November 13, 2023

Cyclone Metals Limited (ASX: CLE) (Cyclone or the Company) is pleased to announce it has received an investment of $1.32 million cash via the issue of secured notes brokered by CPS Capital Group Pty Ltd (Convertible Note) to fund its flagship Block 103 Iron Ore Project (Block 103) and the Company’s general working capital requirements.

Highlights

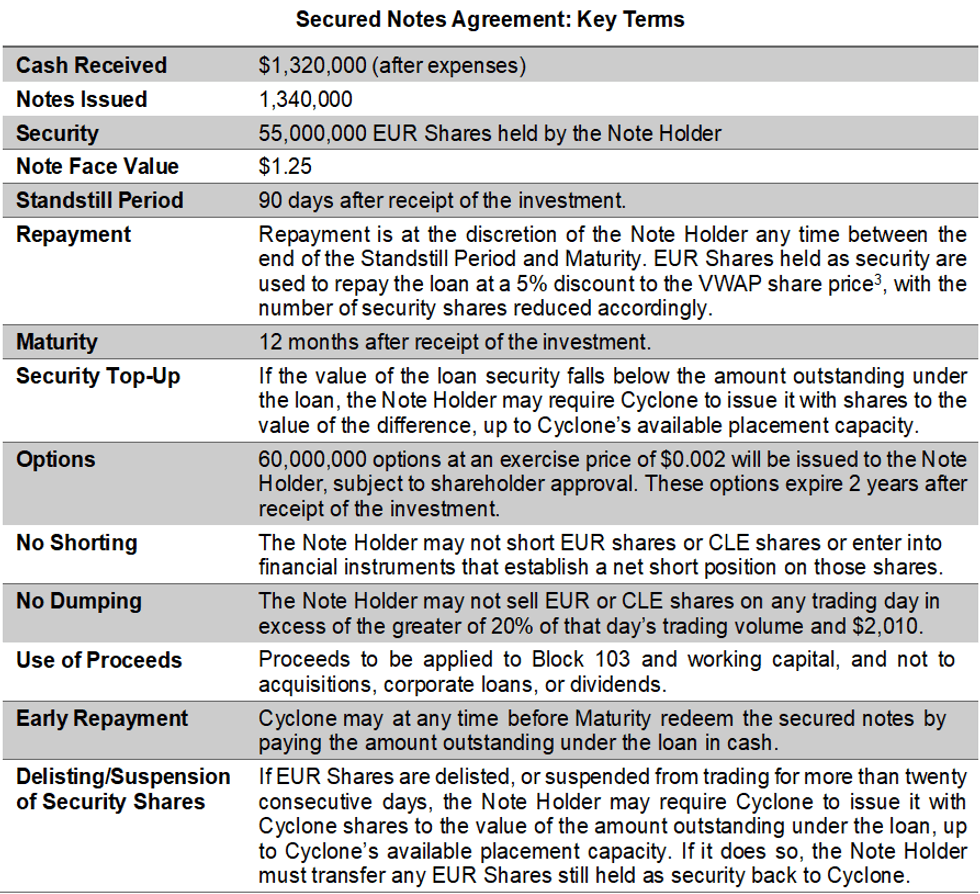

- $1.32 million cash investment after expenses received via secured notes issued to CPS Capital Group Pty Ltd (Note Holder);

- The notes are expected to be non-dilutive for Cyclone shareholders as they leverage securities held by Cyclone in European Lithium Limited (ASX:EUR)

- 1.34 million secured notes issued with a face value of $1.25, repayable in EUR shares at a 5% discount to the EUR VWAP share price1.

- Cyclone owns 62.8m EUR shares valued at $4.96 million as of 13/11/23. 55m EUR shares will be used as security.

- The timing of the note repayment is at the discretion of the Note Holder after a non- repayment period of 90 days, with a maturity of 12 months.

The notes carry a face value of $1.25 and are repayable in EUR securities at the discretion of the Note Holder after a 90 days standstill period. With the exception of the options, the notes should be non- dilutive to Cyclone Shareholders2.

Cyclone Executive Director and CEO, Paul Berend, said: “These notes provide us the oxygen to hit some major operational targets for project Block 103; whilst not diluting our Cyclone shareholders. They are a smart way to leverage our EUR shares; assuming that the merger between EUR and Sizzle Acquisition Corp and the subsequent NASDAQ listing is completed during the 3-month standstill period. If this happens, and if the future EUR share price reflects the current NASDAQ valuation, our Cyclone shareholders would benefit from a higher share price of EUR shares. This is a nice potential upside which explains the structure of the notes but is speculative. The most important takeaway is that we have secured the funding to achieve key operational milestones for Block 103, which could drive substantial value uplift for our shareholders.”

Click here for the full ASX Release

This article includes content from Cyclone Metals Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CLE:AU

The Conversation (0)

11 April 2024

Cyclone Metals

Focused on Developing a World-class Iron Ore Asset in Canada, project Iron Bear

Focused on Developing a World-class Iron Ore Asset in Canada, project Iron Bear Keep Reading...

02 March

Vale CEO: Real Assets Gaining Traction as Money Shifts Away from Tech

With technology, energy and society set to undergo massive transformations over the next few decades, the mining sector may never have been more important than it is today.Globally, demand for consumer electronics such as mobile phones, air conditioners and refrigerators is on the rise.... Keep Reading...

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00