November 07, 2024

Flynn Gold Limited (ASX: FG1, “Flynn” or “the Company”) is pleased to announce a maiden JORC compliant Exploration Target for the Trafalgar, Brilliant and Link Zone prospects at its 100%-owned Golden Ridge Project in North-east Tasmania.

Highlights

- Maiden Exploration Target estimated for the Trafalgar, Brilliant and Link Zone prospects at FG1’s 100%-owned Golden Ridge Project

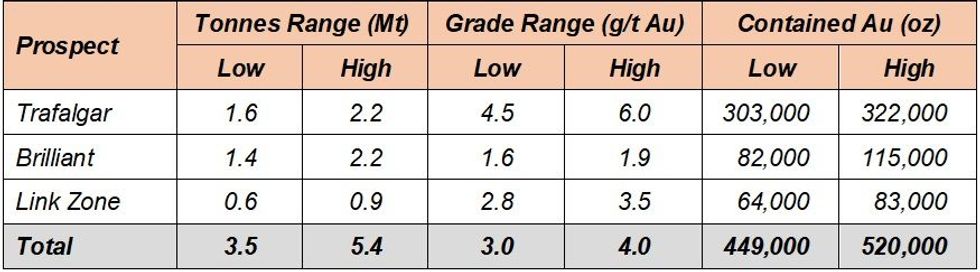

- The estimated range of potential mineralisation for the Exploration Target* is:

- 3.5 to 5.4 million tonnes grading at 3.0g/t Au to 4.0g/t Au for 449,000oz to 520,000oz of contained gold

*The size and grade of the Exploration Target is conceptual in nature and therefore is an approximation. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. The Exploration Target has been prepared and reported in accordance with the 2012 edition of the JORC Code.

- 3.5 to 5.4 million tonnes grading at 3.0g/t Au to 4.0g/t Au for 449,000oz to 520,000oz of contained gold

- Exploration Target is open in all directions and represents less than 30% of the known strike of the 9km gold anomaly that defines the gold mineralised system at Golden Ridge

- Diamond drilling underway at Link Zone testing extensions of known gold-vein mineralisation along strike and down-dip of the historic Golden Ridge Adit

- Further drilling planned to expand the Exploration Target and convert to a Mineral Resource

- To hear our Managing Director Neil Marston discuss this Exploration Target announcement and to further engage with the Flynn Gold team head to: https://investorhub.flynngold.com.au/link/WrAB1P

The combined Exploration Target range is listed in Table 1:

Flynn Gold’s Managing Director and CEO, Neil Marston states: “Following several successful drill campaigns testing the gold mineralisation at Golden Ridge, we are pleased to report an initial JORC-compliant Exploration Target for the Trafalgar, Brilliant and Link Zone prospects.

“The Exploration Target is open in all directions and encompasses less than 30% of the known gold anomalism at Golden Ridge which highlights the substantial future growth potential of this exciting project.

“This is a significant step toward our next goal of defining a maiden JORC Mineral Resource for the project. There is potential to significantly increase the tonnage and grade at Golden Ridge with in-fill and expansion drilling, which will be a major focus for the Company during 2025.”

Exploration Target

The Golden Ridge Project is located within EL17/2018 in North-east Tasmania (see Figure 7).

Flynn has calculated JORC compliant Exploration Targets for the Trafalgar, Brilliant and Link Zone prospects at Golden Ridge dated 8th November 2024. Table 2 below provides a summary of the Exploration Targets for each prospect:

The combined Exploration Target only encompasses areas where Flynn has drill-tested vein mineralisation at locations shown in Figure 1 and does not include areas of anomalous soil geochemistry, which the Company considers to be highly prospective for gold mineralisation and intends to drill-test in the future.

The drill-tested Trafalgar, Brilliant and Link Zone prospects define a significant zone of gold mineralisation extending over a strike length of approximately 3km, which is contained within a broader 9km zone of gold anomalism that trends along the contact between the Golden Ridge granodiorite and the Mathinna supergroup metasediments (Figures 1 - 3).

Potential gold vein extensions at Trafalgar and Brilliant ,defined by anomalous gold-in-soil geochemistry along strike of and surrounding the Exploration Target veins, were not included in the Exploration Target calculation.

Work is currently in progress to in-fill these areas with soil sampling and trenching prior to exploration drill-testing.

Click here for the full ASX Release

This article includes content from Flynn Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FG1:AU

The Conversation (0)

12 August 2024

Flynn Gold

Advancing three high-grade gold projects in Tasmania

Advancing three high-grade gold projects in Tasmania Keep Reading...

20 February 2025

Exploration Update - Golden Ridge Project, NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Update - Golden Ridge Project, NE TasmaniaDownload the PDF here. Keep Reading...

18 February 2025

High-Grade Silver-Lead at Henty Project, Western Tasmania

Flynn Gold (FG1:AU) has announced High-Grade Silver-Lead at Henty Project, Western TasmaniaDownload the PDF here. Keep Reading...

30 January 2025

December 2024 Quarterly Activities Report and Appendix 5B

Flynn Gold (FG1:AU) has announced December 2024 Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

12 January 2025

Flynn Expands Key Gold Targets at Golden Ridge, NE Tasmania

Flynn Gold (FG1:AU) has announced Flynn Expands Key Gold Targets at Golden Ridge, NE TasmaniaDownload the PDF here. Keep Reading...

08 December 2024

Exploration Licence Granted at Beaconsfield in NE Tasmania

Flynn Gold (FG1:AU) has announced Exploration Licence Granted at Beaconsfield in NE TasmaniaDownload the PDF here. Keep Reading...

2h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

19h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

23 February

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00