December 06, 2024

Silver Tiger Metals Inc. (TSXV:SLVR)(OTCQX:SLVTF) ("Silver Tiger" or the "Corporation") is pleased to announce the filing of a Preliminary Feasibility Study ("PFS") for its 100% owned, silver-gold El Tigre Project (the "Project" or "El Tigre") located in Sonora, Mexico. The Technical Report supports the scientific and technical disclosure in the Company's news release dated October 22, 2024, announcing the results of an updated Mineral Resource Estimate and Pre-Feasibility Study. The Technical Report is available at www.sedarplus.ca under the Company's profile.

The updated MRE also contains an Out-of-Pit Mineral Resource that Silver Tiger plans to study in a Preliminary Economic Assessment in H1-2025.

Highlights of the PFS are as follows (all figures in US dollars unless otherwise stated):

- After-Tax net present value ("NPV") (using a discount rate of 5%) of US$222 million with an After-Tax IRR of 40.0% and Payback Period of 2.0 years (Base Case);

- 10-year mine life recovering a total of 43 million payable silver equivalent ounces ("AgEq") or 510 thousand payable gold equivalent ounces ("AuEq"), consisting of 9 million silver ounces and 408 thousand gold ounces;

- Total Project undiscounted after-tax cash flow of US$318 million;

- Initial capital costs of $86.8 million, which includes $9.3 million of contingency costs, over an expected 18-month build, expansion capital of $20.1 million in year 3 and sustaining capital costs of $6.2 million over the life of mine ("LOM");

- Average LOM operating cash costs of $973/oz AuEq, and all in sustaining costs ("AISC") of $1,214/oz AuEq or Average LOM operating cash costs of $12/oz AgEq, and all in sustaining costs ("AISC") of $14/oz AgEq;

- Average annual production of approximately 4.8 million AgEq oz or 56.7 thousand AuEq oz; and

- Three (3) years of production in the Proven category in the Phase 1 Starter Pit.

Preliminary Feasibility Summary

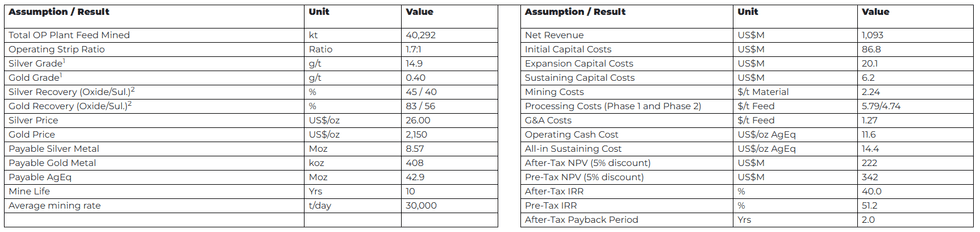

The PFS was prepared by independent consultants P&E Mining Consultants Inc. ("P&E"), with metallurgical test work completed by McClelland Laboratories, Inc. - Sparks, Nevada, process plant design and costing by D.E.N.M. Engineering Ltd., environmental and permitting led by CIMA Mexico, and geotechnical assessment of heap leach design, waste dump design and pit slopes by WSP Global Inc. Table 1 shows key assumptions and results.

Table 1: El Tigre PFS Key Economic Assumptions and Results(1-2)

- Grades shown are LOM average process plant feed grades include only OP sources. Mining losses and external dilution of 3.7% were incorporated in the mining schedule.

- Column testing indicated both variable gold and silver recovery for the oxide material vs the previously reported non-discounted PEA (83% and 64%) at a 3/8-in crush size. In the process design and financial model for the PFS process design and financial model recoveries have been discounted by 3% for leaching in the field versus optimum conditions in the laboratory and shown accordingly. The presence of transition and sulfide zones has affected both the gold and silver recoveries and are shown as separate recoveries. These are reasonable and appropriate for use in this PFS design and economic analysis.

Qualified Persons

Mineral Resource Estimate: Dave Duncan P. Geo. VP Exploration of Silver Tiger, Charles Spath P.Geo., VP of Technical Services of Silver Tiger, and Fred Brown, P.Geo RM-SME Senior Associate Geologist of P&E Mining Consultants, and Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants are the Qualified Persons as defined under National Instrument 43-101. All Qualified Persons have reviewed and approved the scientific and technical information in this press release.

Preliminary Feasibility Study: Andrew Bradfield P. Eng of P&E Mining Consultants, Eugene Puritch, P.Eng., FEC, CET, President of P&E Mining Consultants and David J. Salari, P. Eng. of D.E.N.M. Engineering Ltd are the Qualified Persons as defined under National Instrument 43-101. All Qualified Persons have reviewed and approved the scientific and technical information in this press release.

A Technical Report is being prepared on the Preliminary Feasibility Study in accordance with National Instrument 43-101 ("NI-43-101"), and will be available on the Company's website and SEDAR within 45 days of the date of this news release. The effective date of this Preliminary Feasibility Study is October 22, 2024.

About Silver Tiger and the El Tigre Historic Mine District

Silver Tiger Metals Inc. is a Canadian company whose management has more than 25 years' experience discovering, financing and building large epithermal silver projects in Mexico. Silver Tiger's 100% owned 28,414 hectare Historic El Tigre Mining District is located in Sonora, Mexico. Principled environmental, social and governance practices are core priorities at Silver Tiger.

The El Tigre historic mine district is located in Sonora, Mexico and lies at the northern end of the Sierra Madre silver and gold belt which hosts many epithermal silver and gold deposits, including Dolores, Santa Elena and Las Chispas at the northern end. In 1896, gold was first discovered on the property in the Gold Hill area and mining started with the Brown Shaft in 1903. The focus soon changed to mining high-grade silver veins in the area with production coming from 3 parallel veins the El Tigre Vein, the Seitz Kelley Vein and the Sooy Vein. Underground mining on the middle El Tigre Vein extended 1,450 metres along strike and was mined on 14 levels to a depth of approximately 450 metres. The Seitz Kelley Vein was mined along strike for 1 kilometre to a depth of approximately 200 meters. The Sooy Vein was only mined along strike for 250 metres to a depth of approximately 150 metres. Mining abruptly stopped on all 3 of these veins when the price of silver collapsed to less than 20¢ per ounce with the onset of the Great Depression. By the time the mine closed in 1930, it is reported to have produced a total of 353,000 ounces of gold and 67.4 million ounces of silver from 1.87 million tons (Craig, 2012). The average grade mined during this period was over 2 kilograms silver equivalent per ton.

For further information, please contact:

Glenn Jessome

President and CEO

902 492 0298

jessome@silvertigermetals.com

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release includes certain "forward-looking statements". All statements other than statements of historical fact included in this release, including, without limitation, statements regarding potential mineralization, Mineral Resources and Reserves, the ability to convert Inferred Mineral Resources to Indicated Mineral Resources, the ability to complete future drilling programs and infill sampling, the ability to extend resource blocks, the similarity of mineralization at El Tigre to Delores, Santa Elena and Chispas, exploration results, and future plans and objectives of Silver Tiger, are forward-looking statements that involve various risks and uncertainties. Forward-looking statements are frequently characterized by words such as "may", "is expected to", "anticipates", "estimates", "intends", "plans", "projection", "could", "vision", "goals", "objective" and "outlook" and other similar words. Although Silver Tiger believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, there can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Silver Tiger's expectations include risks and uncertainties related to exploration, development, operations, commodity prices and global financial volatility, risk and uncertainties of operating in a foreign jurisdiction as well as additional risks described from time to time in the filings made by Silver Tiger with securities regulators.

SLVR:CA

The Conversation (0)

09 February

Panelists: Silver in Bull Market, but Expect Price Volatility

Gold often dominates conversations at the annual Vancouver Resource Investment Conference (VRIC), but silver's price surge, which began in 2025 and continued into January, placed the metal firmly in the spotlight. At this year’s silver forecast panel, Commodity Culture host and producer Jesse... Keep Reading...

09 February

Southern Silver Intersects 5.8 metres averaging 781g/t AgEq at Cerro Las Minitas Project in Durango, México

Southern Silver Exploration Corp. (TSXV: SSV,OTC:SSVFF) (the "Company" or "Southern Silver") reports additional assays from drilling which continues to outline extensions of mineralization on the recently acquired Puro Corazon claim and identified further thick intervals of high-grade and... Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00