August 19, 2024

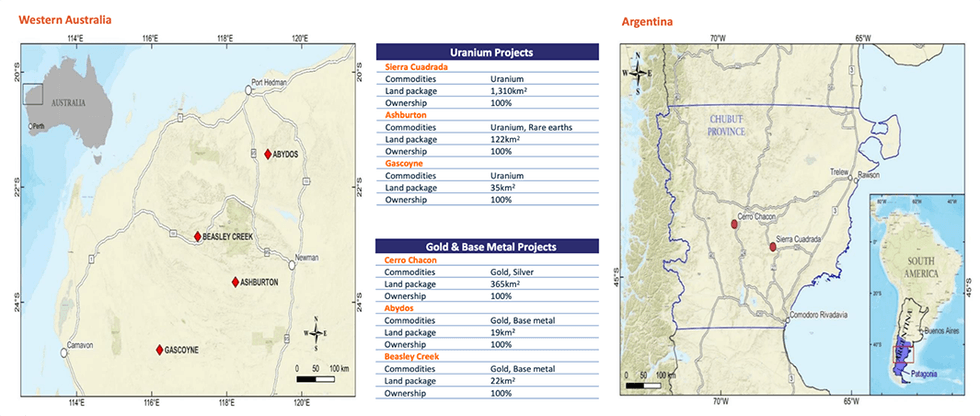

With high-quality, drill-ready assets, with world-class discovery potential, Piche Resources (ASX:PR2) is a compelling business case for investors looking to leverage a bull market for uranium and gold. The company holds a portfolio of drill-ready uranium and gold assets in Argentina and Australia which include the Ashburton uranium project in the Pilbara region; the Sierra Cuadrada uranium project in Argentina; and the Cerro Chacon gold project which shares geological similarities with the Cerro Negro mine.

The Ashburton uranium project comprises three exploration licences and has the potential to host uranium mineral deposits similar to the Pine Creek Geosyncline in Australia’s Northern Territory, and the Athabasca Basin in Saskatchewan, Canada.

iche has an internationally recognized board focused on creating long-term shareholder value, and an in-country technical team in Argentina with a proven track record of taking projects from discovery through to development.

Company Highlights

- The company’s Australian asset is the Ashburton uranium project which has been drilled previously and recorded high-grade uranium intersections over significant widths.

- In Argentina, the company’s Sierra Cuadrada uranium project in the San Jorge Basin has a significant history of high-grade, near-surface uranium mining operations.

- The company is currently drilling one of its prospects at Sierra Cuadrada and has announced visible uranium in numerous holes. Multiple other prospects are drill-ready and have the potential to host tier 1 uranium deposits.

- Exposure to gold with high-quality precious metal projects in Argentina that boast surface outcrop samples with gold grade up to 13 g/t gold.

- Internationally renowned board and management team with extensive uranium and gold exploration and development experience.

This Piche Resources profile is part of a paid investor education campaign.*

Click here to connect with Piche Resources (ASX:PR2) to receive an Investor Presentation

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

25 February

Board Changes

Piche Resources (PR2:AU) has announced Board ChangesDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00