June 28, 2022

Latin Resources Limited (ASX: LRS) (“Latin” or “the Company”) is pleased to provide an update for recent activities and next steps in relation to the advancement of its 100% owned Cloud Nine Halloysite‐Kaolin Deposit (“Cloud Nine”) in Western Australia. The Company released its maiden Mineral Resource Estimate (“MRE”) of 207Mt Inferred Resources at Cloud Nine in May 20211.

HIGHLIGHTS

- Significant thicknesses of exceptionally bright kaolinised granite intersected in the Resource in‐fill drilling, further highlighting the quality of the world class Cloud Nine Halloysite‐Kaolin deposit. Significant intersections include:

- NBAC459: 43m @ 85.4 ISO‐B from 7m

- NBAC397: 38m @ 85.3 ISO‐B from 12m

- NBAC413: 25m @ 85.2 ISO‐B from 17m

- NBAC442: 21m @ 85.2 ISO‐B from 6m

- Geotechnical drilling for bulk density determination has been successfully completed at the Cloud Nine Halloysite‐Kaolin Deposit.

- Bulk density measurements are a vital step in the path to an updated Cloud Nine JORC Resource which is currently being undertaken.

- Permitting and approvals process has commenced to enable the excavation of a trial mining test‐pit.

- The Company has previously reported its maiden JORC (2012) Inferred Mineral Resource of 207Mt of kaolinised granite including a sub‐domain of 50Mt grading 6% halloysite1 – making Cloud Nine one of the largest undeveloped kaolin‐halloysite deposits in Australia.

RESOURCE IN‐FILL DRILLING

To date, nearly two thirds of the composites from the Cloud Nine Resource in‐fill drilling program have been analysed for brightness (Figure 1). The remaining holes’ sample analysis has benefited from optimising the analysis pathway, coupled with a drop in COVID‐related staffing issues at the laboratory. The remaining results are expected towards the end of July.

The drilling thus far2 has returned significant, near surface thicknesses of kaolinised granite with brightness values above 85 ISO‐B. A total of 66% of the drill holes analysed so far, returned results above 80 ISO‐B, with selected significant results >85 ISO‐B including:

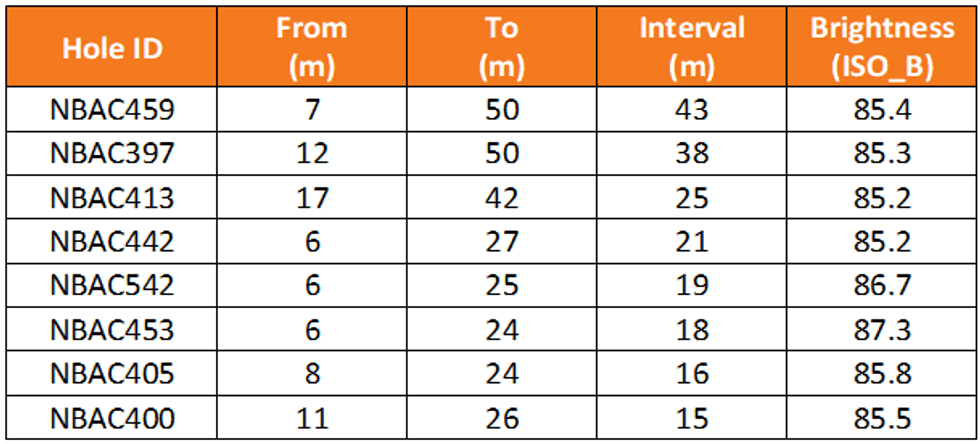

Table 1: Selected significant Cloud Nine kaolin brightness intersections (>85 ISO‐B)

Figure 1: Drillholes with brightness results received and pending, from the Cloud Nine Resource in‐fill drilling

SONIC GEOTECHNICAL DRILLING

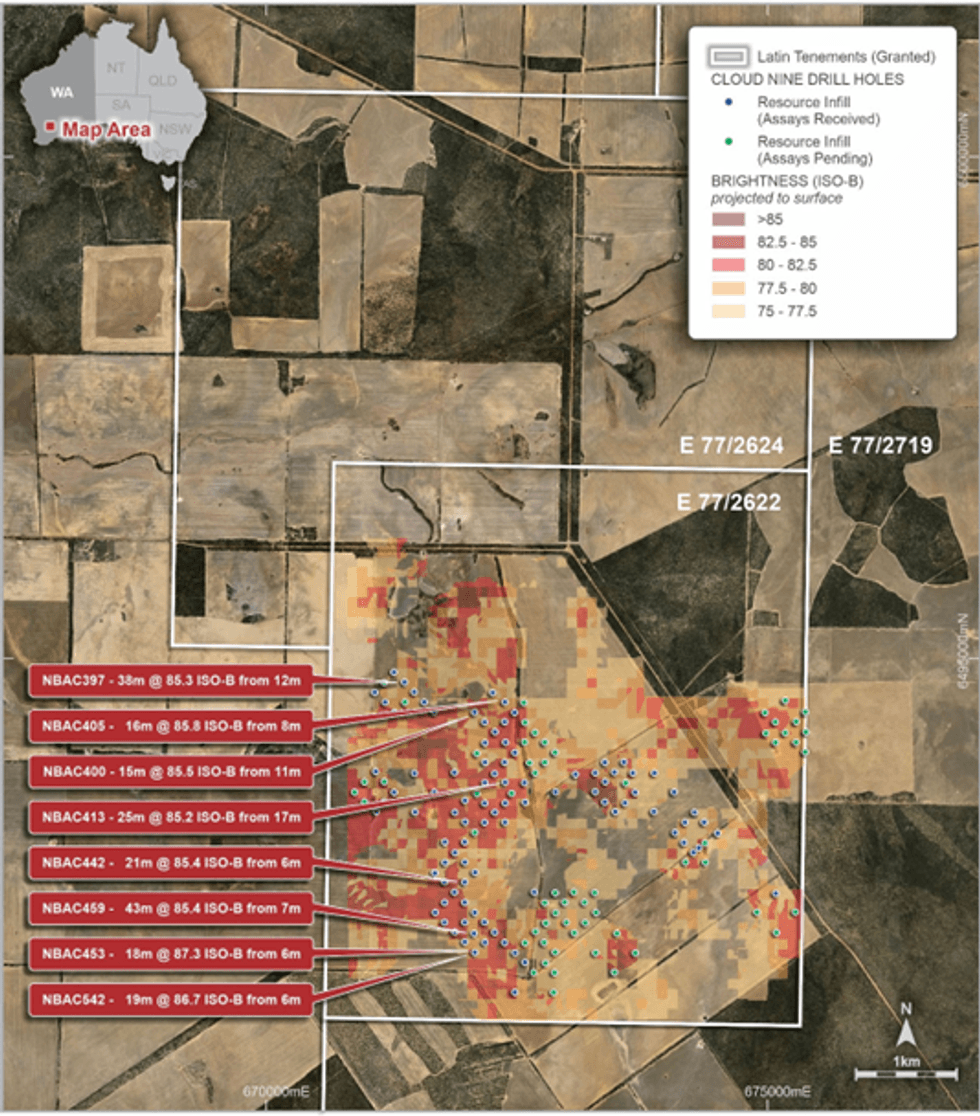

The recently completed sonic geotechnical drilling program, comprising 9 PQ (85mm) drill holes for 365 metres, was designed to provide representative core samples from within the footprint of the existing JORC MRE (Figure 2).

The in‐situ dry bulk density data is an integral part of the ongoing resource estimation work at Cloud Nine and will improve the confidence levels in the current Inferred JORC Resource, while the geotechnical data is required for the mine design and scheduling work currently underway as part of the Company’s Pre‐Feasibility Studies (“PFS”) and other studies.

Figure 2: Cloud Nine – location of sonic drill collars

REGIONAL AEROMAGNETIC SURVEY

The Company has engaged Southern Geoscience Consultants (SGC) to manage a high detail airborne magnetic and radiometric survey covering the Company’s extensive regional tenement package (Figure 3). The regional survey will assist in defining further exploration targets along almost 105 kilometres of prospective tenure and comprises over 13,800 line kilometres on 50 metre spaced east west lines.

Click here for the full ASX Release

This article includes content from Latin Resources Limited (ASX: LRS), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

18h

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00