(TheNewswire)

Metallurgical Copper Recovery up to 88% in a 26% Copper Grade Concentrate and up to 72% Nickel Recovery in a 13% Nickel Grade Concentrate

Highlights

-

Using an NSR cut-off-value of USD$16.34/tonne, the inferred and indicated mineral resource estimates now stand at 102 million tonnes and 15.0 million tonnes grading 0.25% nickel

-

Mineralized material is amenable to produce a 26% copper concentrate at up to 88% copper recovery and a 13% nickel concentrate at up to 72% nickel recovery.

-

60% of the palladium is recovered to the copper and nickel concentrates. The palladium grades are expected to yield attractive payment terms from smelters.

-

A Revised Preliminary Economic Assessment for an open-pit production scenario at the Samapleu and Grata deposits will be produced by year-end.

Montreal, Q C - TheNewswire - June 27, 2023 - Sama Resources Inc. (" Sama " or the " Company ") (TSX-V:SME ) ( OT C :SAMMF) is pleased to announce an increase in Indicated and Inferred mineral resources at its Samapleu and Grata nickel (" Ni "), copper (" Cu "), Cobalt (" Co ") and platinum group elements (" PGE ") project in Côte d'Ivoire, West Africa. The latest mineral resource estimate reflects the outstanding progress made by the Company's dedicated exploration team.

The updated Mineral Resource Estimate has an effective date of June 16, 2023, and incorporates drilling carried out at the Samapleu and Grata deposits from 2010 until mid-2022.

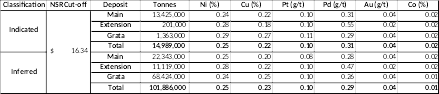

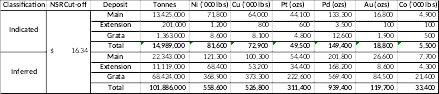

For the Samapleu-Grata deposits combined, Inferred Resources total 101.9 million tonnes (" Mt ") averaging 0.25% Ni for 558.6 million pounds (" Mlbs ") of Ni metal, 0.23% Cu for 526.8 Mlbs of Cu metal, 0.01% Co for 33.4 Mlbs of cobalt (" Co ") metal, 0.29 g/t Pd for 939,400 ounces of palladium (" Pd ") and 0.1 g/t Pt for 311,400 ounces of platinum (" Pt ") .

The combined Indicated Resources total 14.99 Mt averaging 0.25% Ni for 81.6 Mlbs of Ni metal, 0.22% Cu for 72.9 Mlbs of Cu metal, 0.02% Co for 5.5 Mlbs of Co metal, 0.31 g/t Pd for 149,400 ounces of Pd and 0.1 g/t Pt for 49,500 ounces of Pt.

The addition of the Grata mineralization doubled the mineral resources compared with the 2020 PEA (Tables 1 & 2).

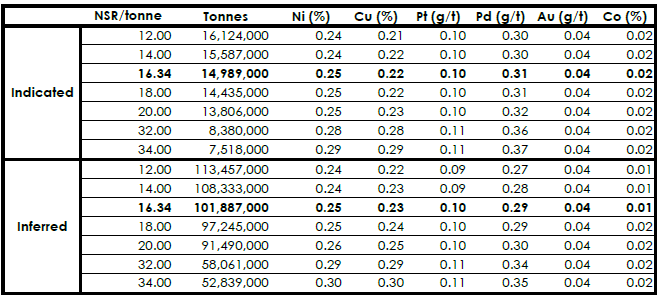

A summary of the Mineral Resources is provided in Error: Reference source not found 1 & 2. Table 3 provides a sensitivity analysis of mineral resources using various Net Smelter Return (" NSR ") cut-off values.

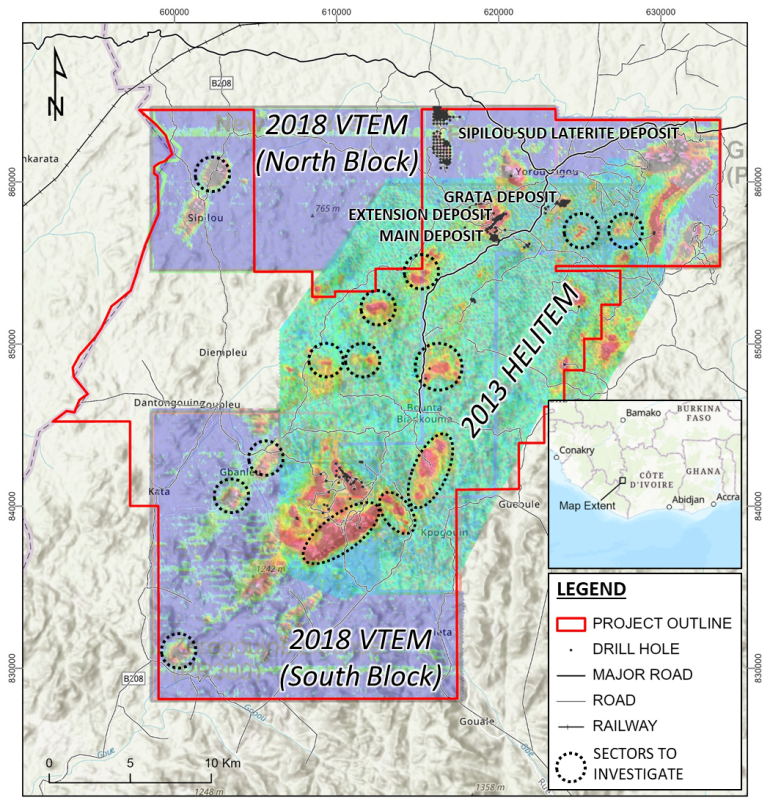

" We are thrilled to announce such remarkable growth in our mineral resources at our Samapleu- Grata nickel and copper project. This achievement is a testament to the hard work and dedication of our exploration team, as well as the vast potential of our project. Together with our partner Ivanhoe Electric, we remain committed to advancing our operations responsibly and to producing a Revised Preliminary Economic Assessment for the combined Samapleu-Grata open-pit potential, " said Dr. Marc-Antoine Audet, President and Chief Executive Officer of Sama Resources. " There are up to twenty additional untested targets showing similar geophysical signatures to Samapleu and Grata within our land package that need to be investigated ."

Sama is advancing exploration and development activities with a primary goal of expanding mineral resources and conducting further technical studies. The Company strategy encompasses sustainable mining practices, fostering positive relationships with local communities, and adhering to the highest environmental standards.

Table 1: Samapleu & Grata Deposits Mineral Resource Statement

Table 2: Samapleu and Grata deposits In-situ Metal within Pit Shells

| Mineral Resource Statement Notes: | ||||||||

| 1. CIM definition standards were followed for the resource estimate. | ||||||||

| 2. The 2023 resource models used ordinary kriging (OK) grade estimation within a three-dimensional block model with mineralized domains defined by wireframed solids. | ||||||||

| 3. Mineral resources are constrained within pit shells | ||||||||

| 3. Open pit NSR cut-off of $16.34/t milled is based on the cost/tonne milled for incremental mining, processing, processing, G&A and sustaining capital of a WMF | ||||||||

| 4. The NSR used for reporting is based on the following: | ||||||||

| a. Long-term metal prices of US$8.70/lb Ni, US$3.75/lb Cu, US$1,140/oz Pt, US$1,300/oz Pd, US$1,690/oz Au, US$25.10/lb Co | ||||||||

| b. Metallurgical recoveries are based on grade recovery curves for the various elements in a copper concentrate. and nickel concentrate | ||||||||

| c. Bulk density was determined by a regression formula based on iron (Fe) for each lithology with each deposit | ||||||||

| d. Mining cost of US$4.08/t mined includes saprolite removal, incremental mining by bench and sustaining capital | ||||||||

| 5. Mineral Resources that are not mineral reserves do not have economic viability. Numbers may not add due to rounding. | ||||||||

Modeling was performed using Datamine Studio RM software, with grades estimated using ordinary kriging (OK) interpolation methodology. Samples were composited at 3.0 metre down hole. Assessment of the raw samples indicated a variety of capping levels for each element by domain and deposit. Block grades were estimated on a multi pass basis with a minimum and maximum number of composites and maximum number of composites per drillhole required for each estimation pass. Block size is 10 metres (x) by 10 metres (y) by 10 metres (z) with up to three sub-blocking divisions comprising a minimum block size of 1.25 metres (x, y, and z). Additional information about the Mineral Resource modeling methodology will be documented in the upcoming NI 43-101 technical report (the "Technical Report").

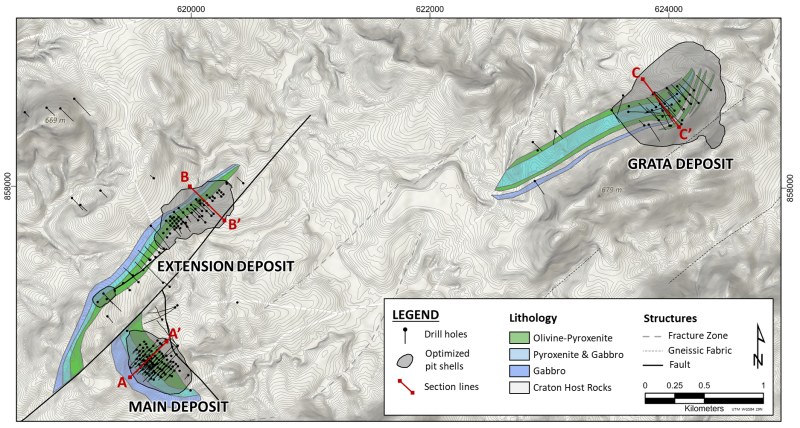

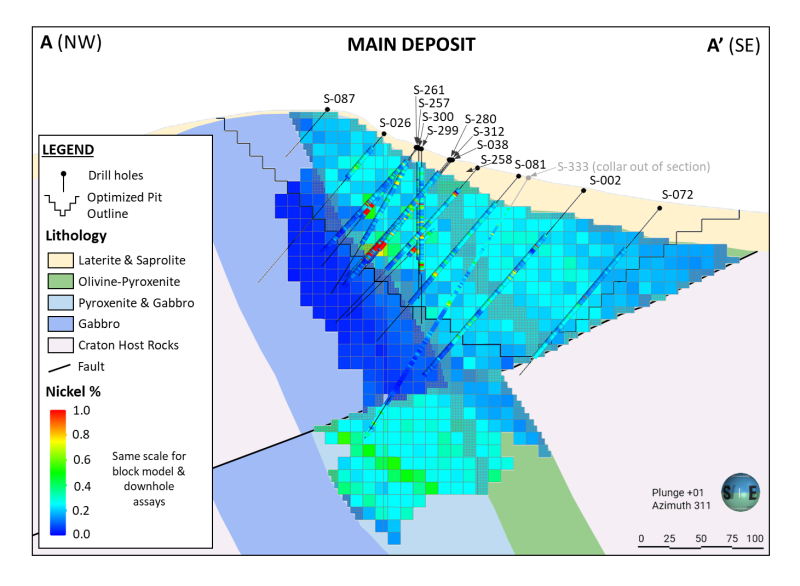

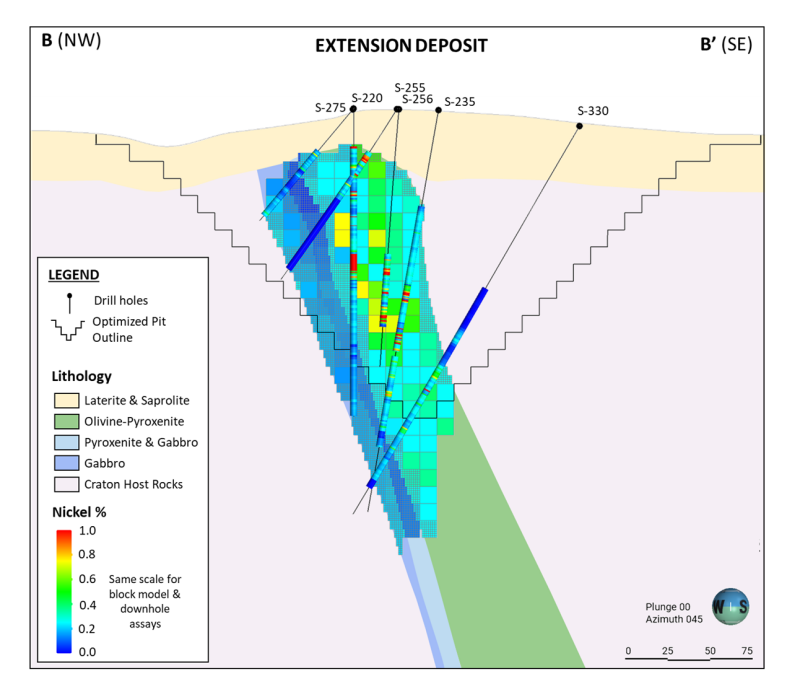

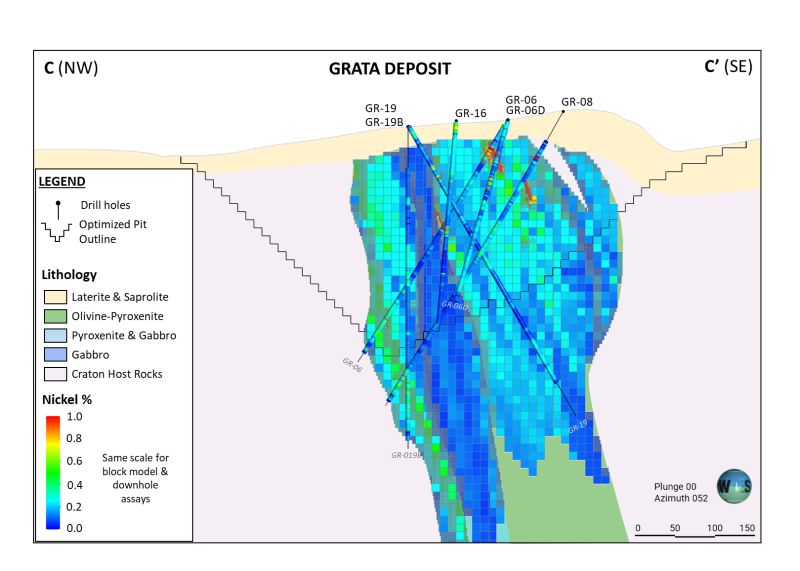

Figure 2 below shows optimised pit layouts at the Samapleu Main, Extension, and Grata deposits. Figures 3 to 5 are geological sections showing grade distribution together with optimized open-pit outlines.

Table 3: Sensitivity analysis on mineral resources using various NSR cut-off values.

2023 Metallurgical test work

As previously announced in our March 6, 2023 news release , metallurgical test work on composites from the Samapleu and Grata deposits completed by Blue Coast Research Ltd (" BCR "), a leading metallurgical testing and consulting company based in Parksville, British Columbia, shows that copper flotation is yielding 83-88% Cu recovery to concentrates assaying 26-27% Cu together with Ni flotation yielding 67-72% Ni recovery to concentrates assaying 13% Ni. Cobalt recoveries were 51% and 61% for the Samapleu Main and Grata composites, respectively.

The metallurgical test work also demonstrates that 60% of the palladium was recovered to the Cu and Ni concentrates, the majority being recovered to the Ni concentrate. The palladium grades are expected to yield attractive payment terms from smelters . Platinum grades should, in most cases, be high enough to attract some payment, with recoveries to the concentrates of 47% and 62% from the Samapleu and Grata composites, respectively. Gold may also attract a small payment from the copper concentrate.

Figure 1: 2013 HTEM & 2018 VTEM conductivity responses outlining numerous additional target/prospective areas for follow-up exploration work.

Figure 2: Surface plan showing optimised pits for Samapleu and Grata deposits.

Figure 3: Cross-section 1 25-metre-thick cross-section through the Main Deposit geological model and the ordinary kriging (OK) nickel (%) block model, overlain by downhole assay data, and the optimized pit shell.

Figure 4: Cross-section 2 25-metre-thick cross-section through the Extension Deposit geological model and the ordinary kriging (OK) nickel (%) block model, overlain by downhole assay data, and the optimized pit shell.

Figure 5: Cross section 3 25-metre-thick cross-section through the Grata Deposit geological model and the ordinary kriging (OK) nickel (%) block model, overlain by downhole assay data, and the optimized pit shell.

QUALITY CONTROL AND ASSURANCE

All scientific and technical information in this release has been reviewed and approved by Todd McCracken, P.Geo., Director – Mining & Geology – Central Canada, BBA International Inc., the qualified person (QP) and Dr. Marc-Antoine Audet, Ph.D. Geology, P.Geo. and President and CEO of Sama, the qualified person (QP) under the definitions established by National Instrument 43-101.

The Qualified Persons have reviewed and verified that the technical information with respect to the Revised Mineral Estimate contained in this press release is accurate and has approved the written disclosure of such information. For readers to fully understand the information in this press release, they should read the Technical Report in its entirety when it is available on SEDAR, including all qualifications, assumptions and exclusions that relate to the information to be set out in the Technical Report. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

QUALIFIED PERSON

The resource estimate was prepared by Mr. Todd McCracken, P.Geo, of BBA International Inc. in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. The resource classification follows the CIM definition for classification of Indicated and Inferred Mineral Resources. The criteria used by the QP for classifying the estimated mineral resources are based on confidence and continuity of geology and grades.

An NI 43-101 compliant Technical Report will be filed on SEDAR within 45 days of this press release.

About Sama Resources Inc .

Sama is a Canadian-based, growth-oriented resource company focused on exploring the Samapleu nickel-copper project in Côte d'Ivoire, West Africa. The Company is managed by experienced industry professionals with a strong track record of discovery. Sama is committed to developing and exploiting the Samapleu Nickel-Copper and Platinum Group Element Resources.

Sama's projects are located approximately 600 km northwest of Abidjan in Côte d'Ivoire and are flanked to the west by the Ivorian and Guinean borders . Sama owns a 70% interest in the Samapleu Nickel Corporation Inc., with its joint venture partner Ivanhoe Electric owning 30%. Ivanhoe Electric has the option to earn up to a 60% interest in Samapleu Nickel Corporation Inc.

For more information about Sama, please visit Sama's website at www.samaresources.com .

About Ivanhoe Electric Inc.

Ivanhoe Electric is an American technology and mineral exploration company that is re-inventing mining for the electrification of everything by combining advanced mineral exploration technologies, renewable energy storage solutions and electric metals projects predominantly located in the United States. For more information, visit www.ivanhoeelectric.com

CONTACT INFORMATION

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835 or (877) 792-6688, Ext. 5

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information such as "will", could", "expect", "estimate", "evidence", "potential", "appears", "seems", "suggest", are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the ability of the company to convert resources in reserves, its ability to see through the next phase of development on the project, its ability to produce a pre-feasibility study or a feasibility study regarding the project, its ability to execute on its development plans in terms of metallurgy or exploration, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2023 TheNewswire - All rights reserved.