Prismo Metals Inc. (the "Company") (CSE:PRIZ)(OTCQB:PMOMF)(FSE:7KU) is pleased to announce that it has updated the mineralization model for the Hot Breccia project in Southern Arizona based on important historical information recently acquired from a third party. The information includes historic Bear Creek Mining Company (then a subsidiary of Kennecott Copper Co. (now part of Rio Tinto, ASX: RIO) exploration data, gathered between the completion of a masters thesis by Larry Barrett (1972) (1) through the completion of their first drill hole on our Hot Breccia property between 1972 and mid-1974. The recently acquired information includes a complete log and assays for hole OC-1 and a geological interpretation after holes OC-1 to OC-3 were completed(2

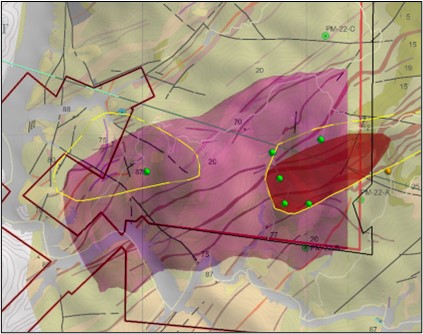

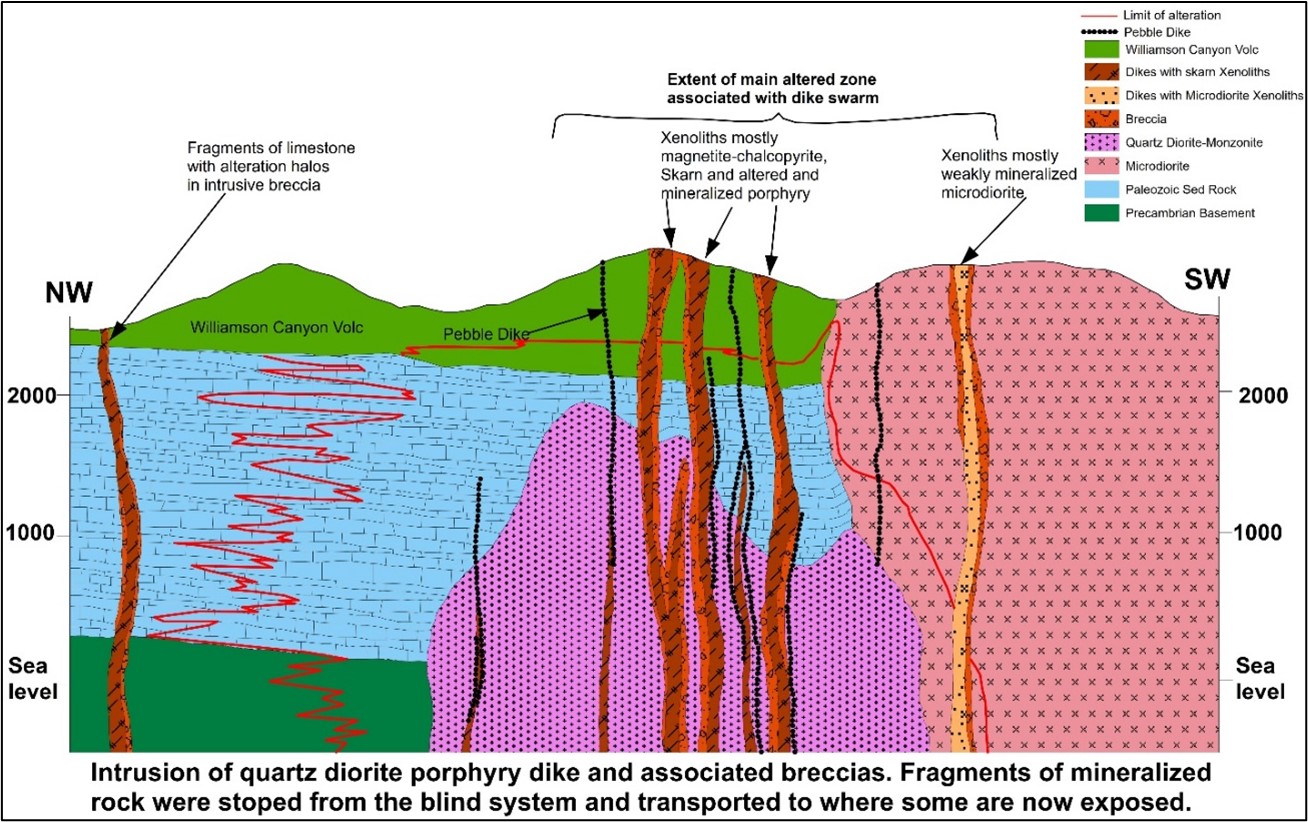

An important portion of the acquired data shows the distribution of post mineral quartz diorite dikes containing fragments of copper bearing mineralization brought up from depth (Fig 2), as well as the location of shallow and deep IP anomalies compiled from several different sources. The shallow IP anomaly follows the orientation of the swarm of quartz diorite dikes, probably reflecting pyrite bearing alteration associated with it. The deeper IP anomaly covers much of the central portion of the claim block and may be related to alteration around a mineralized intrusion or a related sulfide body. Bear Creek's interpretation of the IP data indicates that mineralization is present over a larger area than they had previously recognized. Notably, their deep IP anomaly, as well as the distribution of copper bearing xenoliths in quartz diorite dikes, correspond closely to the area of the conductive anomaly identified in Prismo's 2023 ZTEM geophysical survey (Fig. 2) (see News Release of February 9, 2024).

Also, included in the Bear Creek data is the complete description and assay data for hole OC-1, drilled to a depth of 733 meters in early 1974 (Fig 2), as well as an interpretation of the results by Barrett (1974)(2) (Fig 3). Hole OC-1 was collared in the area of one of the property's namesake breccias that hosts copper skarn fragments sourced from deep below the surface. A Prismo sample of one of these fragments assayed 5.7% copper, as reported in the Company's News Release dated March 26, 2024.

Prismo Metals previously possessed only a portion of the OC-1 drill log to a depth of 295 meters, all in volcanic rocks, with only summary assay data that indicated a mineralized interval deeper in the hole. According to the new data, hole OC-1 cut 403 meters of Cretaceous volcanic and volcano-sedimentary rocks as expected from the geology in the area, followed by an interval of 330 meters of quartz diorite porphyry including a pyritic and copper-bearing stock not exposed at the surface. Bear Creek suggested that this quartz porphyry includes an intrusive phase interpreted to be associated with mineralization, cut by later dikes that include fragments of previously formed skarn. The mineralized porphyry includes a 23.5-meter pendant of skarn mineralization averaging 0.54% Cu including 1.8 meters of 1.81% Cu. The hole was strongly copper-anomalous to the bottom and ended in mineralization.

Exploration Geologist Dr Linus Keating, Manager of Walnut Mines LLC the optionor of Hot Breccia, reviewed the Bear Creek core in the 1990's before it was subsequently disposed of. He stated "I viewed the collection of core and recall seeing, beneath the overlying volcanics, long intervals (500 to 700 plus feet) of retrograde skarn mineralization. Alteration consisted of garnet, amphibole, quartz and calcite veinlets, and widespread chlorite and pyrite, together with scattered chalcopyrite and sphalerite. I remember being impressed with the intensity and extent of the alteration and mineralization and was surprised that it repeated in several holes."

Steve Robertson, President, commented "We take a very thorough, scientific approach to exploration, using all information that we can gather to inform our modelling. This includes data produced and interpreted by previous generations, often by very talented geologists. We view the acquisition of the 1970's data as equally important as fresh data and interpretation. This will have a strong influence on our exploration program in 2024."

Robertson added "With this new data incorporated, our Computing & Artificial Intelligence partners at ExploreTech in California (see Prismo's news release dated March 4th, 2024) have completed the preparation phase for the probabilistic ZTEM inversion and drilling optimization. The computation phase has commenced, and it is expected that this inversion and target processing will take approximately 7 to 10 days on ExploreTech's high-performance computing system."

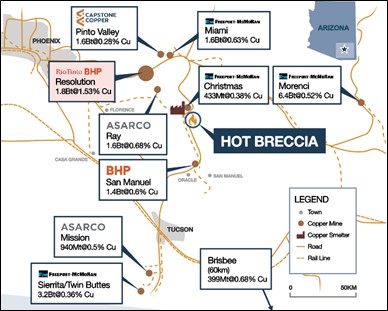

Figure 1. Location ofthe Hot Breccia Project in the Arizona Copper Belt.

Figure 2. Plan view of Hot Breccia showing surface geology by Barrett (1972), the areas where

Cu bearing skarn is present in quartz diorite dikes, outlined in yellow, and an area of >0.5% Cu

in skarn fragments, in red, from a newly acquired report by Barrett and Anderson (1972).

The surface projection of the conductive body is also shown in magenta.

Figure 3. Schematic cross section at Hot Breccia showing interpretation by Barrett (1974).

The Company has established a budget of $3.0 million to complete the proposed five drill hole, 5,000 metre program. Each drill hole is intended to drill through the entire prospective Paleozoic carbonate stratigraphy. Prismo anticipates 1,000 to 1,200 metres per drill hole, although the exploration team will take advantage of the geological information provided by each drill hole to determine if any holes require extended drilling.

Note:

Barrett, Larry Frank (1972): Igneous Intrusions and Associated Mineralization in the Saddle Mountain Mining District Pinal County, Arizona. Unpublished Masters Thesis, University of Utah.

Barrett, Larry Frank (1974): Diamond drill hole OC-1, O'Carroll Canyon, Pinal County, Arizona, unpublished internal report, Bear Creek Mining.

About Hot Breccia

The Hot Breccia property consists of 1,420 hectares in 227 contiguous mining claims located in the world class Arizona Copper Belt between several very well understood world-class copper mines including Morenci, Ray and Resolution. (Figure 1) Hot Breccia shows many features in common with these neighboring systems, most prominently a swarm of porphyry dikes and series of breccia pipes containing numerous fragments of well copper-mineralized rocks mixed with fragments of volcanic and sedimentary derived from considerable depth. Prismo ran a ZTEM survey last year that identified a very large conductive anomaly directly beneath the breccia outcrops.

Sampling at the project has shown the presence of copper mineralization associated with polymictic breccia that has brought fragments of sedimentary rocks and mineralization to the surface from depths believed to be 400-1,000 meters below the surface, so drilling of deep holes, possibly including a twin of an historic hole, is planned.

Assay results from historic drill holes are unverified as the core has been destroyed, but information has been gathered from memos, photos and drill logs that contain some, but not all, of the assay results and descriptions.

The newly acquired information is historical in nature and has not been verified, is not compliant with NI 43-101 standards and should not be relied upon; the Company is using the information only as a guide to aid in exploration.

QA/QC

Dr. Craig Gibson, PhD., CPG., a Qualified Person as defined by NI-43-01 regulations and Chief Exploration Officer and a director of the Company, has reviewed and approved the technical disclosures in this news release.

About Prismo Metals Inc.

Prismo (CSE: PRIZ) is mining exploration company focused on two precious metal projects in Mexico (Palos Verdes and Los Pavitos) and a copper project in Arizona (Hot Breccia).

Please follow @PrismoMetals on Twitter, Facebook, LinkedIn, Instagram, and YouTube

Prismo Metals Inc.

1100 - 1111 Melville St., Vancouver, British Columbia V6E 3V6

Contact:

Alain Lambert, Chief Executive Officer alambert@cpvcgroup.ca

Steve Robertson, President steve.robertson@prismometals.com

Jason Frame, Manager of Communications jason.frame@prismometals.com

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the timing, costs and results of drilling at Hot Breccia.

These forward‐looking statements involve numerous risks and uncertainties, and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things: delays in obtaining or failure to obtain appropriate funding to finance the exploration program at Hot Breccia.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that: the ability to raise capital to fund the drilling campaign at Hot Breccia and the timing of such drilling campaign.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

SOURCE: Prismo Metals Inc.

View the original press release on accesswire.com