January 29, 2025

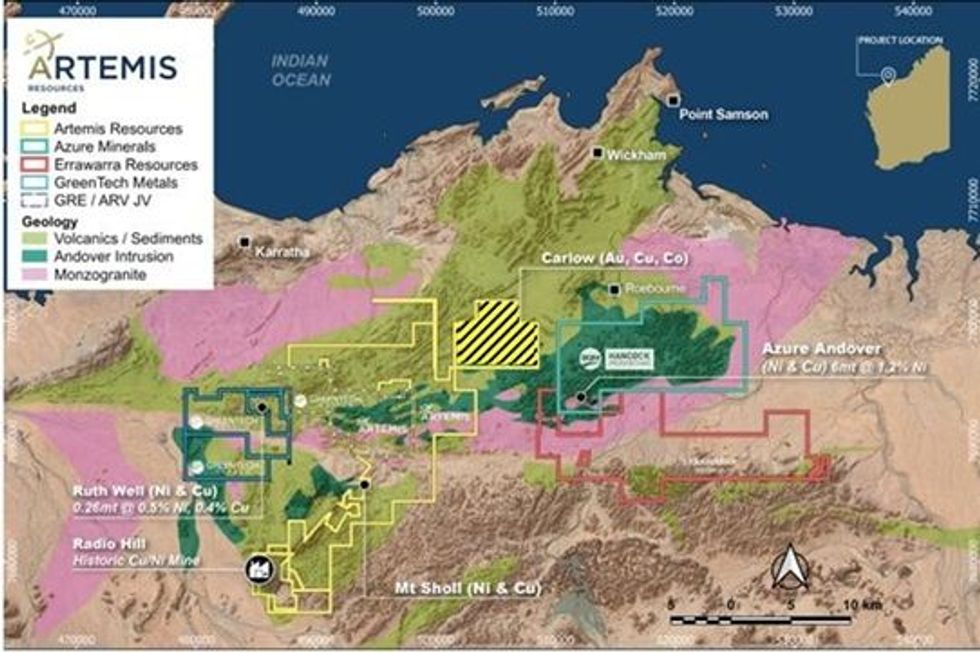

Artemis Resources Limited (‘Artemis’ or the ‘Company’) (ASX/AIM: ARV) is pleased to provide an outline of a substantial drilling program planned to test high priority gold exploration targets on the 100% owned Carlow Tenement within the Company’s extensive holdings in the North Pilbara gold province of Western Australia.

A diamond and Reverse Circulation (“RC”) drilling program is expected to commence in early February to test several compelling targets within a 4km long northwest trending zone centred around the Company’s 704Koz AuEq Carlow Mineral Resource1 which includes 374Koz gold, 64,000t copper and remains open. Despite proximity to Carlow, the targets planned to be drilled during the March Quarter are previously untested.

Summary of Planned Activities – March Quarter 2025

- The first hole will test the large Marillion Electro-magnetic (“EM”) conductor 500m east of the Carlow resource, near the base of the Andover Intrusion

- Diamond drilling will then test the potential for significant extensions to the Carlow resource, down plunge from previous high-grade gold intersections

- RC drilling is then planned across the Titan Prospect 2km northwest of Carlow, as an initial test of widespread high-grade gold occurrences at surface

- Recent assays from outcrops of chert and quartz/ironstone veins at Titan include 51.8g/t Au and 41.4g/t Au, in line with results announced during 2024

- Surface gold occurrences at Titan may be associated with a large gravity-low feature surrounded by chert outcrops, interpreted major faults and thrusts

- Conceptual mining study planned to review the 2022 Carlow Inferred Mineral Resource1 including 7.25Mt @ 1.3g/t gold for 296,000oz Au in an optimised pit

- Artemis is also evaluating other quality assets and recently applied for an EL to cover an interpreted intrusion with potential for IOCG Cu/Au mineralisation

- Following the recent $4M placement, the Company is now well funded to drill priority targets around Carlow and progress other promising gold targets

Recently appointed Managing Director Julian Hanna2 commented: ‘As a result of the excellent work completed by the Karratha exploration team during 2024 and following the announced capital raising in December, Artemis is now in a strong position to undertake drilling of some exciting targets at the Karratha Gold Project.

Exploration in the following months will be focussed on the Carlow Tenement which hosts a significant gold - copper resource at Carlow and covers a wide range of exploration targets within a wide, prospective corridor with minimal previous drilling.

I look forward to working closely with the very experienced and committed team at Artemis and updating shareholders with results from the drilling in due course.’

Priority Drill Targets and other Activities – March Quarter 2025

Marillion Electro-Magnetic Anomaly3

Marillion is a large, highly conductive electro-magnetic (FLTEM) anomaly modelled by the Company’s consulting geophysicist as a 500m long, c.11,000 siemens conductor with the top at approximately 350m vertical depth (refer to Figure 2). Marillion is undrilled, and the source of the conductive anomaly is unknown.

Drilling is planned to start in early February with the first drill hole designed to test the centre of the Marillion EM anomaly for possible sulphide hosted mineralisation.

Marillion may potentially represent an extension of the Carlow gold/copper deposit offset >500m by a fault or represent a possible sulphide accumulation at the interpreted base of the Andover Intrusion which is mapped in outcrop near Marillion.

Click here for the full ASX Release

This article includes content from Artemis Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00