CMC Metals Ltd. (TSX-V:CMB), (Frankfurt:ZM5N), (OTC PINKS:CMCZF); (the "Company") announces that spectacular soil geochemical results continue to validate and expand airborne geophysical targets at its flagship Silver Hart project in Yukon

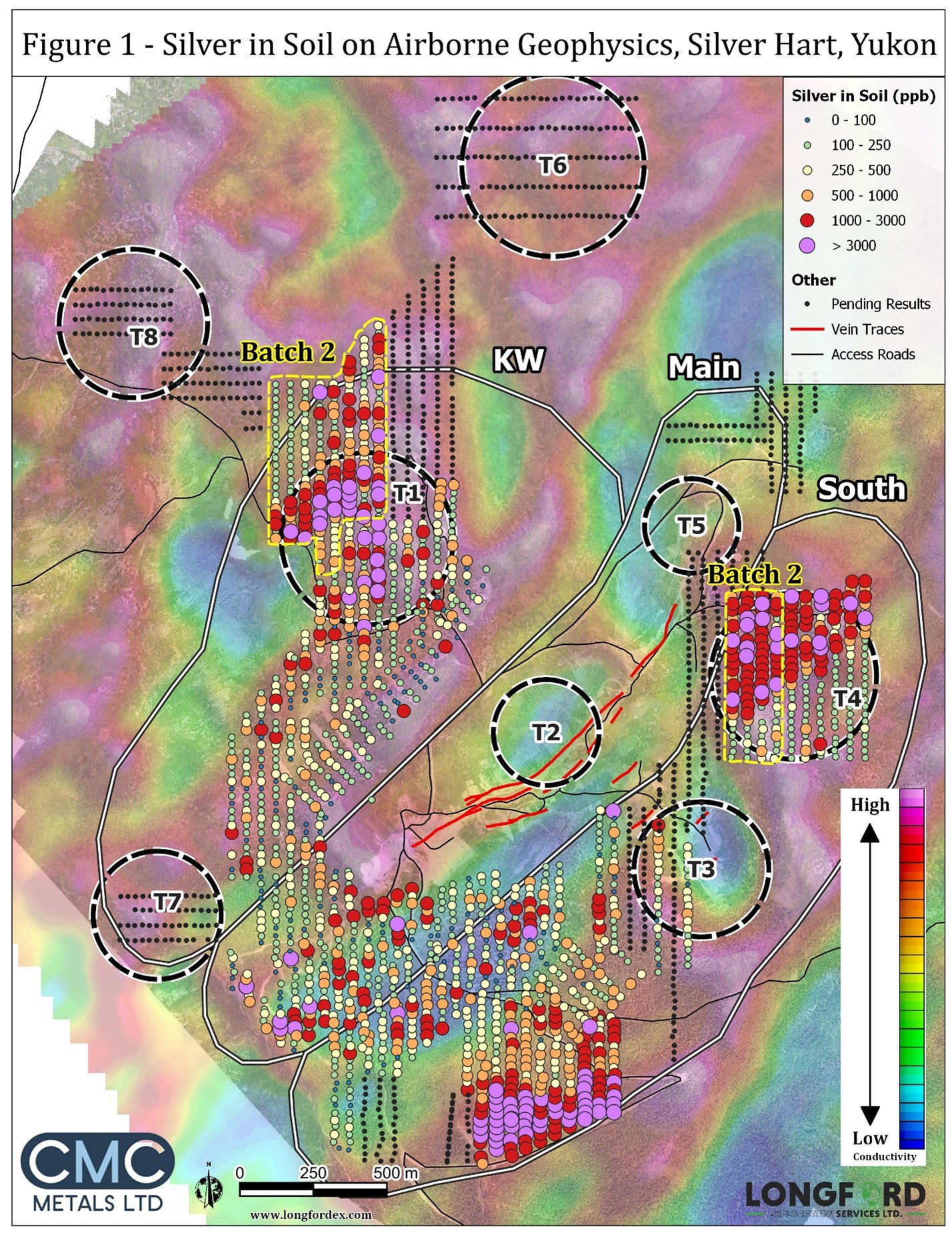

CMC has significantly extended previous soil geochemical surveys at Silver Hart as a part of validating targets identified by its property wide airborne SkyTEM geophysical survey completed earlier this year. The airborne survey identified eight new targets areas on the property (T1 to T8, see Figure 1). Initial results of soil geochemical surveys over T1 and T4 announced on August 25, 2020 were highly encouraging and a second round of test results has now produced spectacular results which are serving to further validate and extend the existing anomalies. Results in the remainder of these target areas and the six other target areas are pending.

As previously noted, existing mineralization in known mineralized veins in the Main Zone occur along northeasterly structures in an area characterized with low magnetic features, moderate conductivity, and in close proximity to the geological contact between volcanics of the Cassiar Batholith with overlying meta-sedimentary sequences including limestones and schists. In the Main Zone, these polymetallic veins are known to have strike extent up to 1.35 kilometers with above average grades of silver, lead, zinc with minor copper and gold.

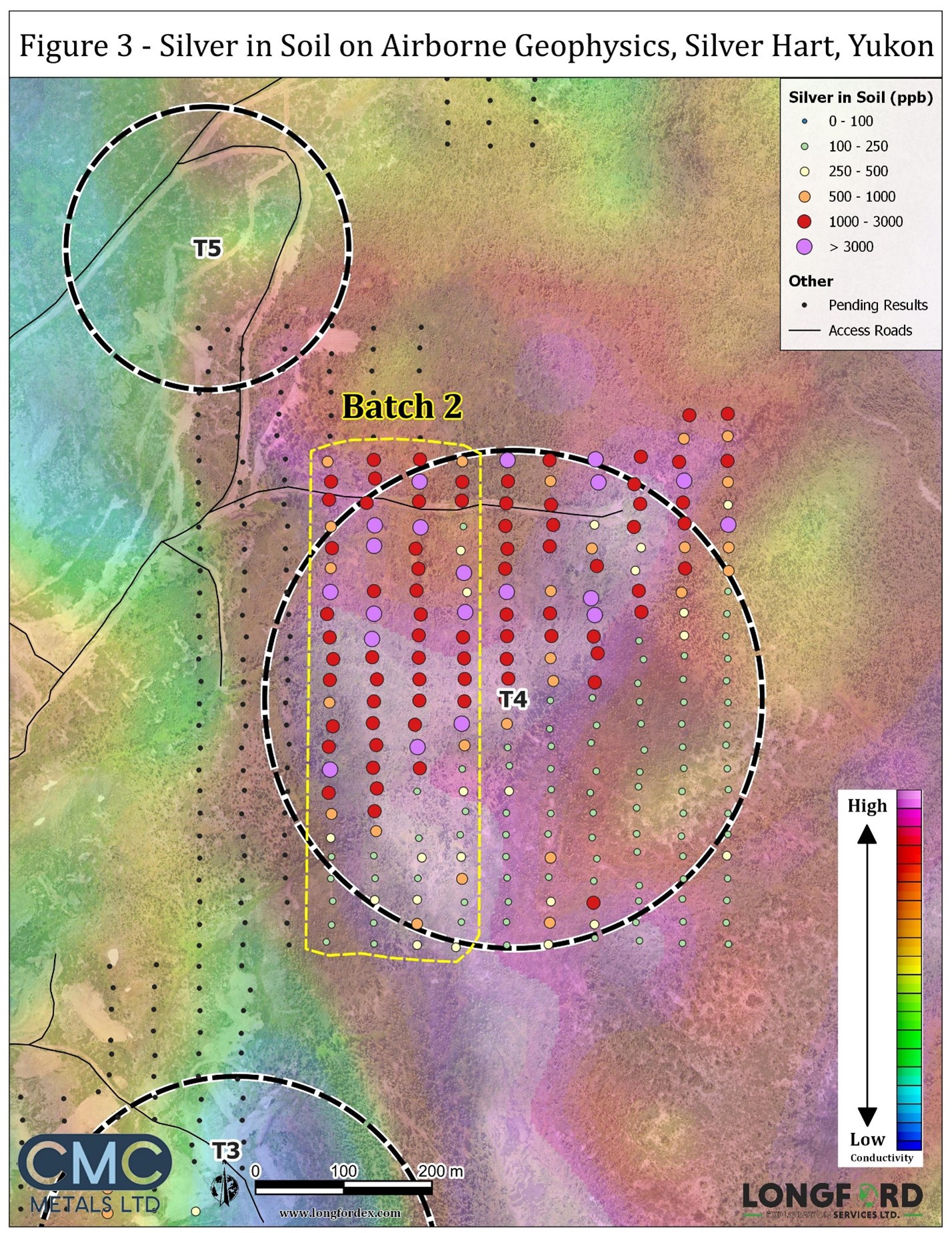

The Company has now completed a detail statistical and spatial analysis of the soil results of the release of August 25 and the recent results (see summary). These combined results show that both T1 and T4 targets are northeasterly trending anomalies that possibly represent a series of parallel vein structures or a larger alteration system, but share typical characteristics and the geological setting associated with the known high grade silver-lead-zinc mineralization in the Main Zone. The geological setting of T1 and T4 is in close proximity to the important geological contact between the Cassiar Batholith and overlying sediments, with low magnetic and moderate conductivity geophysical signatures and viable targets identified in the 3-D modelling.

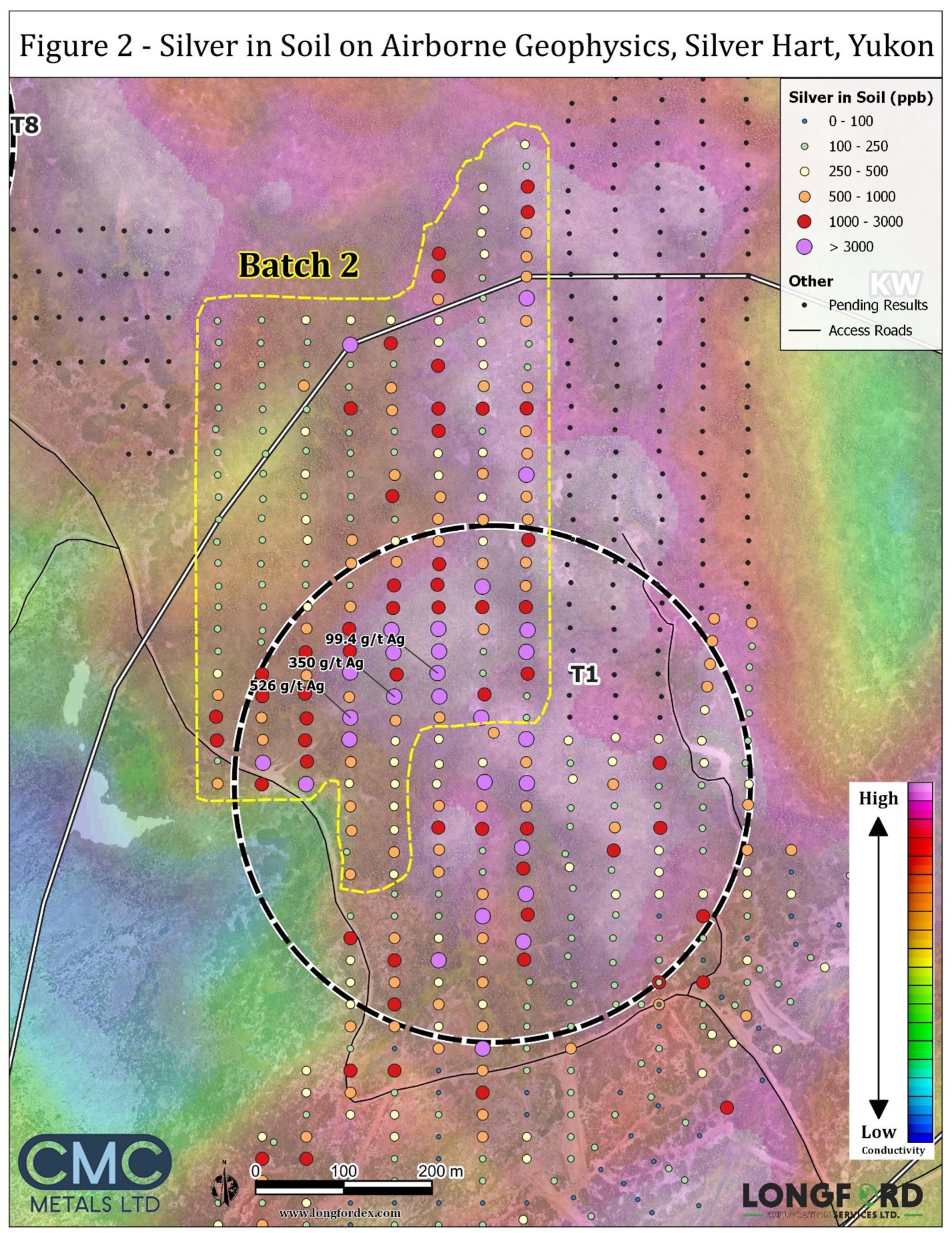

Kevin Brewer, P.Geo. President and CEO notes, "These are the most significant and strongest soil soil anomalies ever identified at Silver Hart. Having soil values of up to 526,000ppb (526 ppm) silver in the midst of a large anomalous area in T1 is significant and presents a great drill target for our future drill programs. These are clearly areas where we will want to further pinpoint targets through trenching and detailed modelling of our geophysical results and then proceed to investigate with drilling in 2022."

John Bossio, Chairman notes, "We are now at a pivotal stage at Silver Hart. Our efforts to increase the exploration footprint are clearly resulting in the identification of meaningful targets. We are becoming increasingly confident that resources can be significantly expanded at Silver Hart through future drilling efforts in these new exploration areas. It has taken a couple of years to reach this point and there is a lot of additional work to do within these areas and to evaluate what we already have identified."

Summary of the Statistical Analysis of Recent Soil Results

Key highlights from recent soil sampling are as follows:

Batch 1:

- From a total of 218 samples (see Press release of August 25, 2021), 93 were anomalous in silver with 14 samples in excess of 3,000 ppb ranging from 3,000-8,000 ppb, 45 samples in excess of 1,000 ppb ranging from 1000- 2999 ppb and 34 samples in excess of 500 ppb;

- One sample had an anomalous value of silver >5,000ppb;

- All anomalous silver samples were also anomalous in zinc, lead, iron and manganese;

- 54 samples were anomalous in Pb with values greater than 50 ppm and a highest value of 358 ppm; and

- 59 samples were anomalous in zinc with values greater than 200 ppm and a highest value of 2,019 ppm.

Batch 2:

- From a total of 281 samples (see Figures 1-3, attached), 174 were anomalous in silver with 35 samples in excess of 3,000 ppb ranging from 3,000ppb - 526ppm (526,000ppb) and two samples with 350,000ppb and 99,400ppb. In addition there were 89 samples in excess of 1,000 ppb ranging from 1000- 2999 ppb and 50 samples in excess of 500 ppb;

- Eight (8) samples had anomalous values of silver >5,000ppb;

- All anomalous silver samples were also anomalous in zinc, lead, iron and manganese;

- 77 samples were anomalous in Pb with values greater than 50 ppm and a highest value of 6089 ppm; and,

- 98 samples were anomalous in zinc with values greater than 200 ppm and a highest value of 3,702 ppm.

Combined testing batches (1 and 2):

- From a total of 499 samples, 267 were anomalous in silver with 49 samples in excess of 3,000 ppb ranging from 3,000ppb - 526ppm (526,000ppb) and another sample with 350,000ppb, 134 samples in excess of 1,000 ppb ranging from 1000- 2999 ppb and 84 samples in excess of 500 ppb;

- Nine (9) samples had anomalous values of silver >5,000ppb;

- All anomalous silver samples were also anomalous in zinc, lead, iron and manganese;

- 131 samples were anomalous in Pb with values greater than 50 ppm and a highest value of 6089 ppm;

- 157 samples were anomalous in zinc with values greater than 200 ppm and a highest value of 3,702 ppm;

Overall, The company concludes that the highly positive soil geochemical results over the Skytem airborne T1 and T4 targets demonstrates the validity of both targets that now merit further evaluation by trenching, 3-D modelling evaluation, and drilling. As previously noted, both of these targets also have the key factors associated with known mineralized areas at Silver Hart which include being proximal to the Cassiar Batholith-sediment contact, low magnetism, moderate conductivity, northeasterly trending anomalies, and viable targets in 3-D modelling.

T1 - Significant Anomalous Area Defined Extending Known Anomaly in the KW Zone.

A significant anomalous area 600 meters by 450 meters that is open to the north, northeast, and southwest has been identified in the northernmost part of the KW zone explored to date. Of particular interest is an area with three very high silver soil anomalies ranging from 99-526 g/t silver (extremely high values for soils) in a possible zone with dimensions of 400 meters in strike length by 150 meters in width.

The aforementioned anomaly, included with previous anomalies identified through soil/rock geochemical sampling and geophysical studies, has resulted in a significant anomalous area with a maximum strike length of approximately 1000 meters by 750 meters with a possible series of parallel northeasterly structures with widths in the range of 200-250 meters. These are thought to represent a series of possible northeasterly trending veins or a larger overall alteration system that is atypical of the known mineralized system in the Main Zone.

T4 - Significant Anomalous Area Defined Extending Known Anomaly in the South Zone

A significant anomalous area 700 meters by 400 meters that is open to the west, north and northeast has been identified in the northernmost portion of the South Zone.

The aforementioned anomaly combined with previous anomalies identified through soil/rock geochemical sampling and geophysical studies, has identified a significant anomalous area of strike length in excess of 2,500 meters by 150-300 meters in width with numerous anomalous soils that trend in a northeasterly direction (the typical direction of other vein structures at Silver Hart) in the South Zone. Like the T1 anomalies these are thought to represent a series of possible northeasterly trending veins or a larger overall alteration system that is atypical of the known mineralized system in the Main Zone.

Comment on Indicator Elements

Mineralized areas in the Main Zone at Silver Hart are associated with significant amounts of manganese and iron alteration. Manganese and iron coating is a prominent feature. The association of the silver, lead, zinc with manganese and iron in the soils is a positive indicator for potential mineralization.

Qualified Person

Kevin Brewer, a registered professional geoscientist in BC, Yukon and Newfoundland, is the Company's President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has approved the technical information reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration company focused on opportunities for silver in Yukon and British Columbia and polymetallic deposits in Yukon and Newfoundland. Our silver-lead-zinc prospects include the Silver Hart Deposit and Blue Heaven claims (the "Silver Hart Project") and the recently acquired Rancheria South, Amy and Silverknife claims (the "Rancheria South Project"). Our polymetallic projects with potential for copper-silver-gold and other metals include Logjam (Yukon), Bridal Veil and Terra Nova (both in Newfoundland).

On behalf of the Board:

"John Bossio"___ _

John Bossio, Chairman

For Further Information and Investor Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc Hons, Dip. Eng

President, CEO and Director

Tel: (604) 670 0019

kbrewer80@hotmail.com

Suite 110-175 Victory Ship Way

North Vancouver, BC

V7L 0B2

To be added to CMC's news distribution list, please send an email to info@cmcmetals.ca or contact Mr. Kevin Brewer.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

"This news release may contain certain statements that constitute "forward-looking information" within the meaning of applicable securities law, including without limitation, statements that address the timing and content of upcoming work programs, geological interpretations, receipt of property titles and exploitation activities and developments. In this release disclosure regarding the potential to undertake future exploration work comprise forward looking statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks, including the ability of the Company to raise the funds necessary to fund its projects, to carry out the work and, accordingly, may not occur as described herein or at all. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, the impact of the constantly evolving COVID-19 pandemic crisis and continued availability of capital and financing and general economic, market or business conditions. Readers are referred to the Company's filings with the Canadian securities regulators for information on these and other risk factors, available at www.sedar.com.

Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation."

SOURCE: CMC Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/662198/CMCs-Spectacular-Geochemical-Survey-Results-Continue-to-Validate-and-Expand-Airborne-Geophysical-Targets-At-Silver-Hart-Yukon