June 05, 2024

Equinox Resources Limited (ASX: EQN) (“Equinox Resources” or the “Company”) is pleased to announce a Mineral Resources Estimate (“MRE”) for Direct Shipping Ore (“DSO”) for the 100% owned Hamersley Iron Ore (“Hamersley” or “Project”) of 108.5Mt at 58% Fe1.

- Equinox has defined a large-scale, high-grade Direct Shipping Ore (DSO) component of its wider Iron Ore Resource, totaling 108.5Mt at 58% Fe.

- Equinox’s DSO Inferred Mineral Resource Estimate (MRE) is very similar in grade to the Pilbara fines product from the region sold to Asian markets.

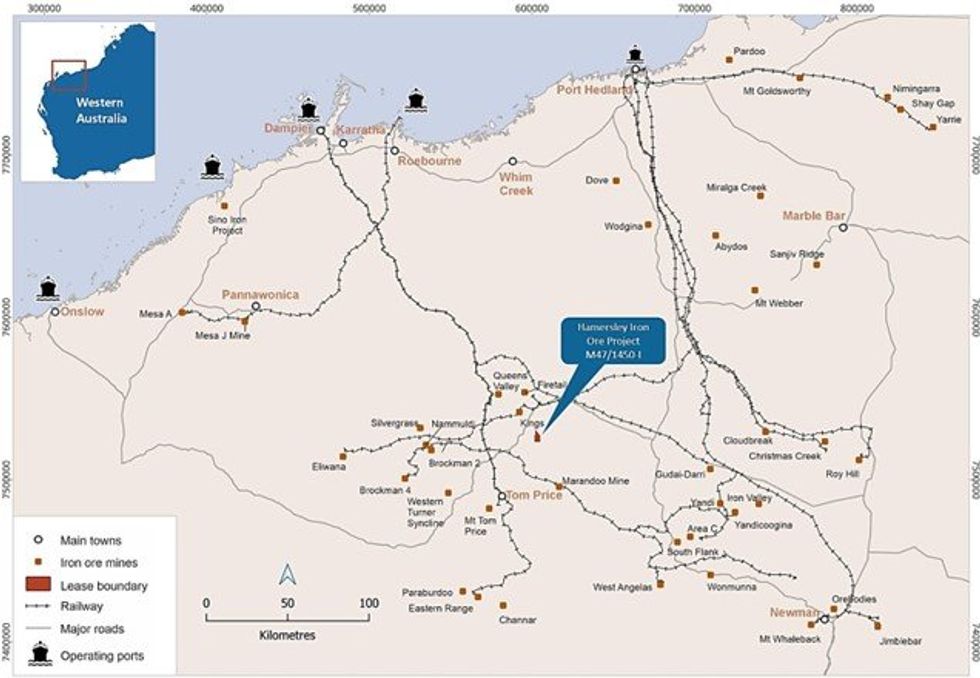

- The resource is strategically located in the infrastructure-rich Pilbara region of Western Australia, approximately 30 km south of Fortescue Metals Group's Solomon Mining Hub (ASX: FMG) currently producing ~65 to 70Mtpa at 56.9% Fe.

- The DSO mineralisation starts ~20 meters below surface and is likely to be easily mineable given the uniform nature of the deposit with no deleterious material present.

- There is significant exploration upside potential to grow the DSO material, as evidenced by drill hole PLRC0167 which ended in mineralisation of 61.6% Fe.

- An infill Phase 1 drilling program of approximately 3,300 meters is planned for H2 CY2024 in the high-grade region of the orebody.

- Metallurgical testwork shows that post-screening and scrubbing, the iron grades can upgrade to approximately 60% to 62% Fe.

- Importantly, this JORC compliant MRE, sits on a mining lease with a native title agreement in place and could be rapidly developed against the backdrop of a high iron ore price environment.

- The initial DSO MRE is one of the largest undeveloped hematite detrital resources in the Pilbara, wholly owned by an ASX-listed junior company.

Equinox Resources Managing Director and CEO, Zac Komur, commented:

“At Equinox Resources, we're committed to advancing the Hamersley Iron Ore Project with a clear focus on accelerating its exploration and development. The reinterpretation of the Mineral Resource Estimate confirms an initial Direct Shipping Ore of 108.5 Mt at a grade of 58.0% Fe targeting the Platts 58% Fe Index and highlighting significant hematite mineralisation. By reassessing the resource and collaborating closely with our geological team, we've unlocked a clearer understanding of its true economic potential, whilst revealing unprecedented exploration upside.

This MRE update lays the groundwork for targeting the higher-grade region of the ore body. Our Phase 1 drilling program for the second half of CY2024 is set to unlock this higher-grade region, further enhancing the resource volume and grade.

These strategic efforts will pave the way for a comprehensive scoping study. This study will thoroughly evaluate alternative valuation scenarios, considering both the MRE for 58% Fe and a +60% Fe market index, with our decisions driven by a commitment to maximising value for shareholders.”

Significant Undeveloped Pilbara Hematite Detrital Project

Equinox Resources has released a DSO MRE as part of the development of the Hamersley Iron Ore Project. This MRE incorporates the results of a recent geological re-interpretation of the deposit conducted by ERM Australia Consultants Pty Ltd, trading as CSA Global, the Company's geological consultant.

The Hamersley Iron Ore Project is supported by a comprehensive knowledge base, including 22,621 meters of historical drilling, assays, geological modelling, metallurgical testwork, and geophysical data. This data has been re-interpreted to enhance the geological characterization and lithological domaining of the deposit.

The initial DSO MRE for the project represents one of the largest undeveloped hematite detrital resources in the Pilbara, wholly owned by an ASX-listed junior iron ore company. With a target grade of 58% Fe, the project can produce a DSO iron ore product that is saleable in the current market.

Click here for the full ASX Release

This article includes content from Equinox Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

02 January 2020

Iron Outlook 2020: Prices to Stabilize Following Supply Shock

Click here to read the latest iron outlook. Iron ore prices have come off their highest level of 2019, but are still ending on a high note. The year was marked once again by a disaster in the space, with Vale’s (NYSE:VALE) news of a dam collapse in January remaining in the spotlight throughout... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00