Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint" or the "Company") is pleased to announce that mobilization is underway for the upcoming summer uranium drill program at its Dorado Project, part of the Purepoint-IsoEnergy Joint Venture in Saskatchewan's eastern Athabasca Basin. Drilling is scheduled to commence on or about May 26, 2025.

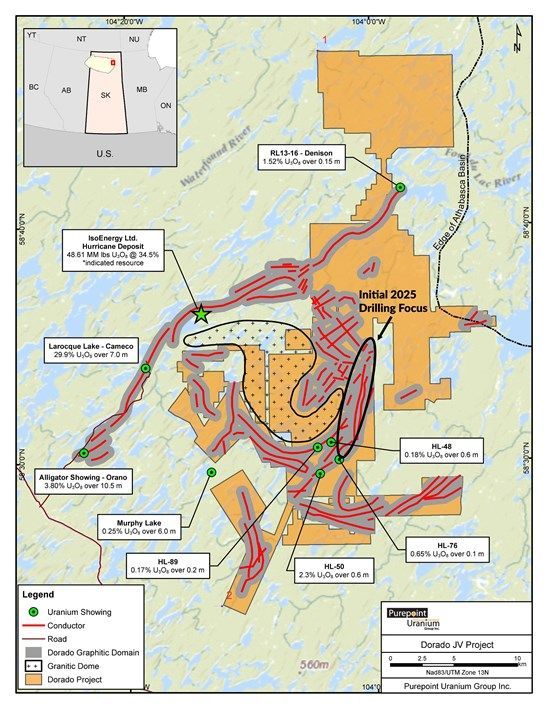

The Dorado Project covers over 150 kilometres of discreet electromagnetic (EM) conductors that lie within the Dorado Graphitic Domain-a structurally controlled package of conductive, graphite-rich rocks (Figure 1). The Dorado Domain encompasses the northeastern extension of the Larocque Trend, a highly prospective structural corridor that hosts multiple high-grade uranium deposits and occurrences, including IsoEnergy's Hurricane Deposit-recognized as the world's highest-grade published indicated uranium resource, with 48.6 million pounds at 34.5% U₃O₈ (https://www.isoenergy.ca/featured-project/). At Dorado, these graphitic rocks bifurcate and wrap around a granitic dome that is considered an important component in the original plumbing system that once directed the flow of uranium-bearing hydrothermal fluids.

The 2025 drill campaign will include approximately 5,400 metres across 18 holes, targeting high-priority EM conductors for uranium mineralization within the underexplored Dorado Graphitic Domain.

Highlights

- Mobilization underway for Dorado Project drill campaign

- Drilling scheduled to begin May 26, 2025

- 5,400 metres of drilling planned across 18 holes

- Targeting discreet ground/airborne EM conductors for uranium mineralization within the Dorado Graphitic Domain

- Same conductive package that hosts IsoEnergy's Hurricane Deposit

- Results from the recently completed Smart Lake JV drill program are under joint review and will be released shortly

"IsoEnergy's nearby success continues to reaffirm the world-class uranium potential of the Dorado Graphitic Domain and this region of the Athabasca Basin," said Chris Frostad, President & CEO of Purepoint. "The Hurricane Deposit is hosted within the same conductive package of graphitic rocks that arc around a granitic dome on our Dorado Project. We are excited to launch our initial JV drill program with a focus on high-priority target areas and advance what we believe could be the next major discovery within this fertile graphitic domain."

Initial 2025 Drilling Focus

The summer drill campaign will begin in the southern portion of the project area along the Q2 conductor, where the first two drill holes will test a zone northeast of historic drill holes HL-50 and HL-76, both of which intersected uranium mineralization associated with a strong graphitic conductor.

- HL-50 intersected weak mineralization within fractured upper basement rocks returning 2.3% U3O8 over 0.6 metres within a zone of strong hematization and anomalous nickel and vanadium, up to 222 ppm and 400 ppm (total digestion), respectively (Alonso et al., 1991).

- Approximately 1.6 kilometres along strike to the northeast of HL-50, drill hole HL-76 encountered a mineralized, flat-lying, graphitic breccia at 267 metres that returned 0.65% U3O8 over 0.1 metres (Munholland and Bingham, 1999).

Figure 1: Dorado Graphitic Domain - 2025 Initial Drill Target Area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/252649_c481e9cfb4309bcf_002full.jpg

About the Dorado Project

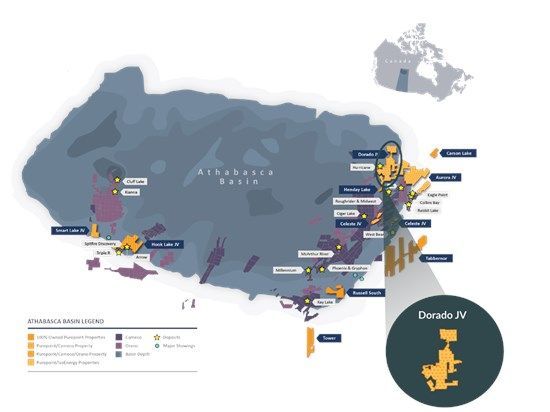

Dorado is the flagship project of the Purepoint-IsoEnergy 50/50 Joint Venture, a partnership encompassing more than 98,000 hectares of prime uranium exploration ground. The Dorado Project now includes the former Turnor Lake, Geiger, Edge, and Full Moon properties, all underlain by graphite-bearing lithologies and fault structures favorable for uranium deposition.

Recent drilling by IsoEnergy east of the Hurricane Deposit has intersected strongly elevated radioactivity in multiple holes. The anomalous radioactivity confirms the continuity of fertile graphitic rock package and further highlights the opportunity for additional high-grade discoveries across the region.

The shallow unconformity depths across the Dorado property-typically between 30 and 130 metres-allow for highly efficient drilling and rapid follow-up on results.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/252649_c481e9cfb4309bcf_003full.jpg

Smart Lake Program Results Pending

In parallel with preparations at Dorado, Purepoint is finalizing the results of its recently completed winter drill program at the Smart Lake Joint Venture with Cameco. The program conducted first-pass drilling of the newly outlined Groomes Lake conductive corridor with 3 completed holes. Initial results and interpretations have been reviewed with Cameco, and the final results will be released shortly.

About Purepoint

Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) is a focused explorer with a dynamic portfolio of advanced projects within the renowned Athabasca Basin in Canada. The most prospective projects are actively operated on behalf of partnerships with industry leaders including Cameco Corporation, Orano Canada Inc. and IsoEnergy Ltd.

Additionally, the Company holds a promising VMS project currently optioned to and strategically positioned adjacent to and on trend with Foran Mining Corporation's McIlvenna Bay project. Through a robust and proactive exploration strategy, Purepoint is solidifying its position as a leading explorer in one of the globe's most significant uranium districts.

Scott Frostad BSc, MASc, P.Geo., Purepoint's Vice President, Exploration, is the Qualified Person responsible for technical content of this release.

For more information, please contact:

Chris Frostad, President & CEO

Phone: (416) 603-8368

Email: cfrostad@purepoint.ca

For additional information please visit our new website at https://purepoint.ca, our Twitter feed: @PurepointU3O8 or our LinkedIn page @Purepoint-Uranium.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this Press release.

Disclosure regarding forward-looking statements

This press release contains projections and forward-looking information that involve various risks and uncertainties regarding future events. Such forward-looking information can include without limitation statements based on current expectations involving a number of risks and uncertainties and are not guarantees of the future performance of the Company. These risks and uncertainties could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information. Actual results and future events could differ materially from those anticipated in such information. These and all subsequent written and oral forward-looking information are based on estimates and opinions of management on the dates they are made and expressly qualified in their entirety by this notice.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/252649