April 26, 2022

Winsome Resources Limited (ASX: WR1) ("the Company" or "Winsome Resources ") is pleased to report on its Quarterly activities for the period ending 31 March 2022.

Quarter Highlights

Exploration- Entered into exclusive option agreement to explore and acquire 669 claims in the highly prospective Decelles Region

- Sourced drill rig, planned combined infill/extension drilling campaign at Cancet

- Commenced 2,100m program in mid-March 2022 at Cancet

- Commenced gravity survey at Cancet

- Made contact with First Nations Cree people and discussed details of Winsome exploration at Cancet. Meeting planned for PDAC conference in June

- Meeting with representatives of the Northern Quebec Regional Directorate for the Department of Energy and Natural Resources to discuss project details

Health and Safety

- In excess of 3,500 hours worked on site at Cancet as part of the drilling and survey, with no lost time or safety incidents

- All contractors and staff remained COVID safe throughout winter exploration activities

Corporate

- Commenced trading on Frankfurt Exchange under code 4XJ

- Application submitted to trade on New York’s OTCQB

- Launched unmarketable parcel facility to reduce administrative costs associated with shareholdings of less than AU$500 in value

- Attendance at Mines and Money& Battery Materials conference

- Discussions held with potential strategic partners

- Acquired new equipment and facilities including skidoo, company truck, base of operations in Rouyn-Noranda, Quebec

- New office secured, located with corporate/IR advisors to reduce overhead costs and enhance synergies by working in the same location

EXPLORATION ACTIVITIES

Decelles Acquisition

Immediately after listing, Winsome formed a partnership with Glenn Greisbach, a Quebec regional geology specialist, to expand its land portfolio by discovering and acquiring new properties in Quebec with a high degree of lithium potential.

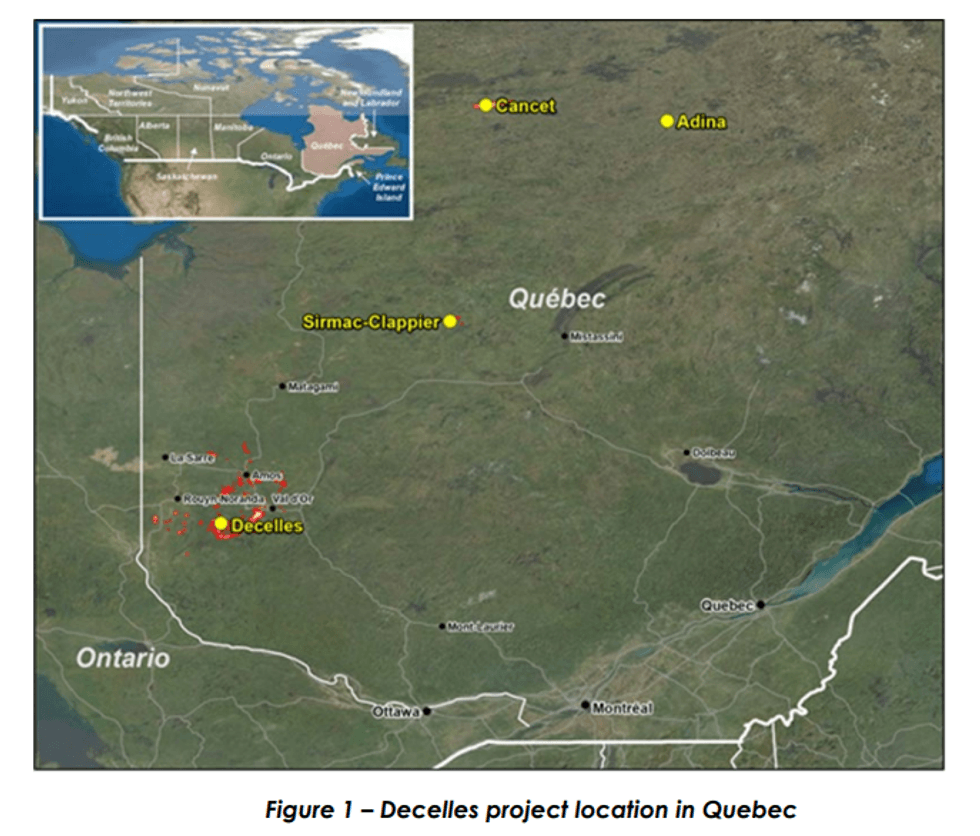

This led to Winsome entering into an exclusive option agreement in late January 2022 to acquire 669 claims, totalling 385km2, in the prospective Decelles region of Quebec, Canada. Decelles is located close to the mining centres of Val-dÓr and RouynNoranda, approximately 600km from Montreal. The Company signed an exclusive option agreement to explore and subsequently acquire the claims over a 24-month period.

By entering into this agreement, the Company can more than double its land holding in Quebec and explore a new area of the province known for granitic and pegmatitic outcrops, located close to infrastructure and the major mining centres immediately adjacent to recent lithium discoveries (see Figure 1).

Click here for the full ASX Release

This article includes content from Winsome Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WR1:AU

The Conversation (0)

14 November 2025

Nextech3D.ai Poised for Growth as Event-Tech and 3D/AR Revenue Accelerates

Nextech3D.AI (CSE:NTAR,OTCQX:NEXCF,FSE:EP2) is gaining investor attention following H.C. Wainwright’s November 2025 coverage, highlighting renewed optimism about the company’s growth prospects, driven largely by its expanding event‑technology business.The analyst firm maintained a Buy rating... Keep Reading...

31 May 2023

Restructure of the Renard Option

Highlights Reduction of initial payment upon exercise of the option from C$15 million to C$1 million . The balance of the Renard consideration payment delayed until 2026 and 2027. Renard Option restructure preserves shareholder value by deferring material payments by 12 months and extending the... Keep Reading...

09 May 2022

Winsome Further Expands Lithium Exploration Footprint in Quebec

Perth-based lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) is pleased to advise it has partnered with geology specialist Mr Glenn Griesbach and with local prospector Mr Marc de Keyser. Highlights: Exclusive option agreement executed for... Keep Reading...

8h

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00