May 30, 2023

Silver Hammer Mining Corp. (CSE: HAMR) (OTCQB: HAMRF) (FSE: 7BW0) (the "Company" or "Silver Hammer") is pleased to announce that it has commenced a property-wide airborne magnetic and radiometric survey at its 100%-owned high-grade Silverton Project in Nevada. The Company has engaged Precision GeoSurveys to complete surveys at both its Silverton and Eliza projects in Nevada.

"I am excited to announce the commencement of another year of exploration for Silver Hammer, and we are pleased to have engaged Precision for airborne magnetic and radiometric surveys in 2023," commented President & CEO Peter A. Ball. "The survey will provide us the final layer of technical data to assist in vectoring in on our current identified priority targets and permitted drill program at the Silverton Project in Nevada. This will be the first time in over 35 years any form of modern exploration will be completed over the Silverton Mine and property, and it will be exciting to review the results of what lays beneath the mine complex and property, where rock chip sampling yielded high grade silver at surface. We are pleased to commence this program ahead of schedule, which will assist in accelerating our exploration efforts across our portfolio. After the Silverton geophysical survey, the Company looks forward to completing a similar survey at the Eliza Silver Project in the summer of 2023."

Silverton Project Survey Highlights

The helicopter supported surveys will use magnetic sensors flown in non-magnetic and non-conductive nose stinger configuration, with gamma sensors internal to the aircraft away from variable fuel cell attenuation, to allow for reduced terrain clearance minimizing noise and improving resolution and accuracy.

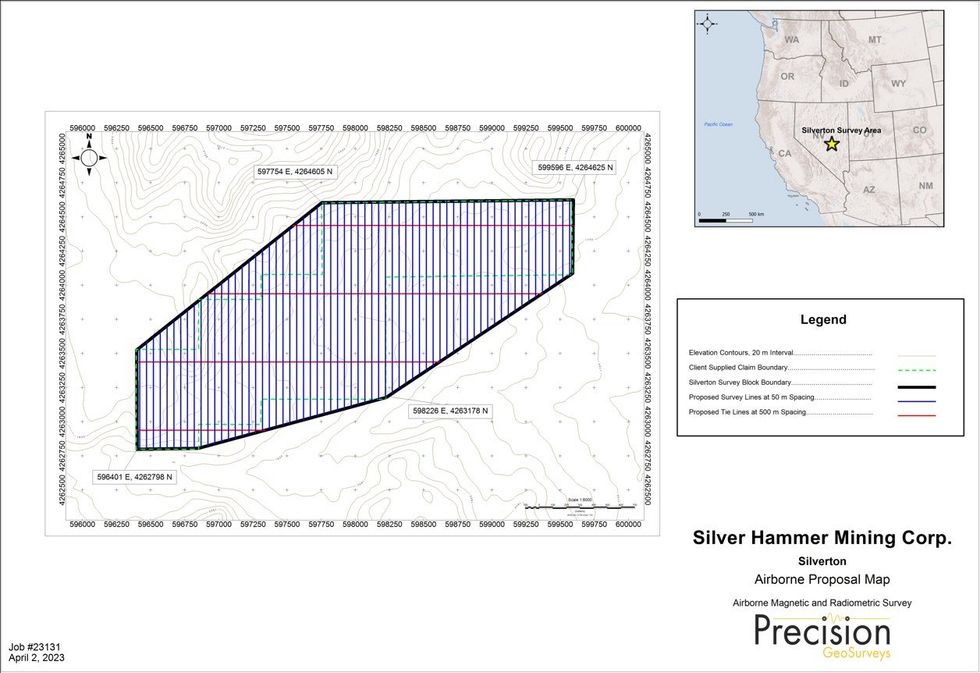

Silverton Project (refer to Figure 1):

- 82 total line kilometres

- 50 metre line spacing

- 3.6 square kilometres coverage

About Silverton Project

The past-producing Silverton Silver Mine is located in East Nevada's "Silver Alley" with high-grade historic production of up to 933 g/t Ag. Despite significant surface exposures and grab samples grading up to 499 g/t Ag and 1.99 g/t Au, no modern-day drilling or subsurface exploration techniques have been conducted on the project for over 35 years. Thirteen drill pads were permitted in advance of a potential 2023 drill program.

Mapping in 2022 and hyperspectral satellite imaging provided evidence of two separate mineralized systems at the project - a silver and a gold. The volcanics-hosted gold system shows sample grades ranging from 0.06 g/t to 6.1 g/t gold Au. A silver-dominated mineral system hosted by silicified limestone shows sample grades ranging from 0.32 g/t Ag to 692 g/t Ag.

About Precision

Precision GeoSurveys is a full-service airborne geophysical contractor and industry leader in providing high resolution surveys in mountainous and remote terrain having acquired and processed high resolution multi-sensor airborne geophysical data in mountainous terrain on over 700 surveys since 2007. The company utilizes state-of-the-art geophysical instrumentation attached directly to the helicopter. The magnetic sensors are flown in a non-magnetic and non-conductive nose stinger configuration, and the gamma sensors are flown internal to the aircraft away from variable fuel cell attenuation. Compared to conventional slung bird-type survey systems, this innovative design allows the survey to be safely flown at reduced terrain clearance to minimize noise, improve resolution, and reduce the need for complex corrections to the data. The geophysical data and maps will be prepared using industry standard Geosoft algorithms and mapping software to show the geomagnetic and radiometric properties of the survey area.

Qualified Person

Technical aspects of this press release have been reviewed and approved under the supervision of Philip Mulholland, (CPG). Mr. Mulholland is a Qualified Person (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About Silver Hammer Mining Corp.

Silver Hammer Mining Corp. is a junior resource exploration company advancing its flagship past-producing Silver Strand Mine in the Coeur d'Alene Mining District in Idaho, as well both the Eliza Silver Project and the Silverton Silver Mine in one of the world's most prolific mining jurisdictions in Nevada. Silver Hammer's primary focus is defining and developing silver deposits near past-producing mines that have not been adequately explored. The Company's portfolio also provides exposure to high-grade copper and gold at its projects.

On Behalf of the Board of Silver Hammer Mining Corp.

Peter A. Ball

President & CEO, Director

E: peter@silverhammermining.com

For investor relations inquiries, contact:

T: 778.344.4653

E: investors@silverhammermining.com

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation. Such forward-looking statements concern, without limitation, the Company's strategic plans, timing and expectations for the Company's exploration and drilling programs, estimates of mineralization from drilling, geological information projected from sampling results and the potential quantities and grades of the target zones. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; and the historical basis for current estimates of potential quantities and grades of target zones. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors, including the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data, and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

The CSE does not accept responsibility for the adequacy or accuracy of this release. The Canadian Securities Exchange has neither approved nor disapproved the contents of this press release.

HAMR:CC

The Conversation (0)

12h

What's Next for the Silver Price After $100 Per Ounce?

First Majestic Silver (TSX:AG,NYSE:AG) CEO Keith Neumeyer’s silver price prediction of over US$100 per ounce came true in 2026. When will silver prices make a more lasting hold in triple digit territory?The silver price was up over 189 percent year-on-year as of March 2, 2026, on the back of... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00