June 15, 2022

Geoscience technology disruptor SensOre Ltd. (ASX: S3N), together with joint-venture partners Torque Metals (ASX: TOR) and Jindalee Resources (ASX: JRL), is pleased to announce imminent commencement of a maiden drill program at Maynards Dam. The project area includes the Marloo project with partner Monger Exploration (a subsidiary of Lefroy Exploration (ASX: LEX)). Drilling will follow recent completion of an initial and extensive heritage survey over the project area.

HIGHLIGHTS

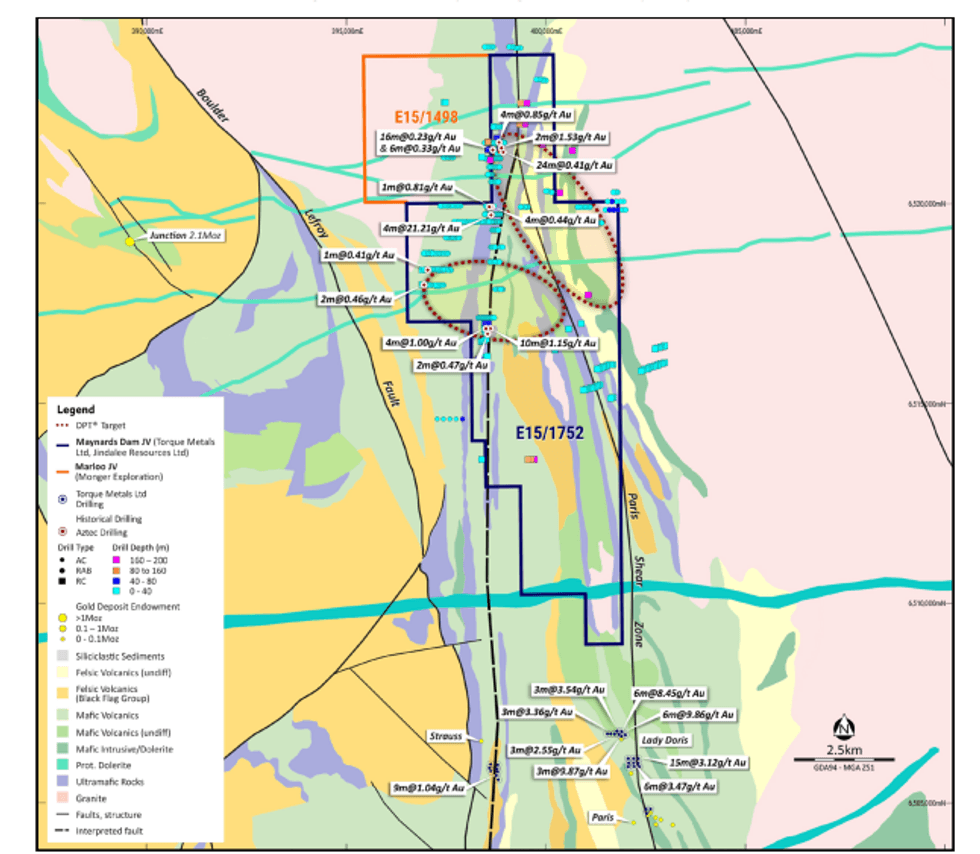

- SensOre is preparing for maiden drilling at Maynards Dam and Marloo prospects in the Goldfields region of WA, which have shown potential to host a major gold system

- SensOre’s AI technology has identified two targets in the north of the Maynards Dam project area and additional targets in the south along strike from recent Torque Metals discoveries

- Marloo is a new tenement at Maynards Dam held with Lefroy Exploration subsidiary Monger Exploration

- SensOre has planned up to 5,500m of air core drilling at Maynards Dam and Marloo based on historical results, gravity geophysics and new surface geochemical samples.

Chief Executive Officer Richard Taylor said:

“SensOre has undertaken extensive work on the Maynards Dam project in the lead up to our maiden drill program including necessary heritage work as a prelude to drilling. Our AI system has identified two special targets in the northern project area and recent surface geochemistry has identified additional targets in the south of the tenement, along strike from recent discoveries by Torque at Strauss and Lady Doris prospects. We are excited by recent and historical results that show the project has potential to host a major gold system. With the recent addition of the Marloo tenement, SensOre has built a significant land package over this prospective domain.”

The Maynards Dam project area is 90km southeast of Kalgoorlie and 25km east of Jindalee Resources’ Widgiemooltha Project and Gold Fields’ (JSE: GFI) St Ives gold complex. Historical drilling records at Maynards Dam indicate intercepts of up to 4m @ 21.21g/t Au from 22m. 1 The Maynards Dam project together with Strauss and Lady Doris prospects as well as Paris mine are inferred to be in a similar stratigraphic sequence to St Ives and similar to the Beta Hunt, Revenge and Intrepide deposits. The targets predicted by SensOre’s DPT® system are interpreted as potentially analogues for both St Ives and Norseman style gold systems consisting of intrusion related and structurally controlled auriferous quartz veins. A splay off the Boulder-Lefroy Fault, a regionally fertile structure in the Eastern Goldfields, passes down the western side of the project area.

SensOre’s air core drilling program at Maynards Dam and Marloo is expected to commence once drilling at Greater Balagundi2 is completed. The proposed 5,000m – 5,500m drilling program follows extensive compilation and review of historical exploration activity, reprocessing gravity geophysics at 100m x 200m spacing released in 2021, and the collection and integration of new surface geochemical samples with extensive multielement assays and proprietary analysis by SensOre.

Project background

The Maynards Dam prospect (E15/1752) is held by Jindalee Resources (ASX: JRL). Torque Metals (ASX: TOR) has the rights to acquire an 80% beneficial interest in the tenement. SensOre can earn a 70% interest in the Maynards Dam tenement (51% by expending $3 million within three years – exclusive of permitting and land access – and 19% by delivering a preliminary feasibility study (PFS)). Torque may buy back 10% by paying $0.5 million to SensOre within 60 days of completion of the PFS.

The Maynard’s Dam area also includes the Marloo tenement, shown in Figure 1. Marloo is a farm-in to E15/1498 with a subsidiary of Lefroy Exploration (ASX: LEX). SensOre has the potential to earn up to a 70% interest by expending $800,000 over four years.

The extended area looks to increase tenure over the Parker Domain and capitalise on the major north-south trend that hosts significant intercepts reported by Torque Metals3 close to the combined project area’s southern boundary.

For further information on the Maynards Dam project refer to the Independent Technical Assessment Report (ITAR) (Appendix A to the SensOre Prospectus released by ASX on 9 February 2022), including the Maynards Dam overview (ITAR section 9.3), historical drilling summaries (ITAR Appendix F) and JORC Table (ITAR Appendix M). Other than as reported in this announcement, SensOre confirms that it is not aware of any new information or data that materially affects the information included in the ITAR in relation to Maynards Dam.

This announcement was approved and authorised for release by the Board of Directors of SensOre.

ENQUIRIES

Richard Taylor

Chief Executive Officer

T +61 3 9492 3843

E richard.taylor@sensore.com.au

Evonne Grosso

Media & Investor Relations

M +61 450 603 182

E evonne@nwrcommunications.com.au

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

S3N:AU

The Conversation (0)

20h

AI Infrastructure Moving to the Edge to Transform User Experience

While the first phase of the AI gold rush was defined by massive investments in centralized data centers, 2026 is about proving those billions can translate into fast, reliable AI that people will use every day. One Canadian startup, PolarGrid, is betting that the answer lies at the edge rather... Keep Reading...

29 January

Quarterly Activities/Appendix 4C Cash Flow Report

Unith (UNT:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

20 January

The Performance Chasm: Is the AI Rally Over or Just Shifting Gears?

The investment landscape of 2025 will be remembered for its historic divide, where the widespread boom in artificial intelligence (AI) created a tale of two worlds in the stock market.On one side, the Magnificent 7 and specialized players like Palantir Technologies (NASDAQ:PLTR) drove massive... Keep Reading...

20 January

Nextech3D.ai Scales National Event Infrastructure to 35 Major U.S. Cities; Launches 58 New AI-Ready Experiences to Meet Enterprise Demand

Strategic Integration of Generative AI 'Semantic Memory' via OpenAI and Pinecone Vector Database Supports Rapid Expansion of Corporate Engagement Platforms TORONTO, ON / ACCESS Newswire / January 20, 2026 / Nextech3D.ai (OTCQB:NEXCF)(CSE:NTAR,OTC:NEXCF)(FSE:1SS), a leader in AI-powered event and... Keep Reading...

16 January

Tech Weekly: Chip Stocks Soar on Taiwan Semiconductor Earnings

Welcome to the Investing News Network's weekly brief on tech news and tech stocks driving the market. We also break down next week's catalysts to watch to help you prepare for the week ahead.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I, Meagen... Keep Reading...

16 January

Nextech3D.ai Partners with BitPay to Power Crypto and Stablecoin Payments for Events

Company Strengthens Event Tech Infrastructure with Milestone AWS Migration and Enhanced Blockchain CredentialingAWS Cloud Infrastructure OptimizationSmart Contract UniformityFlexible Asset Standards ERC721/ ERC1155 TORONTO, ON AND NEW YORK CITY, NY / ACCESS Newswire / January 16, 2026 /... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00