The Company is fully funded for 2022 exploration

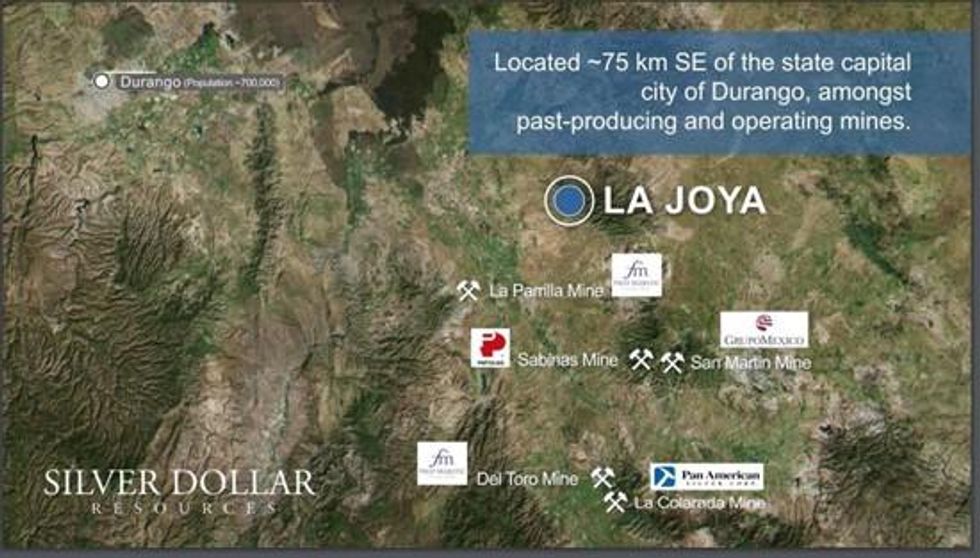

Silver Dollar Resources Inc. (CSE: SLV) (OTCQB: SLVDF) ("Silver Dollar" or the "Company") is pleased to report that a total of 1,134 metres of core drilling has been completed through five holes at the La Joya silver project located in the state of Durango, Mexico (See Figure 1).

The initial drilling program is focused on target development on the Noria portion of the La Joya property with an emphasis on testing for possible structural extensions of known mineralized zones identified in historical drilling. Results from this program are expected to provide valuable information regarding two possible high-grade concepts and will assist in guiding future phases of drilling.

Figure 1: Click on the image above to view a two-minute video introducing the La Joya Project

If you cannot view the video above, please visit:

https://vimeo.com/497779460

Image Source: https://silverdollarresources.com/images/LaJoya/LaJoya-3.jpg

Drill hole statistics are presented below in Table 1 and drill hole target descriptions are as follows:

The first two holes, NOR-21-001 and NOR-21-002, targeted possible westward and downward extensions of the resource shell related to the past-producing Embotelladora mine, the largest of the historic mines on the La Joya property. Both holes cut limestone for almost their entire length but with more intense skarn alteration and mineralization from 70-110 metres (m) and 90-160 m, respectively.

Hole NOR-21-003 was drilled to test the historical 1993 Luismin hole S-5 that had a shallow interval of 3.86 grams per tonne (g/t) gold (Au) over 15.24 m starting at 42 m but was not included in the historical resource wireframes. This short 69 m hole was designed to confirm the reported mineralization and advance it to National Instrument (NI) 43-101 standards.

Hole NOR-21-004 was drilled to test the deep high-grade "San Martin" type mineralization intercepted in historical hole LB96-04 (starting at 401.65m with 406 g/t silver equivalent [AgEq] over 8.65 m and 302 g/t AgEq over 3.5 m, including 812 g/t AgEq over 3 m) and was expected to cut mineralization between 360-400 m. The direction of this hole significantly deviated to the south and failed to intercept the expected mineralization but was extended down to 558 m to test mineralization near the main intrusive contact.

Hole NOR-21-005 is a 100 m step out to test the northward extension of mineralization in historical hole LJ-DD12-96 which intercepted 0.31 g/t Au over 17 m.

| Drill Hole # | Target Area | Target Depth (m) | X Collar | Y Collar | Azimuth | Dip | Hole Length (m) |

| NOR-21-001 | Noria | 120 | 609670 | 2640835 | 35 | -45 | 150.0 |

| NOR-21-002 | Noria | 225 | 609671 | 2640834 | 60 | -45 | 198.0 |

| NOR-21-003 | Noria | 69 | 609695.5 | 2641043 | 30 | -60 | 69 |

| NOR-21-004 | Noria | 500 | 609603.1 | 2641251 | 60 | -75 | 558.0 |

| NOR-21-005 | Noria | 150 | 608177.2 | 2640832 | 45 | -45 | 159 |

Table 1: Drill hole details

"The drilling campaign at La Joya is progressing well, and our crew will take a well-deserved two-week break over the holidays," said Mike Romanik, president of Silver Dollar. "We expect 2022 to be a big year for our Company, thank all our shareholders for their support this past year, and wish everyone a safe and happy holiday season."

Logging and sampling of the drill core is in progress and core samples are being submitted on a hole-by-hole basis for analysis. Results will be reported as they are received.

Mike Kilbourne, P.Geo., an independent Qualified Person as defined in NI 43-101, has reviewed and approved the contents of this news release on behalf of the Company.

About Silver Dollar Resources Inc.

Silver Dollar is a mineral exploration company that completed its initial public offering in May 2020 and is fully funded for 2021 with approximately $10 million in the treasury. The Company's projects are located in two of the prolific mining jurisdictions in the world and include the advanced exploration and development stage La Joya Silver Project in the state of Durango, Mexico; and the discovery-stage Pakwash Lake and the Longlegged Lake properties in the Red Lake Mining District of Ontario, Canada. The Company has an aggressive growth strategy and is actively reviewing potentially accretive acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions internationally.

For additional information, you can download our latest presentation by clicking here and you can follow us on Twitter by clicking here.

ON BEHALF OF THE BOARD

Signed "Michael Romanik"

Michael Romanik,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (204) 724-0613

Email: mike@silverdollarresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain "forward-looking statements." Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/108231