Fabled Silver Gold Corp. ("Fabled" or the "Company") (TSXV:FCO); (OTCQB:FBSGF), and (FSE:7NQ) reports that it has completed the planning for a Phase 2 definition diamond drill program on the Santa Maria Property in Parral, Mexico. An accompanying Phase 2 exploration drill program is still in the planning stage

Peter Hawley, President, CEO reports; "The past year of exploration diamond drilling, underground diamond drilling, definition diamond drilling, and finally surface mapping and sampling, has been not only aggressive, but has resulted in over 6,900 samples collected and analyzed. This massive input of data has led our stream lined analytical team to new important understandings of the structural and mineralization controls on the western sector of the property where approximately 80% of our efforts over the past year were focused.

I would like to extend our thanks to our Project Manager Joaquin Rodriguez and senior geologist Edgar Rojas for their contribution to these important steps forward."

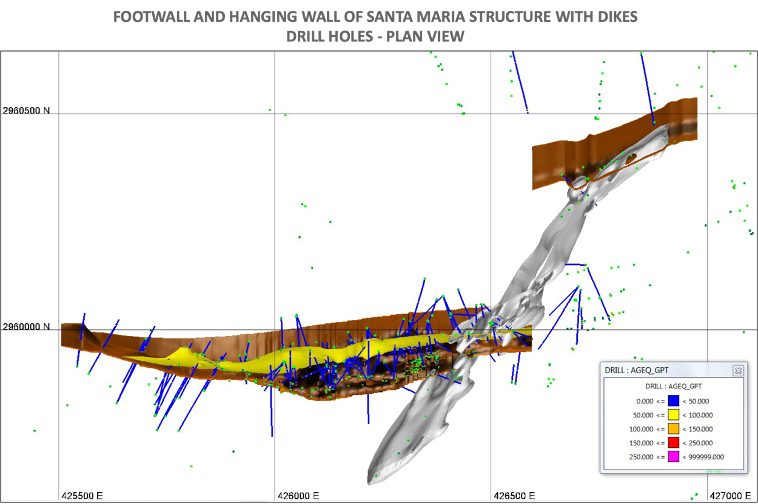

When the Company embarked on this project we were of the opinion this was a low sulfidation epithermal system deposit and contained two veins of interest. The Santa Maria and Santa Maria Dos veins. See Figure 1 below.

Figure 1 - Original Surface Map of Santa Maria Veins

Following the completion of the Phase 1 drilling we have now had time to "stop chasing the bit" and have compiled the total data collected. Through analysis of this many things have become clear.

We now know, as we suspected from the outset, that the Santa Maria vein and Santa Maria dos vein are actually the footwall and the hanging wall of a structure. What we did not know was there is a mineralized hydrothermal diorite dike following the structure, with hydrothermal breccias on both sides of the dike. See Figure 2 below

Figure 2 - Santa Maria Mineralized Dikes

These breccias were previously thought to be the Santa Maria vein. Furthermore, there are different generations of structural / mineralization controls. In addition, some of the 2021 exploration drilling intercepted some of the secondary mineralized dike structures and the Santa Maria off-set to the northeast which remains open in all directions.

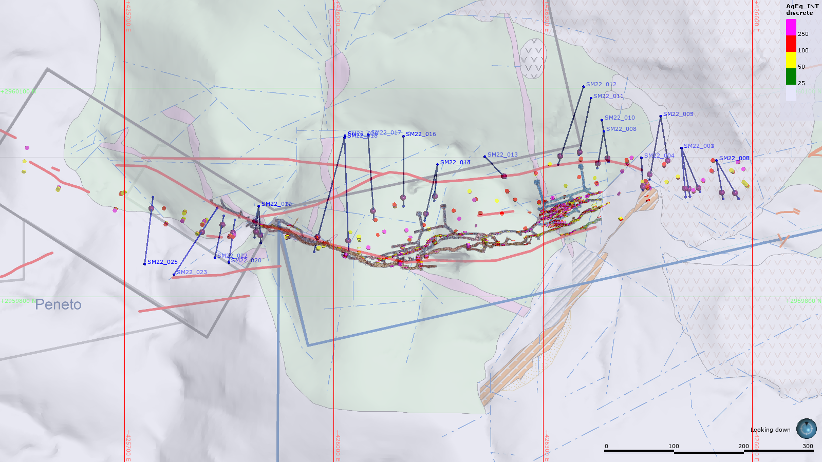

To that end the Company has designed a two-prong attack to aggressively advance the Santa Maria project. The first is a second phase 100% dedicated definition diamond drill program from surface for a minimum of 5,000 meters using one dedicated drill to perform this task.

This program has already been designed with surface drill collars and underground pierce points into the mineralized Santa Maria structure chosen. See Figure 3 below.

Figure 3 - Plan View - Phase 2 Definition Diamond Drill Hole Collars

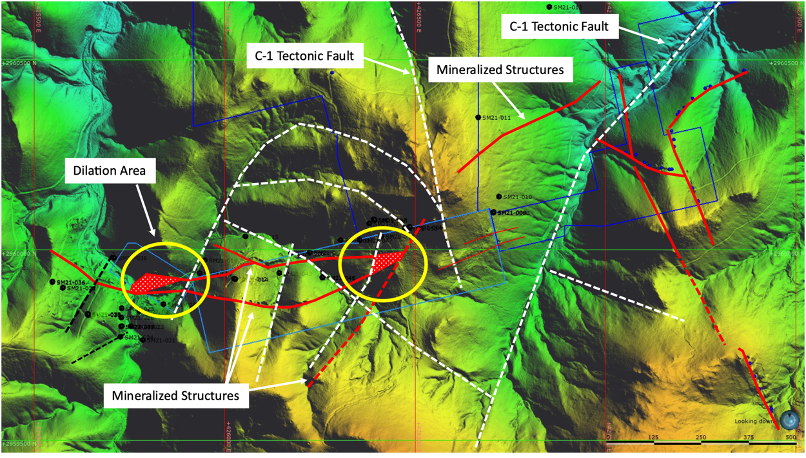

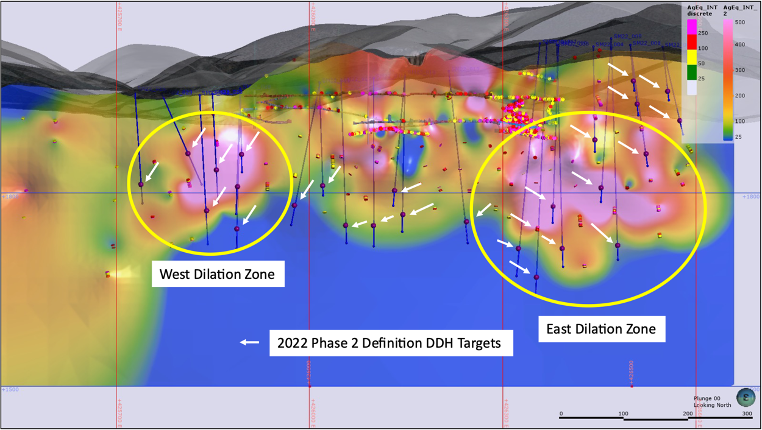

These definition drill targets were chosen based on the modelling of the first and secondary structures and mineralization, and their relationship to the 2021 high grade gold intercepts found to the west and the east. We now know that these two areas are dilation zones as a result of the intercept of 2 structures. The down plunge of these zones remain open in all directions. See Figure 4 below.

Figure 4 - Plan View - Structural Dilation Zones

An example of the western hydrothermal gold domain dilation zone is surface dill hole SM20-20 which intercepted 352.63 g/t Ag Eq with 5.61 g/t Au over 11.60 meters, including 8.40 meters grading 452.62 g/t Ag Eq with 7.24 g/t Au and hole SM20-22 which intercepted 14.40 meters grading 267.60 g/t Ag Eq with 4.95 g/t Au, including 385.07 g/t Ag Eq with 7.17 g/t Au over 9.50 meters.

The eastern dilation zone is defined in part by hole SM20-50 which reported 21.90 meters grading 349.21 g/t Ag Eq with 5.29 g/t Au, including 11.05 meters reporting 664.57 g/t Ag Eq with 10.35 g/t Au and 1.30 meters grading 4,821.98 g/t Ag containing 86.10 g/t Au. See Figure 5 below for drill hole targets and dilation zone locations.

Figure 5 - Definition Drill hole Targets and Dilation Zone Locations

Bigger Picture and Exploration.

Using the valuable 2021 drilling information, we will apply the new structural interpretation and the Santa Maria signature and controls to the rest of the property, paying particular attention to the mineralized structure. See Figure 4 above.

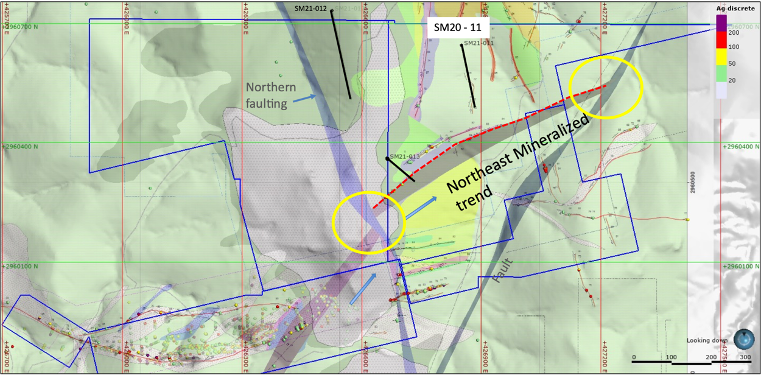

Detailed field mapping and structural analyses led by our senior team including our Project Manager has resulted in the below, property wide interpretation in preparation for Phase 2 exploration drill targets.

Surface sampling of the "Northeast Structure" has reported surface sampling of 1.25 meters of 72.12 g/t Ag Eq and 2.20 meters grading 116.20 g/t Ag Eq including 206.80 g/t Ag Eq over 0.80 meters. In addition, it is now realized that drill hole SM20-11 intercepted the Northeast secondary mineralized structure and reported 3 separate mineralized zones; Zone 1 from 62.80 - 95.59 meters grading 31.72 g/t Ag Eq over the 26.90 meters including 1.20 meters grading 110.11 g/t Ag Eq; Zone 2 from 101 - 103.20 reporting 118.57 g/t Ag Eq over the 2.20 meters and the third Zone which returned 3.50 meters grading 40.80 g/t Ag Eq.

Of particular interest are the areas for possible structural dilation zones. See the yellow circles in Figure 6 below.

Figure 6 - Property Wide Structural Interpretation

Once the field work and observations have been completed the Phase 2 exploration first priority drill targets will be defined in the coming weeks.

QA QC Procedure

Analytical results of sampling reported by Fabled Silver Gold represent core samples that have been sawn in half with half of the core sampled and submitted by Fabled Silver Gold staff directly to ALS Chemex, Chihuahua, Chihuahua, Mexico. Samples were crushed, split, and pulverized as per ALS Chemex method PREP-31, then analyzed for ME-ICP61 33 element package by four acid digestion with ICP-AES Finish. ME-GRA21 method for Au and Ag by fire assay and gravimetric finish, 30g nominal sample weight.

Over Limit Method

For samples triggering precious metal over-limit thresholds of 10 g/t Au or 100 g/t Ag, the following is being used:

Au-GRA21 Au by fire assay and gravimetric finish with 30 g sample. Ag-GRA21 Ag by fire assay and gravimetric finish.

Fabled Silver Gold monitors QA/QC using commercially sourced standards and locally sourced blank materials inserted within the sample sequence at regular intervals.

About Fabled Silver Gold Corp.

Fabled is focused on acquiring, exploring and operating properties that yield near-term metal production. The Company has an experienced management team with multiple years of involvement in mining and exploration in Mexico. The Company's mandate is to focus on acquiring precious metal properties in Mexico with blue-sky exploration potential.

The Company has entered into an agreement with Golden Minerals Company (NYSE American and TSX: AUMN) to acquire the Santa Maria Property, a high-grade silver-gold property situated in the center of the Mexican epithermal silver-gold belt. The belt has been recognized as a significant metallogenic province, which has reportedly produced more silver than any other equivalent area in the world.

Mr. Peter J. Hawley, President and C.E.O.

Fabled Silver Gold Corp.

Phone: (819) 316-0919

peter@fabledfco.com

For further information please contact:

The technical information contained in this news release has been approved by Peter J. Hawley, P.Geo. President and C.E.O. of Fabled, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Neither the TSX Venture Exchange nor its Regulations Service Provider (as that term is defined in the policies of the TSX Venture Exchange) does accept responsibility for the adequacy or accuracy of this news release.

Certain statements contained in this news release constitute "forward-looking information" as such term is used in applicable Canadian securities laws. Forward-looking information is based on plans, expectations and estimates of management at the date the information is provided and is subject to certain factors and assumptions, including, that the Company's financial condition and development plans do not change as a result of unforeseen events and that the Company obtains any required regulatory approvals.

Forward-looking information is subject to a variety of risks and uncertainties and other factors that could cause plans, estimates and actual results to vary materially from those projected in such forward-looking information. Some of the risks and other factors that could cause results to differ materially from those expressed in the forward-looking statements include, but are not limited to: impacts from the coronavirus or other epidemics, general economic conditions in Canada, the United States and globally; industry conditions, including fluctuations in commodity prices; governmental regulation of the mining industry, including environmental regulation; geological, technical and drilling problems; unanticipated operating events; competition for and/or inability to retain drilling rigs and other services; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; stock market volatility; volatility in market prices for commodities; liabilities inherent in mining operations; changes in tax laws and incentive programs relating to the mining industry; as well as the other risks and uncertainties applicable to the Company as set forth in the Company's continuous disclosure filings filed under the Company's profile at www.sedar.com. The Company undertakes no obligation to update these forward- looking statements, other than as required by applicable law.

SOURCE: Fabled Silver Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/692257/Planning-of-Phase-2-Defination-Diamond-Program-on-the-Santa-Maria-Property-Ongoing