- WORLD EDITIONAustraliaNorth AmericaWorld

May 28, 2025

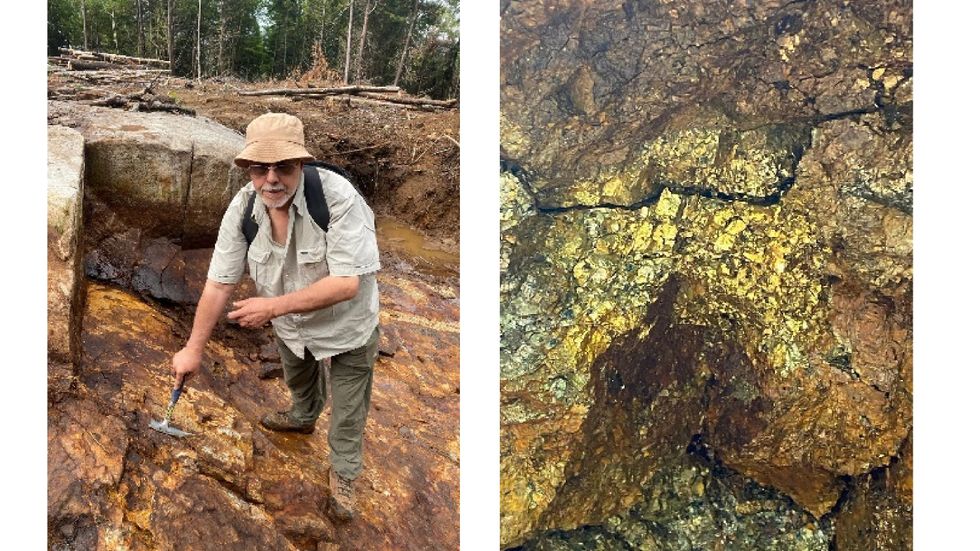

Ni-Co Energy Inc. announces that its technical team will be mobilized to the Kremer property around mid-June 2025. The project is located approximately 90 km north of downtown Montreal and about 15 km from the nearest municipality, in a remote forested area with access via an existing road and close proximity to the hydroelectric grid.

Meet The Team:

Bilingual Corporate Video introducing Ni-Co Energy Inc.

Summer Field Program Priorities (June–July)

- Targeted prospecting of southwest TDEM conductors (Kremer-2)

To verify the presence of outcropping massive or semi-massive sulfides. - Prospecting of northeast TDEM conductors (Kremer-1 2)

To assess the nature of EM anomalies and any associated metallic indicators. - Analysis of residual conductors in the eastern portion

To refine the global geophysical model ahead of final drill target placement.

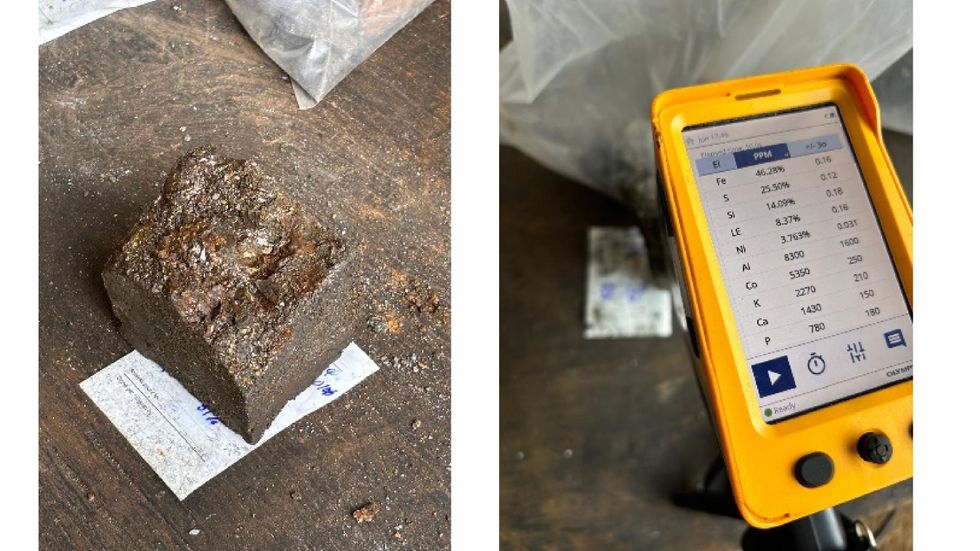

Updated Interpretation of the 420 Assays from 2023

The 420 samples from the 22 holes drilled in fall 2023 have been recalculated in terms of nickel equivalent (NiEq %), using metal prices as of May 22, 2025 (Ni = $7.0375/lb, Cu = $4.6559/lb, Co = $15.286/lb).

Indicator | Updated Result |

Samples > 0.5 % NiEq | 134 (≈ 32%) |

Samples > 1.0 % NiEq | 70 (≈ 17%) |

Maximum grade | 3.89 % NiEq |

Average grade (all samples) | 0.48 % NiEq |

These data confirm the presence of significant mineralization, which may be associated with a mafic intrusion interpreted from geophysical surveys. Magnetic, gravity, and EM data show remarkable alignment over 8 km, suggesting a highly favorable environment in the central block (Kremer-2) over a 3 km section — an ideal structural setting for the formation of thicker sulfide lenses.

Next Steps – The Company Anticipates Undertaking a Drill Program in the Fall

- Validate the position and dip of key targets through surface work.

- Mobilize two drill rigs in the fall to test the central fold hinge and associated deep conductors.

- Carry out borehole EM (BHEM) surveys after each drill hole to visualize the extension of mineralized zones or detect off-hole conductors.

Photos of the team, outcrops, and trenches will be shared regularly on the company website, as well as on Facebook, LinkedIn, and X during the campaign.

The scientific and technical information in this news release has been reviewed and approved by Marc Boivin, P.Geo., a Qualified Person under National Instrument 43-101.

About Ni-Co Energy Inc.

Ni-Co Energy Inc. is exploring the Kremer project, a mafic–ultramafic intrusion prospective for nickel, copper, and cobalt, advantageously located in southern Québec and supported by infrastructure and low-carbon hydroelectric power.

For further information, please contact:

Ni-Co Energy Inc.

info@nicoenergy.ca

Click here to connect with Ni-Co Energy Inc. to receive an Investor Presentation

Sign up to get your FREE

AmeriTrust Financial Technologies Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21h

AmeriTrust Financial Technologies

Unlocking opportunity in used vehicle leasing through proprietary finance technology

Unlocking opportunity in used vehicle leasing through proprietary finance technology Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Sign up to get your FREE

AmeriTrust Financial Technologies Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00