August 02, 2022

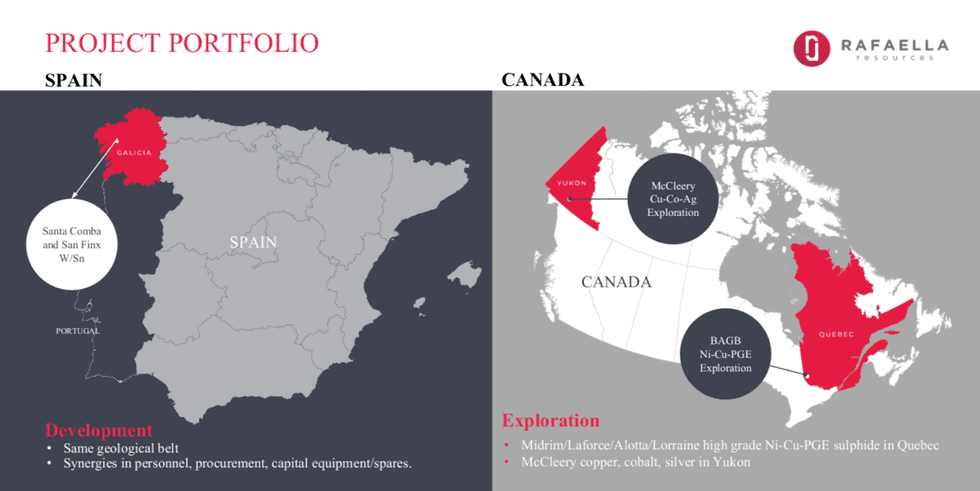

Rafaella Resources (ASX:RFR) consolidates a portfolio of two previously producing tungsten and tin mines in Galicia northwest Spain; San Finx and Santa Comba. The mines are partially permitted and benefit from extensive infrastructure. San Finx was producing tin and tungsten concentrates as recently as 2017. Bringing these mines back into production will substantially mitigate Europe’s supply chain risks.

Rafaella has doubled its exploration position in Quebec with a focus on PGMs, nickel and copper. The Belletere-Anglier Project already hosts shallow high grade deposits and Rafaella is embarking on an exploration programme targeting deeper feeder systems in this prolific mineralised belt.

Company Highlights

- Rafaela Resources is an exploration and development mining company with assets in Europe and North America that enable it to become a significant contributor to domestic supply chains of critical minerals.

- The company has two tungsten projects in the Iberian Peninsula with synergistic opportunities to share resources, personnel, and offtake agreements.

- Rafaela's Iberian Peninsula projects are both moving towards production.

- Additionally, the company has exploration assets in Canada targeting critical minerals, including PGMs, nickel, and copper.

- Rafaela Resources is led by an experienced management team and board of directors that create confidence in its ability to reach its goals.

- Rafaella Resources recently expanded its PGM-Ni-Cu portfolio in Canada through the acquisition of the Alotta and Lorraine PGM-Ni-Cu projects located in Quebec

This Rafaella Resources profile is part of a paid investor education campaign.*

Click here to connect with Rafaella Resources (ASX:RFR) to receive an Investor Presentation

RFR:AU

The Conversation (0)

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00