Purepoint Uranium Group Inc. (TSXV: PTU,OTC:PTUUF) (OTCQB: PTUUF) ("Purepoint" or the "Company") today announced the launch of its inaugural drill program at the 100%-owned Tabbernor Project, located on the southeastern edge of Saskatchewan's Athabasca Basin. The 1,500-metre program will test five drill targets distributed across two of the three high-priority areas defined within a 60-kilometre-long corridor of graphitic conductors. These targets were identified following extensive geophysical and structural interpretation work (see Purepoint News Release, February 24, 2025).

"Tabbernor hosts a highly underexplored structural corridor in the Basin district with scale, structure, and proximity to known mineralization," said Chris Frostad, President and CEO of Purepoint. "We've spent the past two years systematically preparing to test this largely untouched corridor, and this program marks our first step in defining its potential. Our goal is to prioritize areas for more focused drilling in the years ahead."

Highlights

District-scale structural/electromagnetic corridor: Approximately 100 km of electromagnetic (EM)conductors, known to be locally graphitic, have been mapped within the project through extensive airborne and ground geophysics.

Five targets to be tested across a 1,500-metre program—spanning multiple structural domains.

First-pass drilling conducted on the project, now supported by airborne VTEM, MobileMT, gravity, and soil geochemical anomalies.

Strong uranium pathfinders identified by Purepoint in soil sampling along the same structural corridors as nearby mineralized intercepts.

The Tabbernor Project spans more than 50,000 hectares and is positioned along the northern extension of the Tabbernor Fault System—an extensive crustal break known to control gold mineralization to the south and uranium occurrences in the Basin. Despite the project's structural advantages and proximity to uranium-bearing zones, the area has never been properly drill tested for uranium.

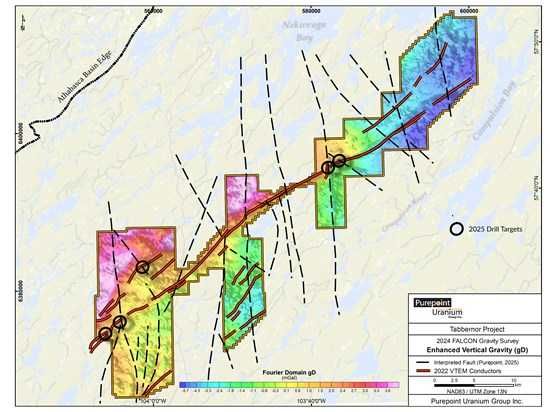

Over the past four years, Purepoint has advanced the project through comprehensive exploration programs, including airborne VTEM, MobileMT and gravity surveys, and structural mapping. These efforts identified an extensive stretch of graphitic conductors with coincident gravity and magnetic lows—key markers for alteration halos that can be associated with uranium deposits.

Figure 1: Enhanced Vertical Gravity Results from 2024 Airborne FALCON Gravity Survey over the Tabbernor Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/268407_b310785a04019b94_002full.jpg

Figure 2: Location of the Tabbernor Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3218/268407_b310785a04019b94_003full.jpg

Tabbernor Project

The 100%-owned Tabbernor Project is strategically positioned along three major trends of the Tabbernor Fault System, a deep seated, 1,500-kilometre crustal shear system that runs north through the Athabasca Basin. The system not only hosts over 80 historic mines and gold occurrences but also crosscuts the Basin's mine trend aligning itself with 8 of the Basin's largest uranium discoveries.

The Tabbernor project is roughly 40 kilometres south of Cameco's Eagle Point deposit and is comprised of 23 contiguous mineral claims covering an area of 51,670 hectares. The original three north-south claim groups that covered Tabbernor structures have now been expanded to include a strong east-northeast trending corridor of conductive rocks further enhancing the project's exploration potential.

Purepoint's current focus is the 60-kilometre graphitic corridor that cuts through the project, specifically, areas with gravity low responses and showing evidence of structural complexity. Notably, recent drilling on an adjacent property intersected significant mineralization associated with the central Tabbernor graphitic structure (see CanAlaska Uranium Ltd. press release, September 27, 2023).

Tabbernor Fault System

The Tabbernor Fault System (TFS) is a wide, >1,500 kilometre geophysical, topographic, and geological structural zone that trends approximately northward along Saskatchewan's eastern boundary. Purepoint's research has shown that although none of the province's currently known uranium deposits have been linked to the north-south trending TFS, localized shear zones hosting uranium mineralization may have an associated north-south structural component.

Reactivation of the TFS may have coincided with the age of formation of large uranium deposits in the Athabasca Basin (Davies, 1998). Davies also concluded that structural similarities between the TFS and mineralized areas suggest that the fault system may have had a control on the location of mineralization. More specifically, he considered that several deposits, such as the Sue, Midwest, Dawn Lake and Rabbit Lake all demonstrate a north-south control and strong Tabbernor-like characteristics.

Reference:

Davies, J.R. (1998): The origin, structural style, and reactivation history of the Tabbernor fault zone, Saskatchewan, Canada; Master's thesis, McGill University, Montreal, Quebec, 105p.

About Purepoint

Purepoint Uranium Group Inc. (TSXV: PTU,OTC:PTUUF) (OTCQB: PTUUF) is a focused explorer with a dynamic portfolio of advanced projects within the renowned Athabasca Basin in Canada. Highly prospective uranium projects are actively operated on behalf of partnerships with industry leaders including Cameco Corporation, Orano Canada Inc. and IsoEnergy Ltd.

Additionally, the Company holds a promising VMS project currently optioned to and strategically positioned adjacent to and on trend with Foran Corporation's McIlvenna Bay project. Through a robust and proactive exploration strategy, Purepoint is solidifying its position as a leading explorer in one of the globe's most significant uranium districts.

Scott Frostad BSc, MASc, PGeo, Purepoint's Vice President, Exploration, is the Qualified Person responsible for technical content of this release.

For more information, please contact:

Chris Frostad, President & CEO

Phone: (416) 603-8368

Email: cfrostad@purepoint.ca

For additional information please visit our new website at https://purepoint.ca, our Twitter feed: @PurepointU3O8 or our LinkedIn page @Purepoint-Uranium.

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this Press release.

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". This forward-looking information may relate to additional planned exploration activities, including the timing thereof and the anticipated results thereof; and any other activities, events or developments that the companies expect or anticipate will or may occur in the future.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, that planned exploration activities are completed as anticipated; the anticipated costs of planned exploration activities, the price of uranium; that general business and economic conditions will not change in a materially adverse manner; that financing will be available if and when needed and on reasonable terms; and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Joint Venture's planned activities will be available on reasonable terms and in a timely manner. Although each of IsoEnergy and Purepoint have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current views of IsoEnergy and Purepoint with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by IsoEnergy and Purepoint, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include but are not limited to the following: the inability of the Joint Venture to complete the exploration activities as currently contemplated; uncertainty of additional financing; no known mineral resources or reserves; aboriginal title and consultation issues; reliance on key management and other personnel; actual results of technical work programs and technical and economic assessments being different than anticipated; regulatory determinations and delays; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions. Other factors which could materially affect such forward-looking information are described in the risk factors in each of IsoEnergy's and Purepoint's most recent annual management's discussion and analyses or annual information forms and IsoEnergy's and Purepoint's other filings with the Canadian securities regulators which are available, respectively, on each company's profile on SEDAR+ at www.sedarplus.ca. IsoEnergy and Purepoint do not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/268407