Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) ("Purepoint" or the "Company") today reported the completion of its initial drill program at the Smart Lake Joint Venture in Saskatchewan's Athabasca Basin. The first-pass program, which included 1,264 metres of diamond drilling across three holes, was conducted to test newly identified electromagnetic (EM) conductors along the Groomes Lake Conductive Corridor. The drill program provided a critical step in defining high-priority uranium exploration targets associated with the Groomes Lake conductive features.

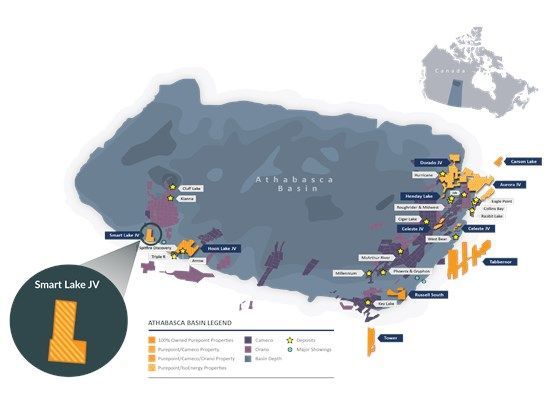

The Smart Lake Project is a joint venture between Cameco Corporation (73%) and Purepoint (27%) and is located approximately 60 km south of the former Cluff Lake uranium mine and 18 km west-northwest of Purepoint's Hook Lake JV project.

Highlights

- 1,264 metres of drilling completed in three holes across all three Groomes Lake EM conductors

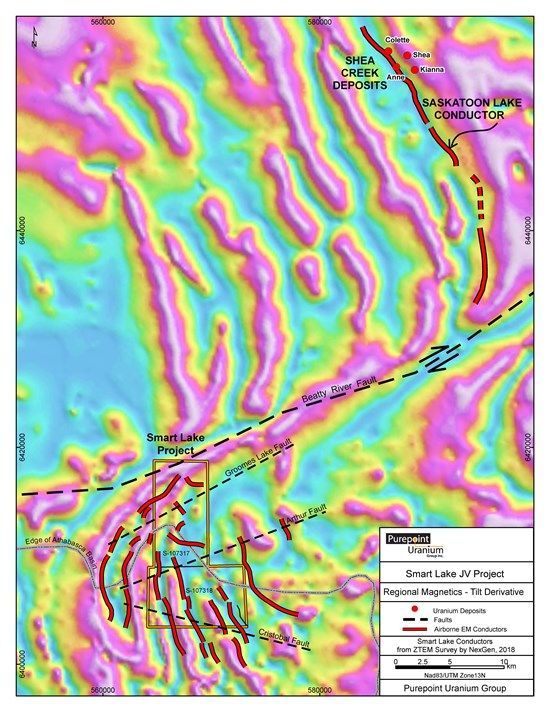

- Geological evidence suggests the Groomes Lake Corridor is a component of the regional-scale Beatty River Fault (Figure 2)

- All three drill holes intersected graphitic shear zones and complex structural features

- The central EM conductor hosts the strongest structural deformation, possibly representing a critical fluid pathway for uranium mobilization and precipitation

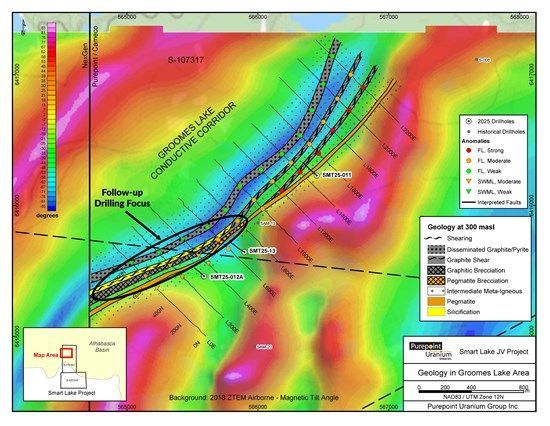

- The top priority Groomes Lake exploration target is the Central EM conductor where it intersects the unconformity

"The drill program was designed to give us a first look into a geologically complex and previously untested portion of the Smart Lake JV project," said Scott Frostad, VP Exploration at Purepoint. "With last year's ground EM survey results and our current drilling, we've made meaningful progress in understanding the project's geologic setting as we continue to advance exploration."

Program Summary and Outcomes

The 2025 Smart Lake JV uranium exploration program marked the first pass drill test of the Groomes Lake Corridor. Drill hole SMT25-13 intersected multiple graphitic shear zones and structural complexities, particularly along the central EM conductor, which appears to be the primary structural feature. Drill and geophysical results indicate the northern portion of the Smart Lake project contains a NE-trending structural zone that is different from the NNW-trending structures that were previously drill-tested to the south.

Following completion of the Groomes Lake drill program, the joint venture's technical and management committees reviewed these initial results. Although uranium mineralization was not intersected in the three 2025 holes, the evidence of strong shear zone development along the Central EM conductor suggests it may have influenced the flow of uranium-bearing hydrothermal fluids. Testing of the Groomes Lake Central EM conductor at the unconformity is now considered a top priority exploration target at Smart Lake.

Figure 1: Graphitic shear zone in drill hole SMT25-13 with lower interval of silicified and brecciated rock

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/252952_f17b1e8a943cfba8_002full.jpg

Next Steps

The joint venture is currently reviewing potential follow-up strategies, including additional ground fixed-loop EM surveying within the central portion of the project covering the NNW-trending airborne EM conductors. Potential follow-up drilling would include the Groomes Lake unconformity target, the new geophysical grid and select historic ground EM results.

Broader Exploration Outlook

Smart Lake is one of several high-priority projects Purepoint is advancing in the Athabasca Basin. The Company's 50/50 Joint Venture with IsoEnergy is currently preparing for a 5,400-metre drill program at the Dorado Project, located along the Larocque Trend and adjacent to the high-grade Hurricane Deposit. Through strategic partnerships and a disciplined exploration approach, Purepoint continues to position itself for discovery in one of the world's most prolific uranium districts.

Figure 2: Smart Lake JV Project - Regional Magnetics (Tilt Derivative) Showing Interpreted Geological Relationship with Beatty River Fault and Shea Creek Uranium Deposits

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/252952_f17b1e8a943cfba8_003full.jpg

Figure 3: Groomes Lake Conductive Corridor - Geologic Interpretation at Unconformity (300 m asl)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/252952_f17b1e8a943cfba8_004full.jpg

Figure 4: Smart Lake Project Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/252952_f17b1e8a943cfba8_005full.jpg

About Smart Lake

The Smart Lake Project is located approximately 60 km south of the former Cluff Lake mine site and 18 km west-northwest of the Hook Lake JV Project (Figure 2). The property spans 9,860 hectares within the Athabasca Basin, an area renowned for hosting the world's highest-grade uranium deposits.

Initial exploration at Smart Lake established the presence of graphitic shear zones, hydrothermal alteration, and anomalous radioactivity. The favourable geological indicators, combined with its strategic location and extensive geophysical data, position Smart Lake for uranium exploration success.

About Purepoint

Purepoint Uranium Group Inc. (TSXV: PTU) (OTCQB: PTUUF) is a focused explorer with a dynamic portfolio of advanced projects within the renowned Athabasca Basin in Canada. The most prospective projects are actively operated on behalf of partnerships with industry leaders including Cameco Corporation, Orano Canada Inc. and IsoEnergy Ltd.

Additionally, the Company holds a promising volcanogenic massive sulphide (VMS) project currently optioned to Foran Mining Corporation that is geologically on trend with its McIlvenna Bay project. Through a robust and proactive exploration strategy, Purepoint is solidifying its position as a leading explorer in one of the globe's most significant uranium districts.

Scott Frostad BSc, MASc, P.Geo., Purepoint's Vice President, Exploration, is the Qualified Person responsible for technical content of this release.

For more information, please contact:

Chris Frostad, President & CEO

Phone: (416) 603-8368

Email: cfrostad@purepoint.ca

For additional information please visit our new website at https://purepoint.ca, our Twitter feed: @PurepointU3O8 or our LinkedIn page @Purepoint-Uranium.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this Press release.

Disclosure regarding forward-looking statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including the completion and anticipated results of the Company's planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the Company's planned exploration activities will be completed in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate. Important factors that could cause actual results to differ materially from the Company's plans or expectations include risks relating to the actual results of current exploration activities, fluctuating uranium prices, possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks detailed from time to time in the filings made by the Company with securities regulators.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise except as otherwise required by applicable securities legislation.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/252952