July 25, 2022

The Directors of eMetals Limited (ASX:EMT)(eMetals)(Company) are pleased to submit the Quarterly Activities Report and Appendix 5B for the quarter ending 30 June 2022.

Highlights

- Two tenement applications following the acquisition of Salmon Gums Minerals Pty Ltd (ACN 651 315 258) have been granted at the highly prospective Salmon Gums Project in the Albany Fraser Range Province of Western Australia.

- The Company now holds four granted tenements (E63/2049, E63/2066, E63/2126, E63/2127) covering an area of 219 blocks for a total of 630 square kilometers of the Eucla Basin prospective for Ionic Adsorption Clay (IAC) style rare earth element (REE) mineralisation.

- Heritage agreement progressed during the June Quarter at the Salmon Gums Project in preparation of a program of works application.

- Additional prospective tenure applied for and granted at the Twin Hills Gold Project.

SALMON GUMS PROJECT

Salmon Gums holds four exploration licenses (E63/2049, E63/2066, E63/2126, E63/2127) covering an area of 219 blocks for a total of 630 square kilometers of the Eucla Basin in the Albany Fraser Range Province of southern Western Australia (Project).

The Project cover areas underlain by meta-granites of Archaean to Proterozoic age. These granitic rocks are situated within the Albany– Fraser Orogen on the south and southeastern margins of the Yilgarn Craton.

Outcrop of the meta-granites within the Project is rare with majority of the tenements overlain by Cainozoic sediments, aeolian sands and salt lakes. Whilst there are no known occurrences of mineralisation in either area, limited prospecting or exploration has been historically conducted.

From a study of the historical open file reports available on WAMEX(A106697,A97441) the previous exploration which has been conducted has predominantly been for gold and to a lesser extent for uranium, lignite and base metals. The majority of previous exploration involved the completion of various geophysical surveys including aero magnetics, gravity and radiometric. In some cases, this work was followed up by limited soil geochemistry, but no anomalies of significance were defined. Most significantly several of the early explorers completed shallow drill evaluation of various targets.

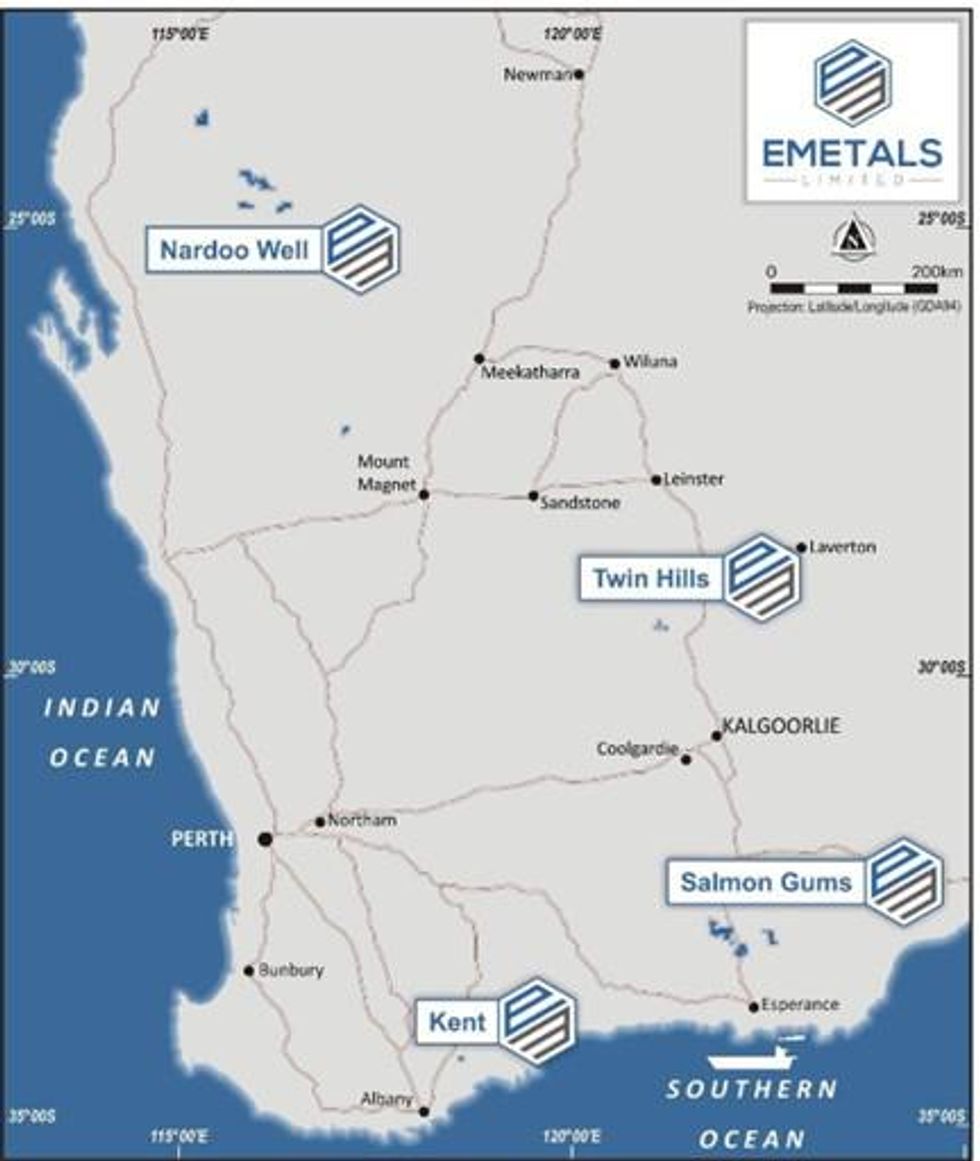

Figure 1 – EMT Projects

In the period 2006 to 2008 Toro Energy Ltd (Toro) completed 10 aircore drillholes within E63/2127 and assayed the resulting spoil for iron, copper, gold, nickel, lead, zinc, and uranium in a search for uranium mineralisation. On E63/2049 Toro completed six aircore drillholes to a maximum depth of 53 meters but once again no drill intersections of significance were reported for the targeted minerals. On adjoining lease E63/2066 two drillholes reached a maximum depth of 44 meters but no significant results were reported. In 2009 to 2013 Anglogold Ashanti Australia Ltd (Anglo) completed 17 aircore drillholes to a maximum depth of 67 meters in a search for gold mineralisation. No significant results were returned, and the tenements were abandoned. Prior to the aircore drilling Anglogold Ashanti had completed fence lines of auger in an effort to detect gold in calcareous soils. Minor gold anomalism was detected but was deemed insignificant. The holes were also analysed for REE mineralisation and produced a maximum result of 1,108 ppm REE oxides (REO) plus Yttrium.

Click here for the full ASX Release

This article includes content from eMetals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMT:AU

The Conversation (0)

25 February 2021

eMetals Limited

Building a strong pipeline of mineral projects to drive shareholder value.

Building a strong pipeline of mineral projects to drive shareholder value. Keep Reading...

27 February

Top 5 Canadian Mining Stocks This Week: Adex Mining Shines with 171 Percent Gain

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian news impacting the resource sector.Statistics Canada released its December data for gross domestic product (GDP) by industry on Friday... Keep Reading...

02 February

Project Update

Tungsten West (LON:TUN), the mining company focused on restarting production at the Hemerdon tungsten and tin mine ("Hemerdon" or the "Project") in Devon, UK, is pleased to provide an update on its Project Financing initiatives and operational activities, against the backdrop of favourable... Keep Reading...

29 January

Top Australian Mining Stocks This Week: Apollo Minerals Triples on Tungsten Exploration Permit Decision

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Companies with news focused on tungsten, gold, bauxite and lithium took the top five spots this week.Critical minerals continue to be a... Keep Reading...

28 January

Redmoor - Continuation of High-Grade Tungsten and Identification of High-Grade Tin Zones

Latest drill results confirm strong WO3, Sn and Cu mineralisation; mineralised continuity within the Redmoor SVS high-grade zones; & validity of historical results

Strategic Minerals plc (AIM: SML; USOTC: SMCDF), an international mineral exploration and production company, is delighted to announce that its wholly owned subsidiary, Cornwall Resources Limited ("CRL"), has received assay results from drillhole CRD036 - the first from Pad 2 within the Redmoor... Keep Reading...

22 January

Viking Acquires Extensive Historical Data for Linka Project

Viking Mines Ltd (ASX: VKA) (“Viking” or “the Company”) is pleased to announce that it has completed a strategic acquisition of a comprehensive historical technical dataset covering the Linka Project in Nevada, USA. The dataset was purchased for US$35,000 (~A$50,000) and contains extensive... Keep Reading...

21 January

Tivan Secures Molyhil Project to Expand Australian Critical Minerals Portfolio

Tivan (ASX:TVN,OTCPL:TNGZF) said on Monday (January 19) has completed its acquisition of the Molyhil tungsten-molybdenum project in the Northern Territory, further growing its Australian critical minerals portfolio.Amounting to AU$8.75 million, the acquisition will provide Tivan 100 percent... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00