October 25, 2023

Critical Metals Corp. Secures Additional Equity Investment

European Lithium Limited (ASX: EUR, FRA:PF8, OTC: EULIF) (European Lithium or the Company) is pleased to provide an update of progress on the proposed merger transaction, NASDAQ Listing and additional equity investment. EUR advises that Sizzle Acquisition Corp. (Sizzle) and CRML have secured an additional investment facility from an investment vehicle managed by a New York based financial group, which is expected to provide CRML with US$10 million in capital at closing. Proceeds from the facility are expected to be used to fund the development of the Wolfsberg Lithium Project in Austria (Wolfsberg or Wolfsberg Project).

HIGHLIGHTS

- Critical Metals Corp. (Critical Metals or CRML) secures equity investment facility for additional capital at closing;

- EUR expects CRML to secure more capital in the following weeks, and leading up to shareholder approval of the transaction;

- EUR expects CRML to file an updated Form F-4 registration statement with the SEC, and keenly awaits the SEC’s response and/or SEC Effectiveness.

Tony Sage, Chairman, commented, “European Lithium and Critical Metals Corp. are excited to welcome another new investor, and more committed equity capital to fund the Critical Metals transaction as well as the Wolfsberg Project.”

Critical Metals Corp.

On 26 October 2022, European Lithium announced that it has entered into a business combination agreement with Sizzle Acquisition Corp. (NASDAQ: SZZL), a publicly traded special purpose acquisition company, pursuant to which EUR will combine its wholly owned Wolfsberg Project with Sizzle via a newly- formed, lithium exploration and development company named “Critical Metals Corp.” which is expected to be listed on NASDAQ under the symbol “ CRML” (Transaction).

European Lithium shareholders approved the Transaction on 20 January 2023. Once the F-4 is declared effective by the SEC, the Sizzle Board will convene a shareholding meeting for purposes of, among other things, approving the Transaction.

The Transaction is progressing through the approval process and remains subject to SEC and Sizzle shareholder approval as outlined above.

Upon the closing of the Transaction, EUR will be issued US$750 million worth of ordinary shares in CRML.

Achievements to Date

The Company can report substantial progress has been made in the development plan for the Wolfsberg Project with the achievement of several key milestones highlighted by:

- Mining permit secured - spodumene mined from the project successfully demonstrated its capability to supply high-purity lithium (99.6% lithium carbonate equivalent) at pilot plant.

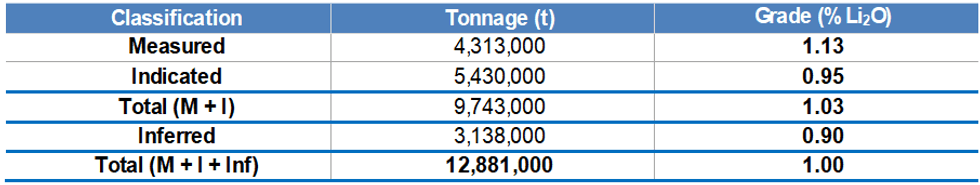

- Mineral Resource Estimate1 - 12.88 Mt of Measured, Indicated and Inferred classified Resources at 1.00% Li2O grade in Zone 1 only:

- Economic viability - Definitive Feasibility Study (DFS)2 that demonstrates a post-tax NPV of US$ 1.5 billion @ WACC13 6%, mined over approximately 15 years.

- Binding offtake agreement with top-tier auto manufacturer secured - direct long term lithium hydroxide supply agreement with BMW4.

- Binding agreement to build hydroxide plant - partnership with Obeikan to build lithium hydroxide processing plant in Saudi Arabia with significant cost savings expected.

- Advanced project with drilling upside – established mine and current resource estimate based only on Zone 1 with drilling undertaken showing prospectivity in Zone 2.

- CRML has entered into a share subscription facility for up to US$125.0M with GEM Global Yield LLC SCS (GEM), a Luxembourg based private alternative investment group. Proceeds from the facility are expected to be used to fund the development of the Wolfsberg Project5.

For full details of the DFS, please refer to EUR announcement dated 8 March 2023, “Wolfsberg Lithium Project Definitive Feasibility Study Results”. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and, in the case of estimates of Mineral Resources or Ore Reserves, that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcement.

Development Plan

The Company has identified several key catalysts in its project development plan for Wolfsberg that include: finalising funding for Wolfsberg infrastructure requirements, commencing construction, and undertaking resource extension drilling in Zone 2 to increase mine life.

The Company has previously advised that it will shortly commence the initial work program at its newly acquired Austrian Lithium Projects (refer EUR announcement dated 21 June 2023), consisting of 245 exploration licenses covering a total area of 114.6 km² located approximately 70km north of the Company’s Wolfsberg Project. The licenses cover ground that is considered prospective for lithium occurrences and initial surface sampling showing 3.98% Li2O.

This article includes content from European Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EUR:AU

The Conversation (0)

07 September 2023

European Lithium

Developing the Advanced Wolfsberg Lithium Deposit in Austria

Developing the Advanced Wolfsberg Lithium Deposit in Austria Keep Reading...

27 August 2025

CRML signs LOI Offtake Agreement with UCORE (DOD Funded)

European Lithium (EUR:AU) has announced CRML signs LOI Offtake Agreement with UCORE (DOD Funded)Download the PDF here. Keep Reading...

20 August 2025

Outstanding New 2024 Diamond Drill Results Tanbreez Project

European Lithium (EUR:AU) has announced Outstanding New 2024 Diamond Drill Results Tanbreez ProjectDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities Report and Appendix 5B

European Lithium (EUR:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 July 2025

EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)Download the PDF here. Keep Reading...

09 July 2025

EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)Download the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00