November 05, 2024

With a market capitalization of approximately C$10 million and no debt, Riverside Resources (TSXV:RRI) has successfully advanced over 80 exploration projects and has completed seven successful spinouts and royalty transactions over its 17-year history. Founded in 2007, the company focuses on precious and base metals, with a unique business model designed to minimize financial risk while maximizing exploration opportunities.

Riverside's diversified portfolio spans different geographies and commodities, including gold, silver, copper and rare earth elements (REE) in Ontario and British Columbia in Canada, and across Mexico. Riverside is well-capitalized, with over $5 million in cash on hand, no debt, and a well-established royalty portfolio. This strong financial position allows the company to continue exploring new opportunities while reducing operational risks.

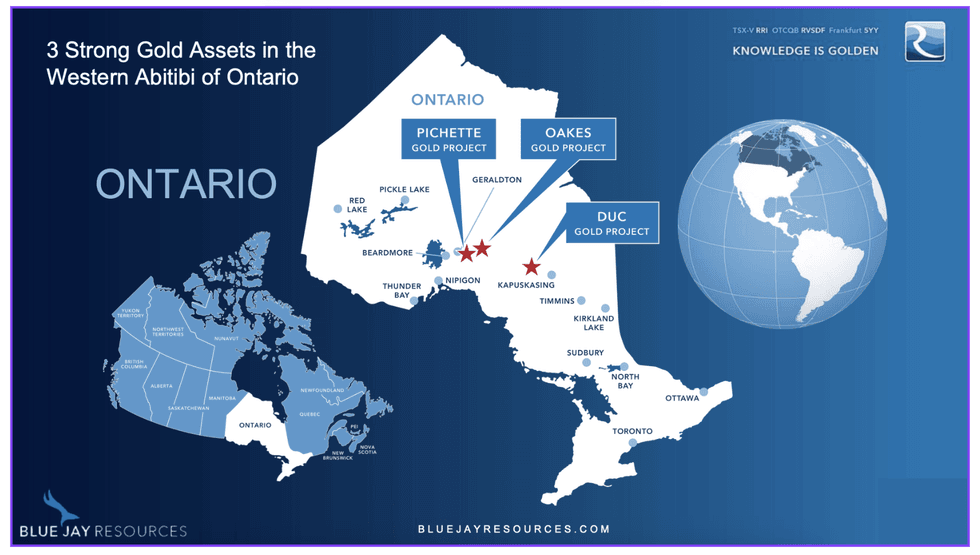

Riverside Resources' Ontario-based gold projects are located in the Western Abitibi region, one of Canada's most prolific gold-producing areas. The company's assets are near Equinox Gold's Greenstone gold mine, which provides significant potential for future development or acquisition. The Greenstone mine is expected to produce more than 390,000 ounces of gold annually for the first five years of its over 15 years of mine life. As this mine nears the end of its life, Riverside's nearby properties could provide valuable ore, potentially making them attractive targets for acquisition by Equinox or other major players in the region.

Company Highlights

- Riverside Resources has successfully advanced over 80 exploration projects using more than $85 million in partner-funded exploration.

- Riverside’s Ontario gold projects are strategically located near Equinox Gold’s Greenstone Mine, offering significant potential for future development or acquisition.

- The Cecilia gold-silver project in Sonora, Mexico, is advancing through a partner-funded drilling program with Fortuna Silver Mines, offering significant discovery potential.

- With over C$5 million in cash and no debt, Riverside Resources is financially strong, ensuring sustained exploration activity.

- The company has completed seven successful spinouts and royalty transactions over its 17 year history, creating substantial value for shareholders.

- The company’s business model minimizes financial risk by partnering with larger companies, enabling multiple simultaneous exploration projects.

This Riverside Resources profile is part of a paid investor education campaign.*

Click here to connect with Riverside Resources (TSXV:RRI) to receive an Investor Presentation

RRI:CC

The Conversation (0)

03 November 2024

Riverside Resources

Project generator with a diversified portfolio of gold, silver, copper and REE assets in Canada and Mexico

Project generator with a diversified portfolio of gold, silver, copper and REE assets in Canada and Mexico Keep Reading...

3h

Peruvian Metals Provides Update on the Minas Visca Silver Project in Northern Peru and Announces Financing

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to provide an update on the Company's Minas Visca Silver property (the "Property") located in Northern Peru. Peruvian Metals acquired the Property in 2021 by submitting a superior offer... Keep Reading...

4h

Blackrock Silver Appoints Sean Thompson as Head of Investor Relations

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) (the "Company" or "Blackrock") is pleased to announce the appointment of Sean Thompson as Head of Investor Relations for the Company.Mr. Thompson is a seasoned capital markets professional with over 17 years of experience in... Keep Reading...

14h

Mark Moss: Trust is Gold's Key Driver as Price Hits Record Levels

Gold and silver's historic price rises are raising questions about the broader state of the world. For Mark Moss, the surges reflect a deeper breakdown of trust in sovereign currencies. “The real driver is not inflation,” the investor and commentator emphasized during a fireside chat at the... Keep Reading...

14h

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00