November 01, 2023

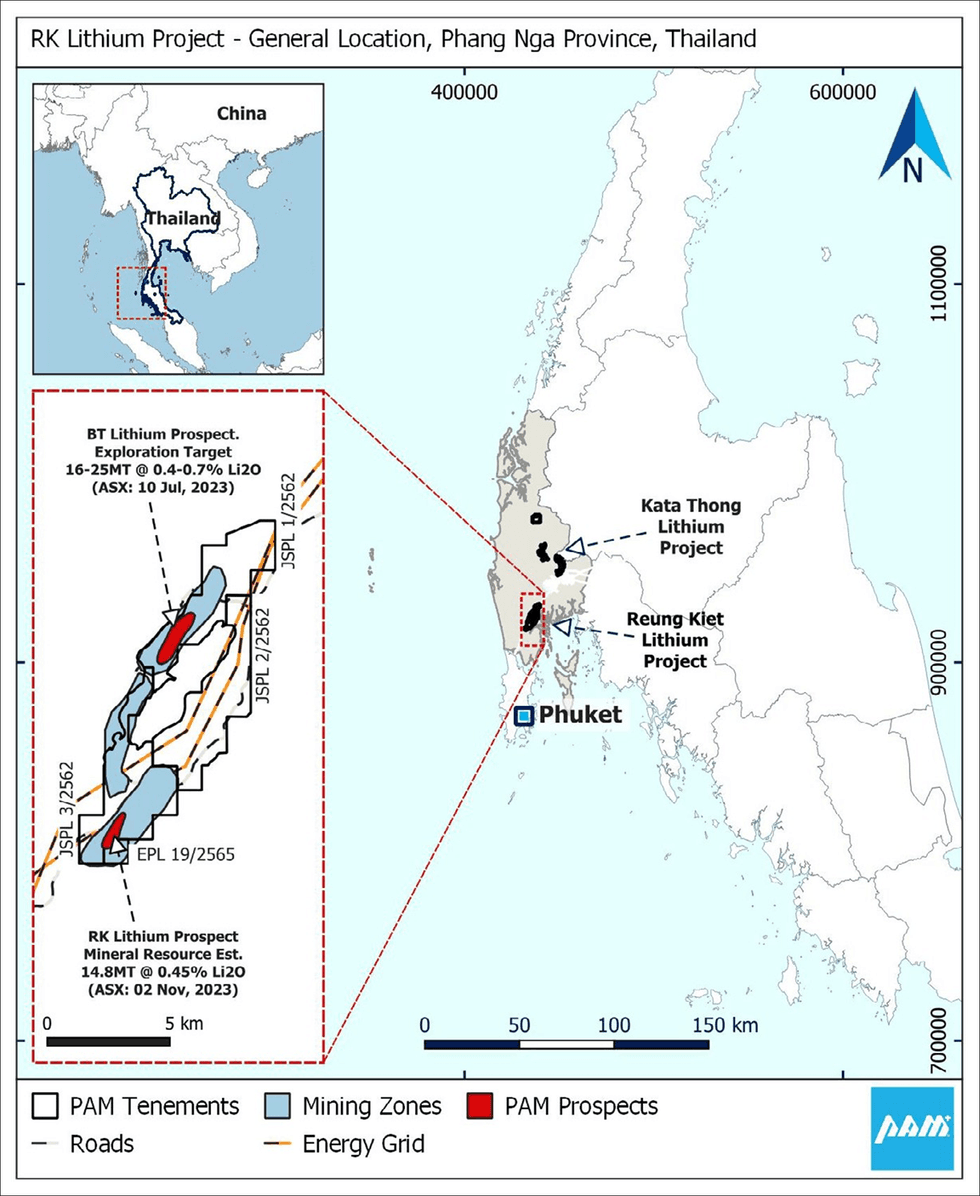

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to is pleased to announce an updated Mineral Resource Estimate (MRE) for its 100% owned RK Lithium Project (RKLP) located insouthern Thailand (See Figure 1). The MRE was estimated by CSA Global in accordance with the JORC Code (2012). Technical details of the MRE are presented in Table 1 of the JORC Code in Appendix 1.

HIGHLIGHTS

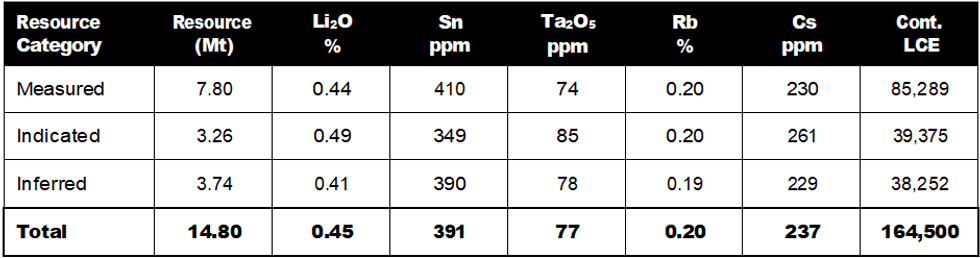

- Measured, Indicated & Inferred Mineral Resource Estimate at a 0.25% Li2O cutoff of: 14.8Mt @ 0.45% Li2O, 391 ppm Sn, 77ppm Ta2O5, 0.20% Rb and 237ppm Cs

- 42% increase in total Mineral Resource tonnes

- 46% increase in contained LCE to 164,500 tonnes

- 75% of Mineral Resource in the Measured and Indicated categories

- Bulk of Mineral Resource located from Surface to 150m Depth

- Mineralisation commences at surface and is amenable to open cut mining

- Mineralisation remains open along strike and at depth, especially in the south

- Metallurgical testwork shows positive flotation recoveries to concentrates and to roast/leach liquor

- Potential for numerous by-products for local markets such as Sn-Ta concentrates, fine sand concentrates, clay concentrates

- PAM has strong support from local communities, provincial and federal Government

- Thailand’s large vehicle manufacturing industry is transitioning rapidly to EV production with Mercedes producing EVs, BYD and GWM building EV factories.

- Demand for Li-ion batteries in all forms is increasing rapidly, supply demand projections support tight markets

- Discussions with IRPC progressing very well and positioning PAM to meet its aim to produce battery grade lithium compounds in Thailand

Pan Asia Metals Managing Director, Paul Lock, commenting on the Mineral Resource Estimate update said: “This is a solid result, increasing the Mineral Resource by nearly 50% is in itself a great outcome but shifting 50% of the Mineral Resource into Measured and 75% into Measured and Indicated and delivering 164,500t of LCE, is a fantastic outcome. Further, the bulk of the Mineral Resource is in the 0-150m zone, so it’s doable, and PAM’s metallurgical testwork confirms that the oxide zone beneficiates essentially as well as the fresh zone, putting PAM in a great position. With the updated Mineral Resource we will generate a pit shell and this will feed into our feasibility work, which is progressing well“. With 23 countries passing the crucial 5% tipping point to mass EV adoption, that 5% or greater EV sales to total auto sales, the outlook for lithium and critical metals looks very good.

The MRE is reported at 0.25% Li2O lower cut-off. The current Mineral Resource at RK is shown in Table 1 below.

The stated aim of the drilling campaign post reporting of the inaugural Mineral Resource for the RK Lithium Prospect in 2022 was to increase the maiden Mineral Resource tonnage and upgrade the classification of the Mineral Resource from Inferred to Indicated, with some Measured possible. With an additional 56 diamond drill holes for a total 102 diamond drill holes the Mineral Resource tonnage was increased by 42% to 14.8 million tonnes and the contained LCE was increased by 46% to 164,500 tonnes.

Mining studies can now be undertaken and used to complete the Preliminary Feasibility Study (PFS) and submission of a Mining License Application (MLA).

Subject to the results of the PFS, the upgraded Mineral Resource will allow for an Ore Reserve to be declared.

Mineral Resource Estimate

The RK Lithium Project (RKLP) is one of PAM’s key assets, comprising the RK Lithium Prospect (RK) and the BT Lithium Prospect (BT). RKLP is a hard rock lithium project with lithium hosted in lepidolite/muscovite rich pegmatites chiefly composed of quartz, albite, lepidolite and muscovite, with minor cassiterite and tantalite as well as other accessory minerals including some rare earths. Previous open pit mining extracting tin and tantalum from the weathered pegmatites at both RK and BT was conducted into the early 1970’s. At RK, the prospect subject to this Mineral Resource upgrade, this activity was focused in the northern half of the Mineral Resource trend.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00