October 15, 2024

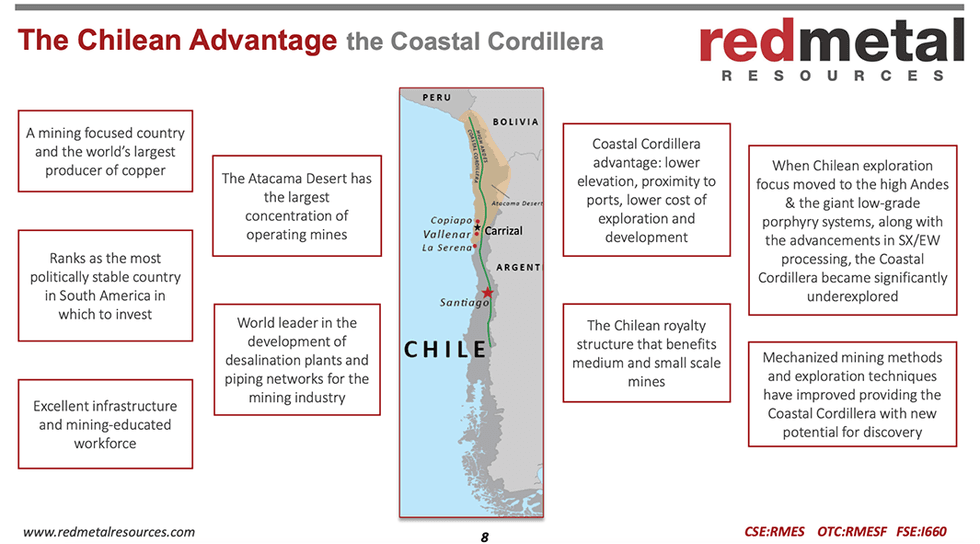

With assets located in a historic copper mining district in Chile that boasts high-grade mineralization and low-cost operations, Red Metal Resources (CSE:RMES) is well-positioned to benefit from Chile’s globally significant copper sector.

The company holds 3,278 hectares across 21 secure mining claims within the Carrizal Alto mining district in the prolific Coastal Cordillera. The Carrizal property comprises two projects - Farellon and Perth - located in an area with a rich copper and gold production history.

The Carrizal Alto district provides a favorable geographic position located at a low elevation of around 500 meters above sea level, reducing the logistical challenges often associated with exploration in higher-altitude regions. The district is also well-connected by infrastructure, including highways and proximity to major urban centers. Red Metal Resources' property is situated just 150 kilometers south of Copiapó, 25 kilometers from the coast, and only 20 kilometers west of the Pan-American Highway. This close access to infrastructure allows for easier transportation of equipment and supplies, as well as streamlined access to labor and other resources.

Red Metal Resources enhances its portfolio of clean energy exploration projects with the acquisition of three mineral claim packages contiguous to Quebec Innovative Materials Corp.'s (QIMC) recent hydrogen sample discovery of over 1,000 ppm. The claims are located within the Timiskaming Graben formation covering 19 cells and totaling over 1,100 hectares. Red Metal Resources intends to begin initial exploration and field work that could include a soil gas survey, geophysical surveys and fieldwork in the municipality of St-Bruno-de-Guigues sector.

Company Highlights

- Red Metal Resources holds 3,278 hectares across 21 secure mining claims within the Carrizal Alto mining district in the prolific Coastal Cordillera.

- The company’s Carrizal property comprises two projects - Farellon and Perth - located in an area with a rich history of copper and gold production.

- The Farellon project has over 9,000 metres of drilling, identifying 1.5 kilometres of mineralized strike length with potential for an additional 3.5 kilometres.

- In 2022, a high-grade surface sample from Farellon returned 5.77 percent copper, 1.55 percent cobalt, and 0.11 g/t gold.

- Management and insiders control approximately 35 percent of the company’s shares, aligning their interests with investors.

This Red Metal Resources profile is part of a paid investor education campaign.*

Click here to connect with Red Metal Resources (CSE:RMES) to receive an Investor Presentation

RMES:CC

Sign up to get your FREE

Red Metal Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

16 October 2024

Red Metal Resources

Advancing high-grade copper assets in Chile’s Coast Cordillera Belt

Advancing high-grade copper assets in Chile’s Coast Cordillera Belt Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Sign up to get your FREE

Red Metal Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

10h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00