NV Gold Corporation (TSXV:NVX)(OTCQB:NVGLF)(FSE:8NV) ("NV Gold" or the "Company") The Company announced today an update on its Slumber project in Nevada, USA

Slumber Gold Project, Humboldt County, Nevada

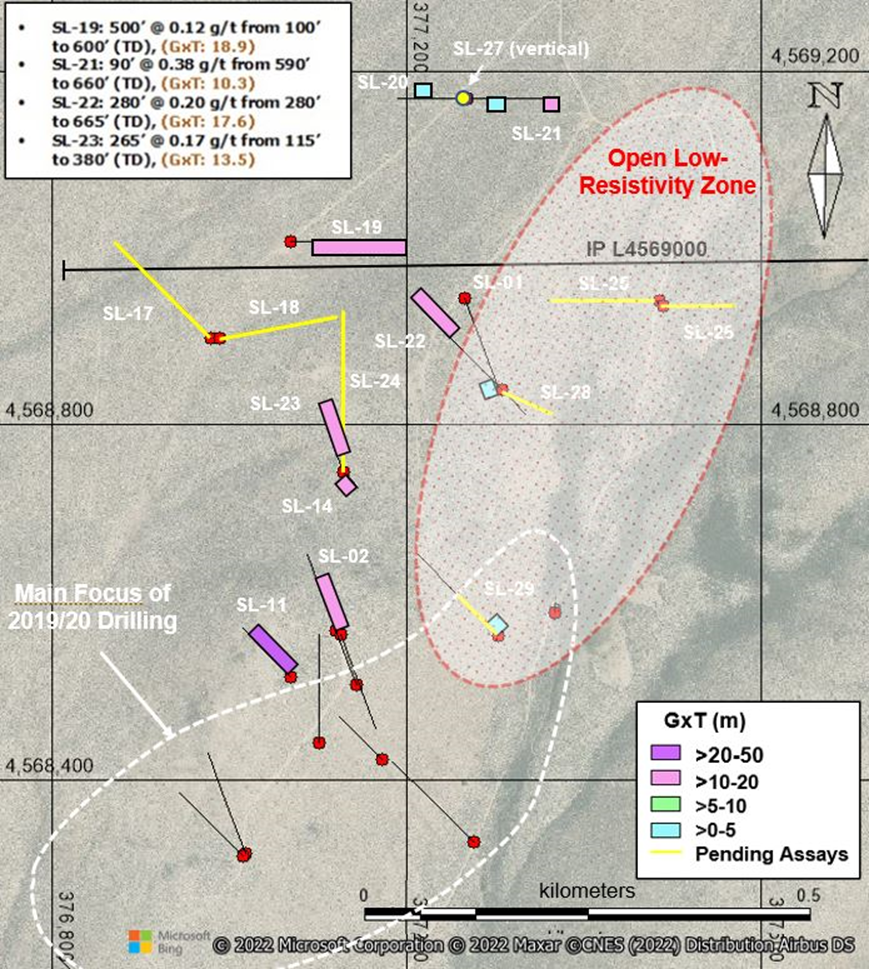

Our Q4/Q1-2021/22 reverse circulation drill program at Slumber has been completed. Twelve (12) reverse circulation drill holes totaling approximately 2,350 meters (7,710 feet) have been drilled and sampled. Results have been reported for the first five holes and the remaining seven holes are being submitted for assay. These final holes encountered longer thicknesses of silicified, oxide mineralization, distributed over an area in excess of 900 meters by 500+ meters, with drill-site RC chip logging having recorded thicknesses of 100-150 meters or more of mineralized material. The last two (deepest) holes revealed mineralization to depths of nearly 300 meters. The Company reports that Slumber has now been demonstrated to host a low-grade bulk-tonnage, oxide gold system, which remains open in multiple directions. Drilling is still very wide-spaced over this large area, with reasonable expectations of structural and stratigraphically favorable zones of higher grades yet to be encountered.

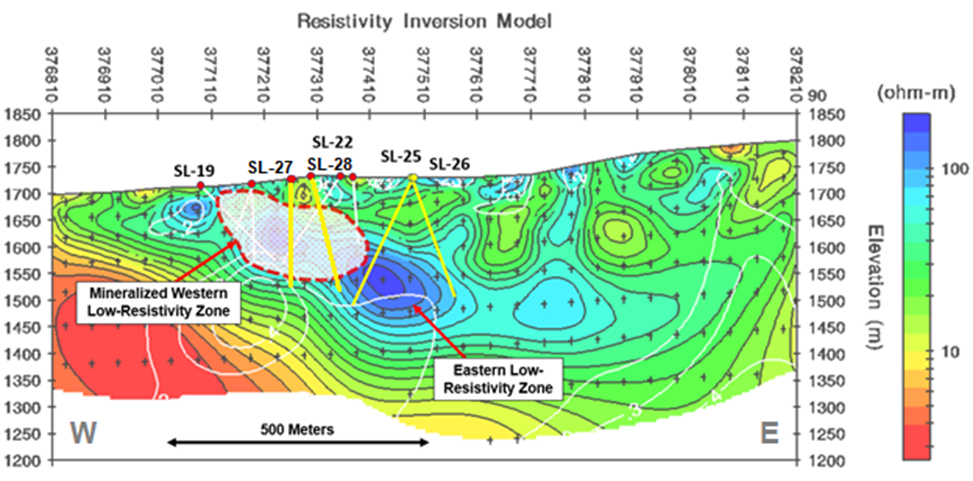

"I am very pleased that the "Low-Resistivity Model" has confirmed that alteration and related gold mineralization correlate extremely well with the low resistivity zones. All the reverse circulation holes drilled into the eastern low-resistivity extension have intercepted the same type of silicification and oxidation, suggesting that width of the Slumber gold system now appears to exceed half a kilometer (see Figures 1 & 2). NV Gold is also conducting a mercury-vapor survey which will be supported by additional biochemistry sampling to assist in locating potential higher-grade feeder structures." commented Thomas Klein VP Exploration NV Gold.

The Company plans further work at Slumber to include both reverse-circulation and diamond core drilling. A Plan of Operations is envisaged to allow for the larger program.

John Watson, President and CEO of NV Gold added "This years' work at Slumber continues to enlarge the dimensions of a new oxide gold system in Nevada. Our goal is the discovery of a million+ ounce gold deposit, building upon the current program's success. We believe that Slumber shows excellent potential to achieve this goal. As we have stated previously, we feel that there is great potential for new discoveries in Nevada for those willing to take the risks to explore obscured or covered areas of interest."

Figure 1 - Grade by Thickness (GxT) map showing recently discovered zone of low-grade oxide gold mineralization.

Figure 2 - Induced Polarization Line L4569000 showing correlation of gold mineralization with Low-Resistivity

Damir Cukor, P.Geo. is a Qualified Person pursuant to National Instrument 43-101 and has reviewed and approved the technical information contained in this news release.

About NV Gold Corporation

NV Gold (TSXV:NVX)(OTCQB:NVGLF)(FSE:8NV) is a gold exploration company with ~80 million shares issued, with no debt. The Company is based in Vancouver, British Columbia, and Reno, Nevada and is focused on delivering value through mineral discoveries in Nevada, USA. Leveraging its expansive property portfolio, its highly experienced in-house technical team, and its extensive geological data library, 2022 promises to be highly productive for NV Gold.

On behalf of the Board of Directors,

John E. Watson, President & CEO

For further information, visit the Company's website at www.nvgoldcorp.com

Forward-Looking Statements

This news release includes certain forward-looking statements or information. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration activities, that the Company's expectations of encountering structural and stratigraphically favorable zones of higher grades are reasonable, that the drilling suggests the width of the Slumber gold system appears to exceed half a kilometer and that there is excellent potential to discover a million+ ounce gold deposit at Slumber are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's plans or expectations include regulatory issues, market prices, availability of capital and financing, general economic, market or business conditions, timeliness of government or regulatory approvals, the lack of continuity of mineralization, the extent to which mineralized structures extend on to the Company's Projects and other risks detailed herein and from time to time in the filings made by the Company with securities regulators. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether because of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

SOURCE: NV Gold Corporation

View source version on accesswire.com:

https://www.accesswire.com/692179/NV-Gold-Completes-2021-2-Program-at-Slumber-Project-Continues-expansion-of-Mineralized-Zone