May 04, 2022

Phase II drilling in progress and the Company is fully funded for 2022

Silver Dollar Resources Inc. (CSE: SLV) (OTCQX: SLVDF) ("Silver Dollar" or the "Company") is pleased to report the remaining assay results from the Phase I drilling completed on the underexplored Noria portion of the La Joya Silver Project (the "Property") located in the state of Durango, Mexico. Phase II drilling is now in progress and targeting the wide intervals of mineralization intersected in the new Phase I discoveries.

Highlights include:

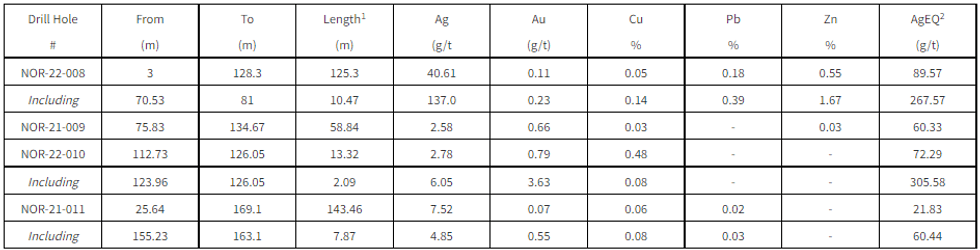

- Hole NOR-22-008 intersected 89.57 grams per tonne (g/t) silver equivalent (AgEQ) over 125.3 metres (m) starting at 3 m downhole. This interval includes 267.56 g/t AgEQ over 10.47m starting at 70.53 m downhole. Mineralization consists of Ag, gold (Au), copper (Cu), lead (Pb), and zinc (Zn) mineralization over wide intervals associated with sulphide veins, hornfels, and quartz veins hosted in Indidura formation carbonates adjacent to a monzonite intrusive.

- Hole NOR-22-009 intersected 60.33 g/t AgEQ over 58.84m starting at 75.83m downhole. This hole was higher grade in gold recording 0.66 g/t Au over the same 58.84m interval. Gold tenors were over twice the grade and triple the width of mineralization encountered in historical hole LJ-DD12-96.

- Phase I drilling exceeded expectations by:

- identifying structural extensions of the known mineralized zones;

- the discovery of a near-surface gold zone with appreciable grades and widths; and

- wide skarn-type Ag-Au-Cu-Pb-Zn mineralization representing a new extension along the unexplored Coloradito intrusive beyond historical workings.

Drill core samples from all 11 holes completed over a total of 2,424 metres of Phase I drilling were submitted for analysis. Results for the first seven holes were reported on March 24, 2022 (See: news release), and the results reported below are for the last four holes.

"Our successful Phase I drilling has provided us with several new follow-up targets well outside the historic resource area. Assays from hole 8, which is approximately 1 kilometre west of the Main Mineralized Trend, are some of the best results ever reported from the Coloradito area," said Mike Romanik, president of Silver Dollar. "Phase II drilling continues, and we have encountered similar sulphide mineralization over even broader widths and will expand the program as analytical results dictate."

Phase 1 Drilling Objectives and Discussion

Hole NOR-22-008 (See: cross-section) was designed to target mineralization on the west side of the Coloradito intrusive where anomalous gold and zinc values were intersected in historical hole LLDD12-96. This hole intersected wide intervals of skarn-type Ag-Au-Cu-Pb-Zn representing the highest reported grades and widths to date from the Coloradito area. This area represents an exciting new discovery, particularly given it is located a full kilometre west of the Main Mineralized Trend.

Hole NOR-22-009 (See: cross-section) was designed to test the downward extension of the mineralization previously encountered in hole LJ-DD12-96 with an intercept of 0.32 g/t Au over 29m. This hole returned 0.66 g/t Au over 58.84m starting at 75.83m downhole, both increasing previous gold tenors and width encountered in historical hole LJ-DD12-96. This intercept also averaged 60.33 g/t AgEQ. Additional drilling in Phase II will follow up on this near-surface gold and skarn polymetallic mineralization.

Hole NOR-22-010 was designed to test mineralization at a depth of 375m. While the deep target was not encountered, interesting values were intercepted at shallower depths with the hole returning 72.29 g/t AgEQ over 13.32m starting at 112.73m downhole, which included 0.78 g/t Au over the same interval. The above interval includes 305.57 g/t AgEQ and 3.63 g/t Au over 2.09m starting at 123.96m downhole. Higher grade gold mineralization in Phase I has been observed associated with rhodonite and within an 80-170m vertical depth horizon spatially associated with the Coloradito intrusive. This higher-grade gold corridor which reported 29 g/t Au over 1.01m in NOR-21-004 represents a potential new target for Phase II follow-up drilling.

Hole NOR-22-011 targeted a western extension of the Yeyis structure with an intercept of 0.55 g/t Au over 7.87m starting at 155.23m downhole. While this mineralization generally coincides with the strike of the Yeyis structure, it is right on the intrusive contact.

Table 1: A summary of downhole drill intersection results for the last four holes of the Phase I program.

1.True widths have yet to be determined.

2.AgEQ in results assume (USD) $1,750 Au and $22 Ag per/oz, and $4.30 Cu, $1.25 Pb, and $1.50 Zn per/lb, and 100% metallurgical recovery.

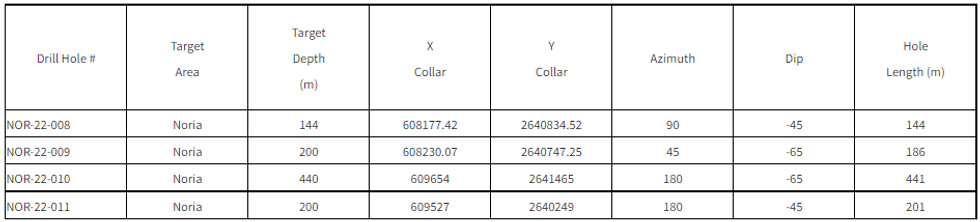

Table 2: La Joya Drillhole Details

Procedure, Quality Assurance / Quality Control, and Data Verification

The diamond drill core (HQ size) was geologically logged, photographed, and marked for sampling. Core designated for sampling was sawn in half with a diamond blade core saw. One-half of the core was sealed in plastic bags and shipped for analysis. The remaining half portion is returned to the core trays for storage and/or for metallurgical test work.

The sealed and tagged sample bags were transported to either the ActLabs facility in Zacatecas, Mexico or the Bureau Veritas facility in Durango, Mexico where the samples were crushed and 200-300-gram pulp samples prepared with ninety percent passing Tyler 150 mesh (106μm). The pulps were assayed for gold using a 30-gram charge by fire assay (Code 1A2 and/or FA450) and over limits greater than 10 grams per tonne were re-assayed using a gravimetric finish (Code 1A3 and/or FA550). Silver and multi-element analysis was completed using total digestion (Code 1F2 Total Digestion ICP). Over limits greater than 100 grams per tonne silver were re-assayed using a gravimetric finish (Code 8-Ag FA-GRAV Ag).

Quality assurance and quality control ("QA/QC") procedures monitor the chain of custody of the samples and include the systematic insertion and monitoring of appropriate reference materials (certified standards, blanks, and duplicates) into the sample strings. The results of the assaying of the QA/QC material included in each batch were tracked to ensure the integrity of the assay data. All results stated in this announcement have passed Silver Dollar's QA/QC protocols.

Mike Kilbourne, P.Geo., an independent Qualified Person as defined in NI 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company.

About the La Joya Project

The La Joya Property is situated approximately 75 kilometres directly southeast of the state capital city of Durango in a prolific mineralized region with past-producing and operating mines including Grupo Mexico's San Martin Mine, Industrias Penoles's Sabinas Mine, Pan American Silver's La Colorada Mine, and First Majestic's La Parrilla and Del Toro Silver Mines. For additional information on the Property click on the image below to watch the two-minute video.

Figure 1: Click on the image above to view a two-minute video introducing the La Joya Project

If you cannot view the video above, please visit:

https://vimeo.com/497779460.

About Silver Dollar Resources Inc.

Silver Dollar is a mineral exploration company that completed its initial public offering in May 2020 and is fully funded for 2022 with approximately $9 million in the treasury. The Company's projects are located in two of the prolific mining jurisdictions in the world and include the advanced exploration and development stage La Joya Silver Project in the state of Durango, Mexico; and the discovery-stage Pakwash Lake and the Longlegged Lake properties in the Red Lake Mining District of Ontario, Canada. The Company has an aggressive growth strategy and is actively reviewing potentially accretive acquisitions with a focus on drill-ready projects in mining-friendly jurisdictions internationally.

For additional information, you can download our latest presentation by clicking here and you can follow us on Twitter by clicking here.

ON BEHALF OF THE BOARD

Signed "Michael Romanik"

Michael Romanik,

President, CEO & Director

Silver Dollar Resources Inc.

Direct line: (204) 724-0613

Email: mike@silverdollarresources.com

179 - 2945 Jacklin Road, Suite 416

Victoria, BC, V9B 6J9

Forward-Looking Statements:

This news release may contain "forward-looking statements." Forward-looking statements involve known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Any forward-looking statement speaks only as of the date of this news release and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

CSE: SLV

The Conversation (0)

26 January

Silver Dollar Outlines 2026 Exploration Plans at its La Joya Silver (Cu-Au) Project

Five targets are being developed to drill test for deep San Martin-type mineralization

Silver Dollar Resources Inc. (CSE: SLV) (OTCQX: SLVDF) (FSE: 4YW) ("Silver Dollar" or the "Company") is pleased to provide an overview of the 2026 exploration plans for advancing its flagship La Joya Silver (Cu-Au) Project in the state of Durango, Mexico. Figure 1: La Joya Project location,... Keep Reading...

26 January

Silver Dollar Outlines 2026 Exploration Plans at its La Joya Silver Project

Five targets are being developed to drill test for deep San Martin-type mineralizationSilver Dollar Resources Inc. (CSE: SLV,OTC:SLVDF) (OTCQX: SLVDF) (FSE: 4YW) ("Silver Dollar" or the "Company") is pleased to provide an overview of the 2026 exploration plans for advancing its flagship La Joya... Keep Reading...

11 December 2025

Silver Dollar Completes Sale of Ranger-Page Silver-Zinc-Lead Project to Bunker Hill Mining

Located in Idaho's prolific Silver Valley, the historical Ranger-Page workings and mineralized zones are geologically continuous with the Bunker Hill system Silver Dollar Resources Inc. (CSE: SLV,OTC:SLVDF) (OTCQX: SLVDF) (FSE: 4YW) is pleased to announce that, further to the news release of... Keep Reading...

25 November 2025

Silver Dollar Samples Up to 2,753 g/t AgEq in Underground Sampling Campaign at its La Joya Silver Project

Silver Dollar Resources Inc. (CSE:SLV)(OTCQX:SLVDF)(FSE:4YW) ("Silver Dollar" or the "Company") is pleased to report underground sample assay results and preliminary geologic modeling of existing high-grade drill results in support of an exploration and mining strategy shift from open pit to... Keep Reading...

27 February

Obonga Project: Wishbone VMS Update

Panther Metals Plc (LSE: PALM), the exploration company focused on mineral projects in Canada, is pleased to provide an update for the Obonga Project's Wishbone Prospect which is an emerging and highly prospective base metal volcanogenic massive sulphide ("VMS") system in Ontario,... Keep Reading...

26 February

Agadir Melloul Mining Licence

Critical Mineral Resources is pleased to announce that a Mining Licence has been awarded for Agadir Melloul, marking an important step forward as the Company accelerates development towards production.The Mining License is 14.6km 2 and covers Zone 1 North and Zone 2, which remain the focus of... Keep Reading...

26 February

EIA Approval for Agdz Cu-Ag Project and Funding

Aterian plc (AIM: ATN), the Africa-focused critical metals exploration company, is pleased to announce the approval of it's recently commissioned Environmental Impact Assessment (''EIA'') for the 100%-owned Agdz Mining Licence, part of the Agdz ("Cu-Ag") Project ("Agdz" or the "Project") in the... Keep Reading...

25 February

Clem Chambers: I Sold My Gold and Silver, What I'm Buying Next

Clem Chambers, CEO of aNewFN.com, explains why he sold his gold and silver, and where he's looking next, mentioning the copper and oil sectors. He also speaks about the importance of staying positive as an investor: "The media negativity is the most wealth-crushing thing you can fall for. So be... Keep Reading...

25 February

What Was the Highest Price for Silver?

Like its sister metal gold, silver has been attracting renewed attention as a safe-haven asset. Although silver continues to exhibit its hallmark volatility, a silver bull market is well underway. Experts are optimistic about the future, and as the silver price's momentum continues in 2026,... Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00