- WORLD EDITIONAustraliaNorth AmericaWorld

August 15, 2023

Impact Minerals Limited (ASX:IPT) is pleased to announce that it has finalised revised terms for the sale of up to a 75% interest in the Company's 100% owned Commonwealth Project to Burrendong Minerals Ltd (Burrendong), an unrelated public company.

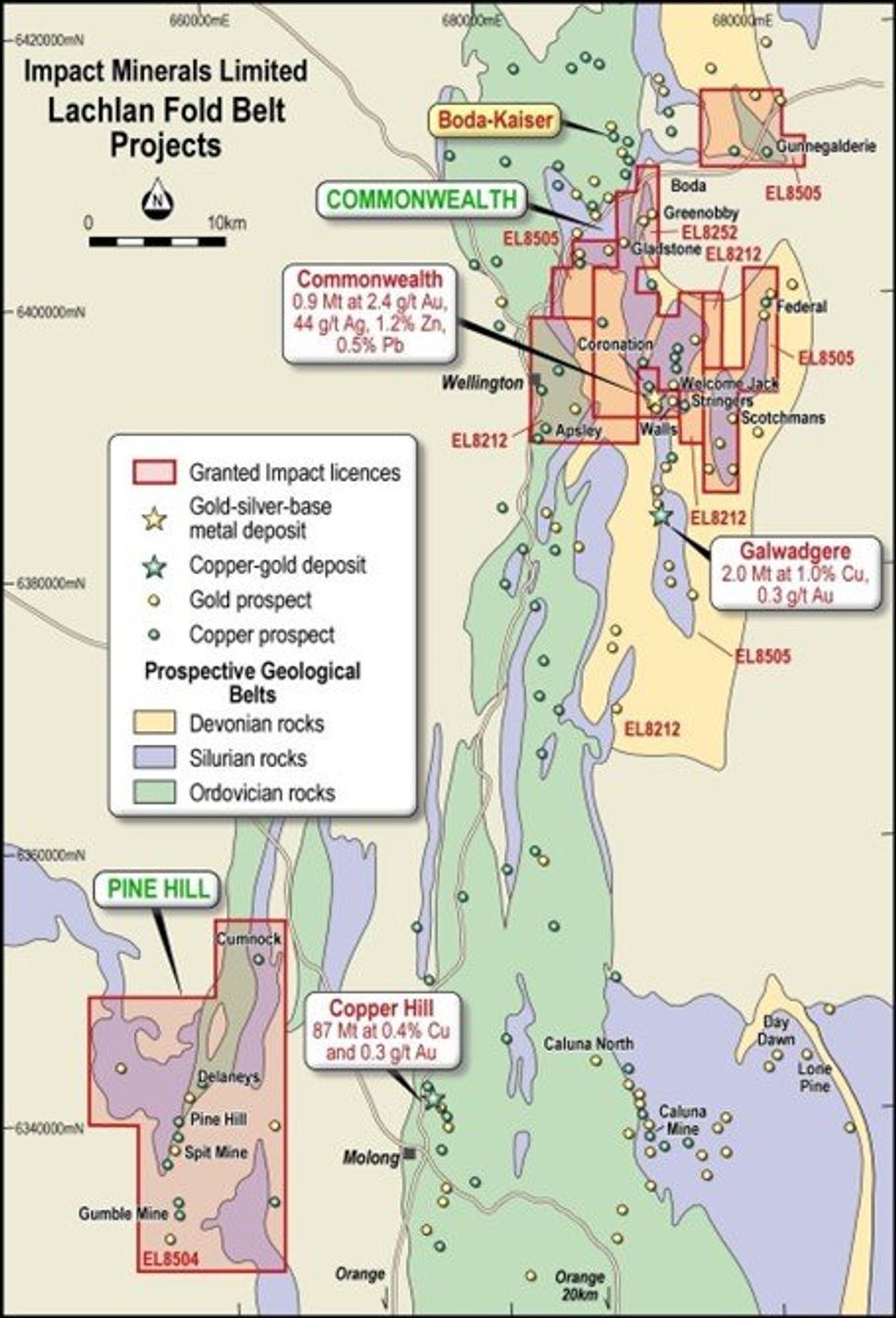

The revised terms will see Impact retaining a 49% interest in the project following a proposed IPO of Burrendong. In addition, Burrendong recently acquired the right to acquire the Galwadgere copper- gold project, located 7 kilometres along trend from the Commonwealth deposit, from Sky Metals Limited (Figure 1 and ASX:SKY Release 14th July 2023).

Galwadgere contains an Inferred Resource of 3.6Mt at 0.82% copper and 0.27g/t gold at a cut-off grade of 0.5% copper (ASX:SKY Release July 7th 2021). This is a significant addition to the resources defined by Impact at Commonwealth and detailed below.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “These revised terms, should Burrendong list, will allow Impact to retain a larger percentage of the Commonwealth Project as well as being a shareholder in a company that could have three deposits containing a significant global resource under its belt, Commonwealth, Silica Hill and Galwadgere. These deposits all occur within the Lachlan fold belt, one of Australia’s most prolifically mineralised areas and host to the similar Woodlawn deposit, a world-class deposit currently under development. We look forward to supporting Burrendong as they progress towards their IPO”.

The revised terms, which supersede the terms announced by the Company on August 8th 2022, are:

1. An extension of the Exclusivity Period to September 30th 2023, to complete a Share Purchase Agreement (SPA) and Joint Venture Agreement (JVA). Burrendong can extend the Exclusivity Period for a further eight weeks for a non-refundable payment of $25,000.

2. On execution of the SPA, Impact to receive a non-refundable payment of $75,000.

3. Following the execution of the SPA, Burrendong will have nine months to complete a listing on the ASX.

4. Upon listing, Impact will receive a further $250,000 in cash, a 12.5% interest in Burrendong and will retain a 49% interest in the Commonwealth Project.

5. Upon listing, the project will operate under an incorporated joint venture, whereby Burrendong may acquire a further 24% interest in the Commonwealth Project by sole funding exploration until the earlier of the first $5 million of expenditure within 36 months of the SPA Completion or a Decision to Mine.

6. Normal dilution clauses will subsequently apply, and if Impact reduces to less than a 10% interest, it will convert to a 2% Net Smelter Royalty.

7. Impact shareholders will receive a priority entitlement to subscribe for up to $2 million worth of shares under the Burrendong initial public offering.

About the Commonwealth Project

The Commonwealth Project (100% Impact) comprises 565 km2 in the northern part of the Lachlan Fold Belt in New South Wales, about 100 km north of Orange (Figure 1). The Lachlan Fold Belt is renowned for three types of world-class deposits, including:

1. Porphyry copper-gold such as the Cadia-Ridgeway mine just south of Orange (25.6 M oz Au and 4.9 Mt Cu);

2. Epithermal gold such as the Cowal mine 35 km north of West Wyalong (4.0 M ozs Au); and

3. Volcanogenic Massive Sulphide (VMS) deposits such as Woodlawn 50 km northeast of Canberra (21 Mt at 8.1% Zn, 1.7% Cu, 3.1% Pb, 0.5 g/t Au and 66 g/t Ag).

Work by Impact has shown the Commonwealth deposit to be a high sulphidation, gold-rich VMS deposit, a deposit style only recognised in the past 25 years, and with striking similarities to the world-class Eskay Creek VMS Deposit in Canada (production of >4 million ounces of gold and >180 million ounces silver).

Impact’s work defined Inferred Resources with 88,800 ounces of contained gold and 3,300,000 ounces of contained silver with significant zinc and lead credits, all within 250 metres of the surface and with potential for bulk open pit mining. All resources are open at depth and along trend (ASX Release 22nd August 2019).

The Mineral Resources at Commonwealth and Silica Hill were prepared in accordance with the JORC 2012 Code by independent resource consultants Optiro and followed several drill programmes across the project area by Impact and previous explorers (ASX Release 22nd August 2019). The information in this announcement that relates to those Mineral Resources is based on information announced to the ASX on 22nd August 2019. The Company confirms that it is not aware of any new information or data that materially affects the information included in the relevant market announcement, and that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00