June 01, 2022

Queensland Pacific Metals Ltd (ASX:QPM) (“QPM” or “the Company”) is pleased to announce that it has entered into a binding ore supply agreement (“Agreement”) with Société des Mines de la Tontouta (“SMT”).

Highlights

- Binding ore supply agreement entered into with Société des Mines de la Tontouta (“SMT”), a significant New Caledonian mining company, for up to 600,000 wmt per annum.

- Targeting a typical limonite ore specification of 1.6% Ni and 0.18% Co.

- Ten year ore supply term.

- Agreement between QPM and SMT to explore further opportunities for mutual investment and commercial arrangements.

- In combination with the Société Le Nickel ore supply agreement, QPM has now secured up to 1,600,000 wmt nickel ore per annum under binding contracts.

SMT was one of the original supporters of QPM and the TECH Project and QPM is delighted to have formalised this agreement with SMT. In combination with the ore supply agreement executed with Société Le Nickel (“SLN”), QPM has now contracted its ore supply requirements for the TECH Project (refer to ASX announcement 1 March 2022).

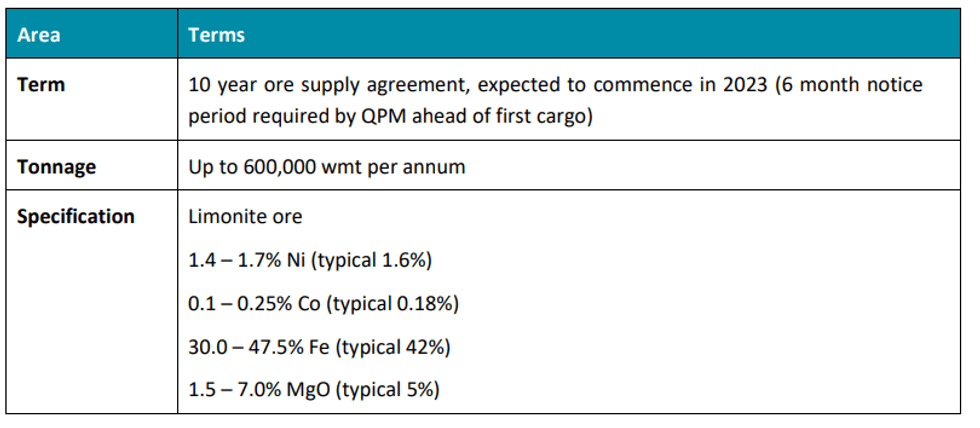

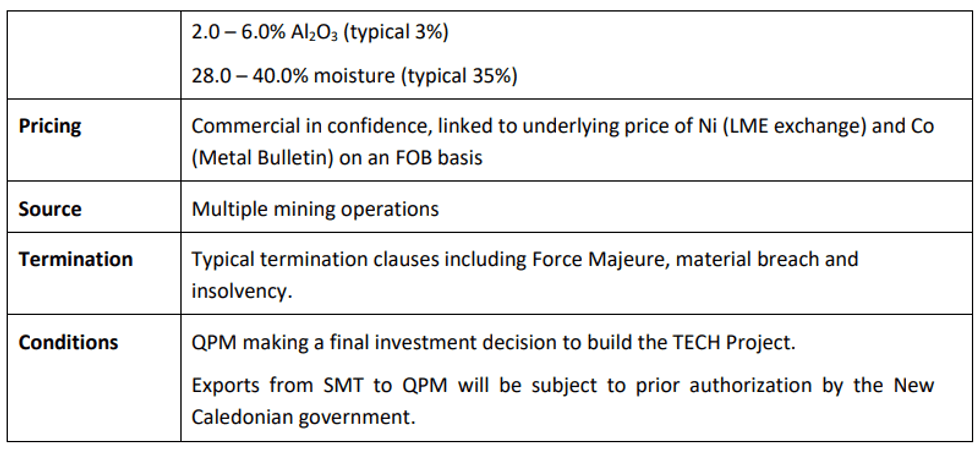

Key Terms

The key terms of the Agreement are detailed in the table below:

As part of the Agreement, SMT and QPM have also agreed to explore further opportunities that are mutually beneificial including investment and other commercial arrangements.

QPM Managing Director Dr Stephen Grocott commented,

“I am delighted to enter into this agreement with SMT who have impressive mining operations in New Caledonia that meet the requirements of western automobile manufacturers who are concerned with sustainability and responsible mining.

SMT has been a strong supporter of the TECH Project for a long time and we look forward to having a long term partnership that delivers value to both companies.”

SMT General Manager Arnaud Bondoux commented,

“Signing a nickel ore supply contract with QPM means renewing relations with Australia, which has always been a historical partner of SMT and New Caledonia. Indeed, exports between SMT and Australia have taken place over a period of more than 25 years, from 1989 until recently in 2015.

SMT was involved in QPM's innovative project from the outset by actively participating in the pilot tests. In fact, QPM and SMT have been in contact for four years now and have formed a partnership that led to the signing of a first MOU in 2017.

SMT would like to make a long-term commitment to QPM, beyond its role as a supplier, in order to propose a new model for the valorization of New Caledonian ore.”

About SMT

SMT (Société des Mines de la Tontouta) is a subsidiary of the Ballande Group. A "small miner" and historic mining company, it has been present in New Caledonia since the end of the 19th century. SMT is also committed to sustainable development and exporting ore to this project (which is aimed for the battery market), so close to New Caledonia, is an opportunity for our company.

This announcement has been authorised for release by the Board.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00