow-up."

V-21-002 was collared in hornfels Ordovician siltstones of the Road River group on the edge of a newly-discovered Cretaceous-aged felsic intrusion belonging to the fertile Mayo plutonic suite. It was drilled obliquely towards the intrusion and encountered alternating zones of sediments and intrusive rocks, interpreted as dikes along the edges of the Valley stock.

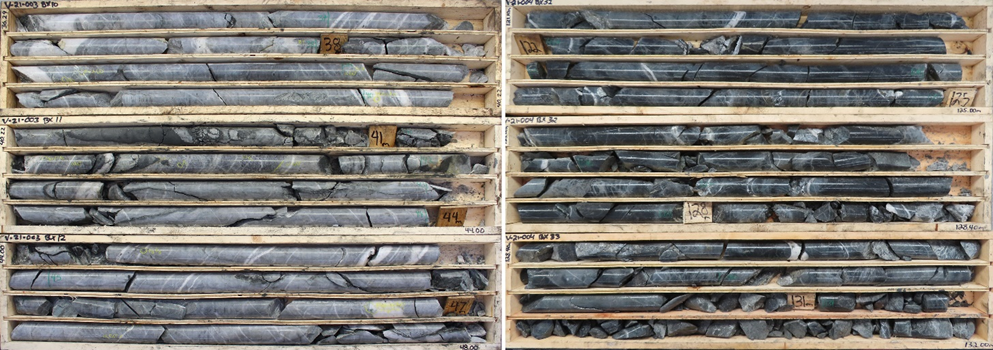

Gold is thought to be carried primarily in arrays of subparallel ("sheeted"), low-sulphide quartz veins present throughout the core, with the total volume of quartz in each sample acting as a control on grade. Trace amounts of visible gold was observed in sixteen veins along the hole, commonly associated with bismuthinite.

Valley is a discovery-stage bulk-tonnage prospect with no estimated resources nor reserves. It is still too early-stage to determine the size of the mineralized system nor whether it will prove to be economically viable.

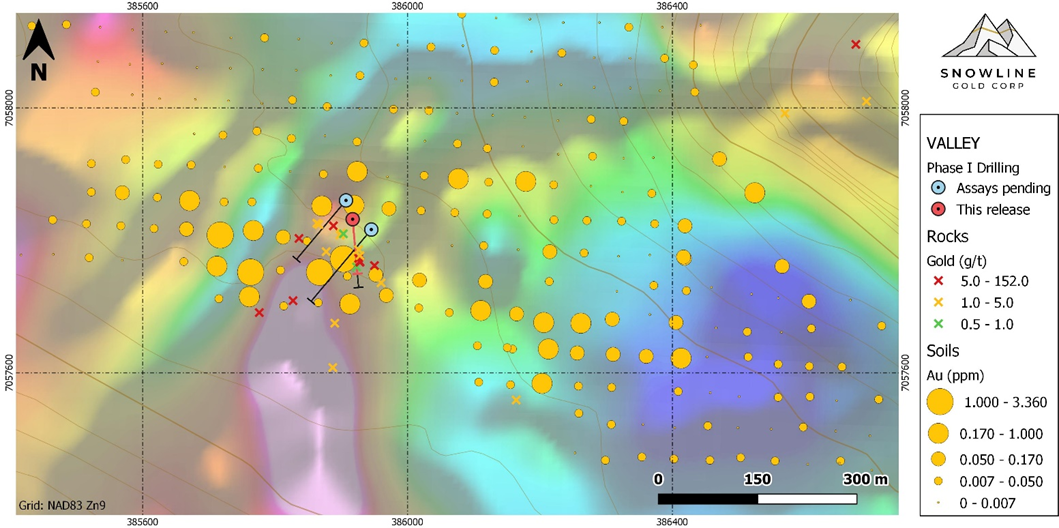

Figure 2 - Drill hole locations at Valley atop soil, rock and magnetic surveying results. Anomalous gold in soils defines a WNW-ESE trend some 900 m in length, roughly parallel to sheeted quartz veins that span the edge of the Valley intrusion. Certain rock samples >5 g/t Au are labeled with pink haloes. High-resolution magnetic data captured by drone surveying shows a pronounced magnetic low (blue) over the centre of the intrusion, and a magnetic high (pink) owing to hornfels alteration. Holes V-21-001 & 002 targeted local structures in a hornfels roof/shoulder pendant in addition to sheeted vein arrays, whereas holes V-21-003 and 004 were drilled to target the sheeted vein arrays themselves.

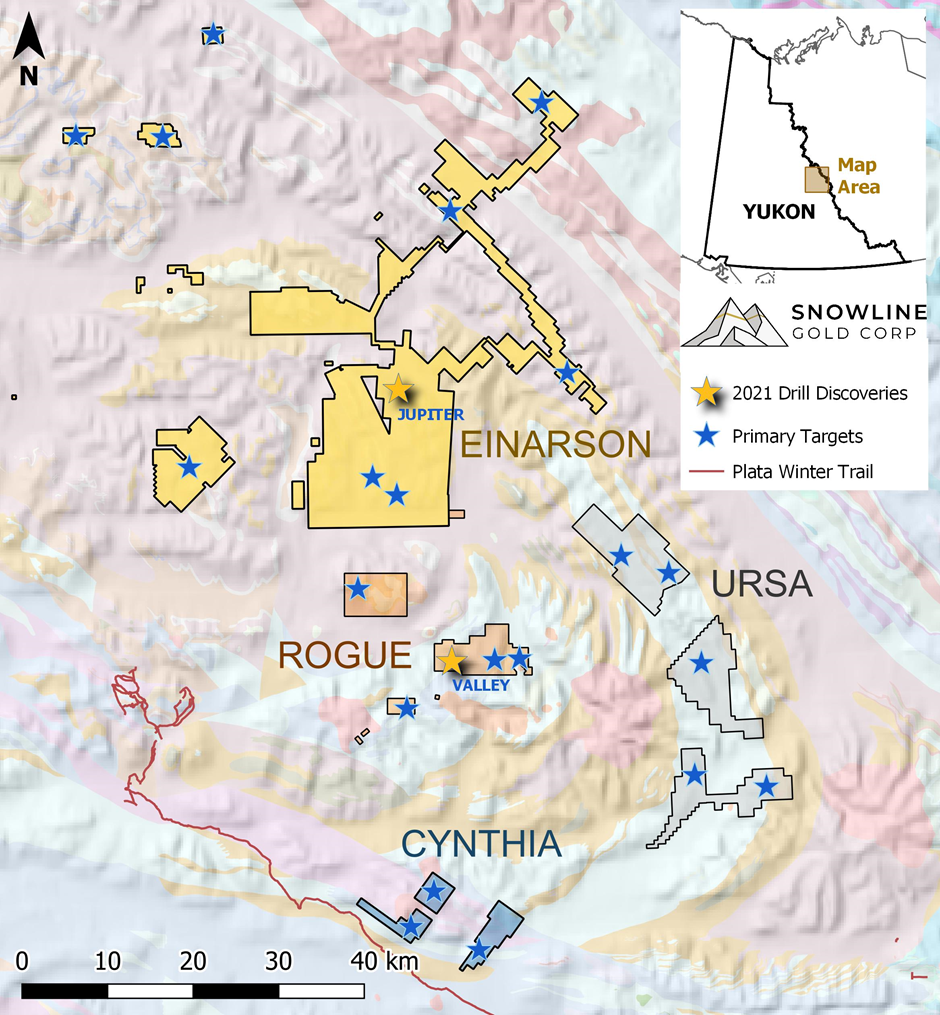

Figure 3 - Valley zone location map in relation to surrounding Snowline Gold Corp. projects. Valley is the westernmost in an east-west line of 3 small intrusive bodies, each of which appears to have potential to host an intrusion-related gold deposit.

FORTHCOMING RESULTS

Samples for V-21-002 were processed by the lab before the first Valley drill hole, V-21-001. Assays from V-21-001 are further delayed by 4 overlimit triggers (assays >10 g/t Au) across a total, non-contiguous core length of 1.9 m. As with V-21-002, all three remaining holes at Valley intersected trace amounts of visible gold in drill core along with extensive zones of sheeted quartz veins. Full results from these holes are expected in the coming weeks.

UPCOMING EXPLORATION

With over $8.6M CDN in the treasury, Snowline is actively preparing for a busy 2022 exploration season. The upcoming program will see at least two drills turning on an 8,000+ m program focused on the Company's Jupiter and Valley discoveries along with nearby targets. This work continues to build toward establishing North America's newest gold district in the Yukon's Selwyn Basin.

The Company currently has a drill under contract and on site at Valley, overwintering for a quick and cost-effective resumption of drilling in Spring 2022. Given the scale of the associated geochemical anomaly, the extent of sheeted veins observed on surface and the potential for higher vein densities within the intrusion, a program of grid drilling is planned at Valley to establish the scale and continuity of the mineralized zone.

QA/QC AND QUALIFIED PERSON

On receipt from the drill site, drill core from V-21-002 was systematically logged for geological attributes, photographed and sampled at Snowline's 2021 field camp. Smaller sample lengths were used to isolate zones of interest, otherwise a default 1.5 m downhole sample length was used. Core was cut in half lengthwise, with one half collected for analysis and one half stored as a record. Standard reference materials, blanks and duplicate samples were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor and by Snowline personnel to ALS Laboratories' preparatory facility in Whitehorse, Yukon, with analysis completed in Vancouver.

ALS is accredited to ISO 17025:2005 UKAS ref 4028 for its laboratory analysis. Samples were crushed by ALS to >70% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. An aqua regia digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 51-element analysis on 50 g samples (ALS code: Au-ME-TL44). All samples were re-analysed for gold content by fire assay with an inductively coupled plasma atomic emission spectroscopy (ICP-AES) finish on 30 g samples (ALS code: Au-ICP21).

Samples with visible gold and other samples returning >5 g/t Au will undergo further processing, analysing the screen rejects to determine whether the screening process could introduce a sampling bias in current results by excluding coarse gold from analysis.

Information in this release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >100,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. Snowline's first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/685310/Snowline-Gold-Intersects-101-grams-per-tonne-over-1368-metres-in-First-Hole-Returned-from-Its-Bulk-Tonnage-Valley-Discovery-Rogue-Project-Yukon