Northern Lights Resources Corp. ("Northern Lights" or the "Company") (CSE:NLR)(OTCQB:NLRCF) is pleased to announce that it has received approval from the Arizona State Land Department ( the "ASLD") to commence drilling at the Tin Cup Prospect at the Company's Secret Pass Gold Project ("Secret Pass") in Mohave County, Arizona

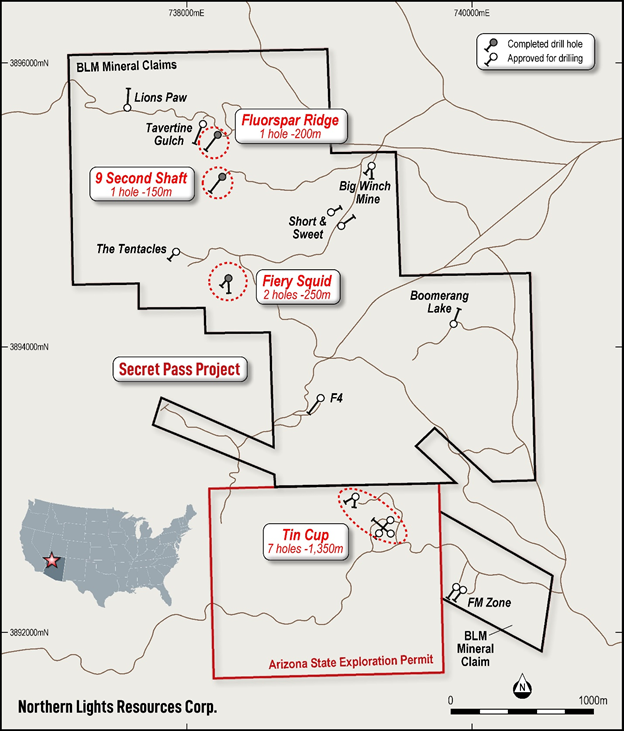

Northern Lights began drilling at Secret Pass on April 15 and is now completing the 4rth drill hole (total approximately 600 metres) out of the total 22 permitted drill holes located on mineral claims registered with the US Bureau of Land Management (the "BLM"). The prospects drilled included Fiery Squid, Nine Second Shaft and Fluorspar Ridge locations. (See Figure 1) All drill core has been split and sent to Skyline Laboratories in Tucson, assays are pending.

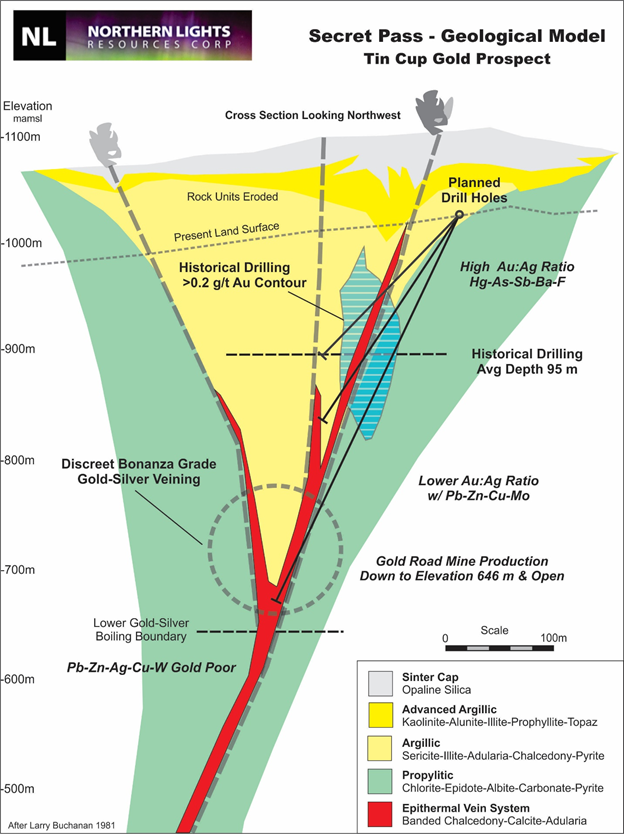

CEO, Jason Bahnsen, commented "Historic RC drilling at Tin Cup in the 1980s intersected steeply angled veins with grades up to 40 grams per tonne gold. We are excited to begin drilling at Tin Cup where we plan to confirm the previous high-grade RC results with large diameter HQ diamond core drilling and test the system to a depth of approximately 350 metres, well below the maximum historic drilling depth of 180 metres. We are completing drilling at the Fluorspar Ridge Prospect and will immediately move the drill to the Tin Cup Prospect to begin the planned 7-hole program."

Seven exploration drill holes have been approved at the Tin Cup Prospect (total 1,350 metres planned) The initial drill program at Tin Cup is planned to confirm high-grade mineralization from historic drilling and to test the down plunge extension of the mineralization to a depth of approximately 350 metres below the surface.

Table 1 - Planned Drill Holes at Tin Cup Prospect

Hole No. | Location | Azimuth (o) | Dip (o) | Length (m) |

TC01 | Tin Cup | 310 | -50 | 250 |

TC02 | Tin Cup | 220 | -45 | 175 |

TC03 | Tin Cup | 220 | -55 | 225 |

TC04 | Tin Cup | 220 | -65 | 400 |

TC05 | Tin Cup | 040 | -60 | 100 |

TC06 - F2 | Tin Cup | 180 | -45 | 100 |

TC07 - F2 | Tin Cup | 100 | ||

Total | 1,350 |

Tin Cup Zone

Records show that there was an historic small scale open pit and underground mine located at Tin Cup. The mine reportedly produced several hundred tons of mineralized materialgrading 15 g/t to 31 g/t of gold. Historic workings, from approximately 1918 to the early 1930's, included an open pit and an inclined shaft to a depth of 21 metres (70 ft) with minorunderground level workings.

During the period from 1984 to 1991, a total of 145 drill holes (predominately reverse circulation drilling) were drilled at Tin Cup with a number of holes intersecting high grade gold mineralization. The historic drilling had an average depth of approximately 95 metres and a maximum depth of 180 metres.

The Tin Cup Gold Zone is localized along the steeply northeast-dipping Frisco Mine

Fault. The gold mineralization is hosted by Tertiary andesite and associated with the

margins of rhyolite dykes that occur as lenses within the Frisco Mine Fault. A few of the

deepest historic drill holes intersect gold mineralization in the Proterozoic basement granite.

The mineralized zone at Tin Cup has a strike length of approximately 245 metres to drill-indicated depth of 180 metres and is open along strike and depth. Higher grademineralization (greater than 10 g/t Au), is localized in narrow sub-vertical structures developed within broader zones of lower grade mineralization ranging up to 86 metres in width. The mineralization plunges to the northwest at 50 degrees. Surface oxidation is variable extending to a maximum depth of up to120 metres based on historical drilling. Selected historic intersections are summarized in Table 2.

Table 2 - Selected Historic Drill Results at Tin Cup Zone

Hole No. | Year | Type | Depth (m) | Interval (m) | Width (m) | Au g/t |

TC-01 | 1984 | RC | 52 | 22.9-30.5 | 7.6 | 7.6 |

21.2-51.5 | 30.3 | 2.9 | ||||

TC-10 | 1985 | RC | 176 | 89.9-121.9 | 32 | 13.6 |

including | 1.5 | 40.4 | ||||

including | 12.2 | 20.8 | ||||

TC-15 | 1985 | RC | 146 | 111.2-115.8 | 4.6 | 13.1 |

TC-30 | 1986 | RC | 150 | 63.3-150 | 86.7 | 4.1 |

including | 9.1 | 17.7 | ||||

TC-32 | 1986 | RC | 90 | 18.8-69.7 | 50.9 | 2.7 |

TC-11 | 1987 | RC | 90.9 | 46.9-90.9 | 44 | 2.8 |

TC-14 | 1986 | RC | 121 | 90.9-121.9 | 31 | 5.8 |

Note: These results are historical in nature and a Qualified Person has not done sufficient work to verify these previous drilling results. Previously released on October 28, 2020.

Figure 1 -Secret Pass Project Drill Hole Locations

Figure 2 - Tin Cup Prospect Cross-Section Model

The scientific and technical data contained in this news release was reviewed and approved by Gary Artmont (Fellow Member AUSIMM #312718), Head of Geology and qualified person to Northern Lights Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

Shawn Balaghi, Investor Relations

Email: shawn@northernlightsresources.com

Tel: +1 604 773 0242

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned, Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada where Northern Lights, in joint venture with Reyna Silver are earning 100% ownership. Northern Lights Resources is a member of the Arizona Mining Association.

Northern Lights Resources trades under the ticker of "NLR" on the CSE. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/650805/Northern-Lights-Receives-Permit-to-Drill-Tin-Cup-Prospect-at-Secret-Pass