- WORLD EDITIONAustraliaNorth AmericaWorld

July 27, 2023

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide its Appendix 5B cash flow statement for the quarter ended 30 June 2023, along with the following operational summary.

Investment Highlights

HORDEN LAKE COPPER-NICKEL-PGM

- Drilling permits extended to 31 March 2024 to allow for delayed 8,000m drilling campaign. Delays due to extensive and ongoing forest fires in Canada over the summer period.

- Post quarter end, appointment of Eddy Canova to position of Executive, Operations Officer to manage the exploration programmes at Horden Lake and Belleterre- Angliers Greenstone Belt (BAGB).

SAN FINX TIN-TUNGSTEN

- Sale of Tungsten San Finx S.L., owner of the San Finx mine, to Metáis Estratéxicos, S.L. with economic effective date of 30 June 2023.

SANTA COMBA TIN-TUNGSTEN

- Appeal commenced to overturn the decision by the Department of Mines in Galicia to cancel the mining concessions at Santa Comba.

CORPORATE

- Completion of a A$4 million placement comprising:

- 61.4m flow through share issued at a 58.5% premium to Pivotal’s last closing price of A$0.04 on 10 May 2023 to fund the drilling and metallurgical test programme at Horden Lake and the survey work at BAGB, and

- 5.4m private placement shares issued at a 18.8% discount to the last closing price on 10 May 2023 to fund working capital.

- For every two placement shares one free attaching option was granted, expiring two years from the date of grant, with an exercise price of A$0.065.

- Pivotal’s cash position at 30 June 2023 was $5.535m

Managing Director Steven Turner said: “The Company has continued the strategic shift to Canada through the sale of San Finx, leaving all shareholder value in the exciting Quebec portfolio of battery metals. In parallel, Pivotal has planned an active programme of drilling and exploration work underpinned by the successful flow through share placement and the recent appointment of Eddy Canova as the Company’s head of operations in Quebec.”

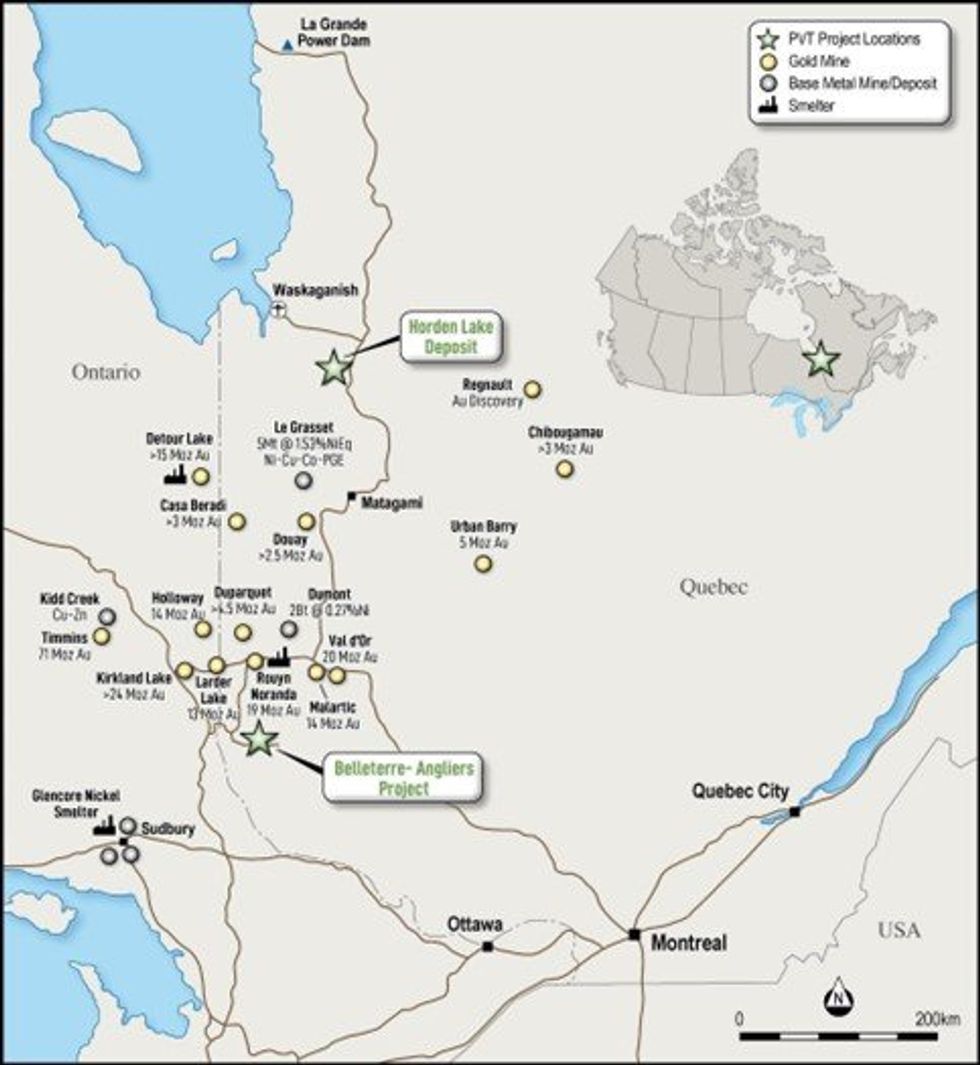

Canadian Portfolio

Horden Lake is an advanced exploration project containing a JORC compliant pit constrained resource of 27.8Mt at a 1.49% CuEq1. The resource estimate does not include all of the Au, nor any of the significant Co and Ag known to exist within the deposit. The planned drilling programme for 2023/24 will look to better define these various additional metals for inclusion in an updated MRE and provide a bulk sample for detailed metallurgical test work in advance of a maiden PFS for the project.

Belleterre-Angliers Greenstone Belt (‘BAGB’) is a high impact exploration project that has exceptional near surface grades of nickel, copper and PGMs, potentially indicative of a large deeper system. A review of EM anomalies below 300m from recent VTEM surveys has identified 20 high priority targets never previously explored. These targets will be the focus of a survey programme scheduled for later in 2023.

The extensive Quebec forest fires have resulted in the Company rescheduling the order of its activities with an immediate focus on BAGB, noting that a winter drill programme at Horden Lake would avail the Company of significant costs savings given the use of a temporary land access track as opposed to the use of helicopters to complete the planned 8,000m programme.

Belleterre-Angliers Greenstone Belt (BAGB)

Geophysical and drill programme planning has continued for the exciting, high-grade nickel-copper-PGM exploration project at BAGB, with a continued focus on the 20 deeper untested VTEM targets indicative of a possible that have yet to drilled. It is intended to advance this project later in 2023 using MT surveys that can penetrate below 1,000m.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00