- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

April 14, 2025

Ni-Co Energy is a Canadian mineral exploration company advancing the discovery and development of critical metals—particularly nickel, copper, and cobalt. Headquartered in Gatineau, Quebec, the company is focused on the underexplored yet highly prospective Grenville geological province, known for its potential to host mineral-rich systems.

Through its 100 percent-owned project in Quebec, Ni-Co Energy offers investors direct exposure to high-demand critical minerals. The project benefits from strong early-stage drill results, excellent infrastructure access, and a clear path to discovery in a geopolitically stable, mining-friendly jurisdiction.

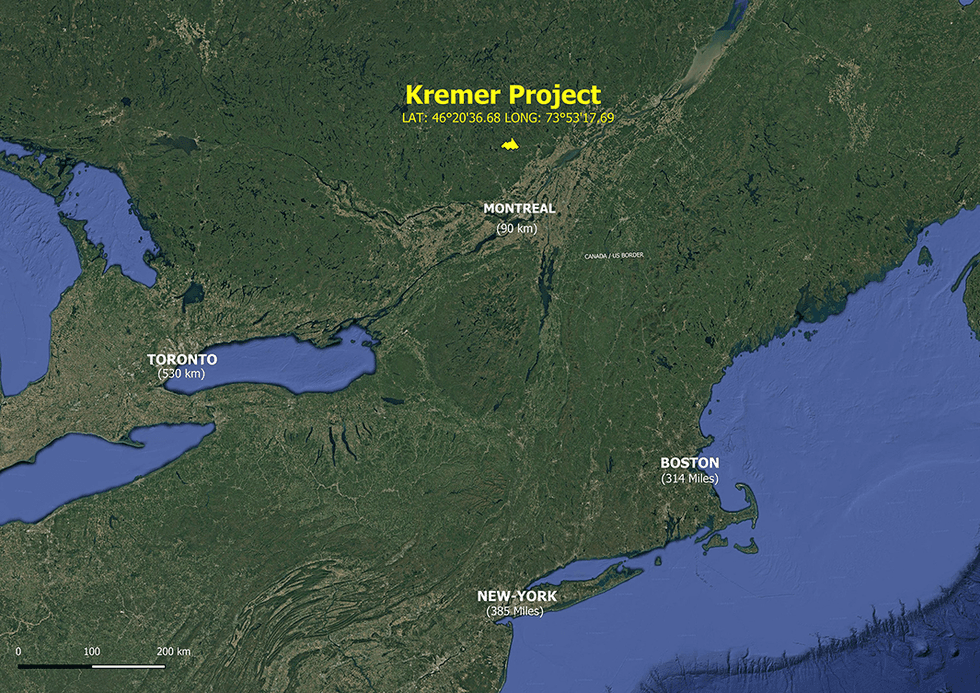

The 100 percent-owned Kremer Project is Ni-Co Energy’s flagship exploration asset and a clear reflection of the company’s strategy to unlock critical mineral resources in geologically prospective yet underexplored regions. Located just 90 kilometers from downtown Montreal and 15 kilometers northwest of Saint-Côme, the Kremer property benefits from exceptional accessibility and established infrastructure—key advantages that enhance its potential as a high-impact, early-stage exploration project.

Company Highlights

- Ni-Co Energy targets high-demand metals essential to the energy transition: nickel, copper and cobalt, with applications in EV batteries, energy storage and electrification infrastructure.

- The flagship Kremer project is a 100 owned, 15,375-hectare property located 90 km to the north from downtown Montreal (but 15 km away from the nearest town) in the highly prospective Grenville Geological Province in Quebec.

- Early-stage Discovery Potential: Multiple massive and semi-massive sulfide intercepts confirmed in 2023 drilling campaign with grades up to 1.73 percent nickel and 0.85 percent copper over 2.95 meters. This campaign consisted of 22 holes and 4,200 meters; ~41 percent of the drilled holes intersected sulfides.

- Airborne and ground EM surveys revealed an 8-kilometer-long EM conductor corridor, with overlapping gravity and MAG anomalies, and multiple surface showings.

- The project is road-accessible year-round via Route 347 and forestry roads, with power lines nearby and proximity to regional mining services.

- A two-phase, C$2 million exploration program planned for 2025, including an 8000-meter drilling campaign along with borehole TDEM focused on high-priority geophysical and geochemical targets.

This Ni-Co Energy profile is part of a paid investor education campaign.*

Click here to connect with Ni-Co Energy to receive an Investor Presentation

Sign up to get your FREE

Homerun Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

23 February

Homerun Resources

Establishing a vertically integrated leader in high-purity silica for solar & energy markets

Establishing a vertically integrated leader in high-purity silica for solar & energy markets Keep Reading...

5h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

13h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Homerun Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00